The US’ move on imposing sanctions on Iran led to a surge in the Asian benchmark, Brent crude oil, to a four year high, upsetting countries like India, which largely rely on imported oil. US plan to impose sanction ignited concerns over supply crunch as Iran is the OPEC’s (Organization of the Petroleum Exporting Countries) third largest producer, contributing about three percent of global oil output.

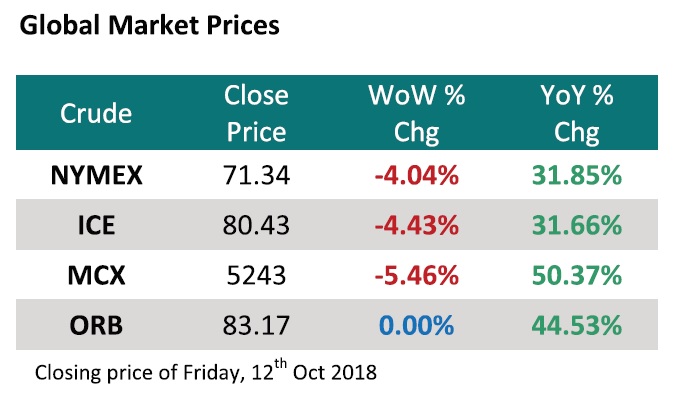

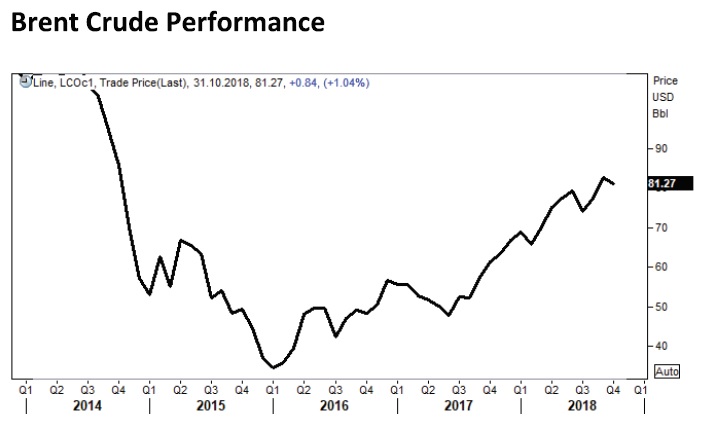

Brent crude oil price in the ICE futures exchange recently hit a high of $86.74 a barrel. Since hitting its lowest level of $27.10 a barrel in mid-January 2016, Brent crude oil has been on a recovery mode on expectations of upbeat global demand and supply worries. Despite the trade standoff between world’s top two economies, the US and China, crude stayed largely insulated and continued moving higher.

OPEC Output cut and tensions on supply

OPEC and other top producers have been limiting their oil output by 1.8 million barrels per day since last year with a view to reducing global supply glut and lift prices, which had a significant bearing on oil market.

Currently, Saudi Arabia is the top producer in the OPEC group followed by Iraq, Iran, UAE and Kuwait. The recent sanctions on Iran is raising concerns over supply from the OPEC’s third largest producer. The US re-imposing sanctions on Iran over the nuclear deal will be effective by 4th November. The US Administration is pressurising Iranian crude buyers to stop all energy dealings with the country by that date as well. It is expected that the absence of Iranian oil would spur supply crunch as supplies have already been limited from other top OPEC producers. China is the top importer of Iranian oil followed by India. Iran has been exporting almost 30 percent of their production to India revealing the importance of Iranian oil to the country.

Declining output from other important OPEC members like Venezuela and Libya is weighing the sentiment as well. Political instability in these countries has affected their output. As per reports, oil production from Venezuela has halved in the last two years.

Monthly production of OPEC producers

Anyhow, the risk of supply shortage is now mitigated after reports from Saudi Arabia that the country will hike their production if the market needs. Saudi Arabia, the largest producer among the OPEC, can tap its spare production capacity to offset any such immediate shortage from Iran. Saudi output is now at around 10.5 million barrels per day and they can use their spare capacity of 1.3 million barrels per day, if needed. Higher US production and record output from OPEC’s second largest producer Iraq may supplement to narrow the supply shortage later. Moreover, as per reports OPEC and its allies have now agreed to raise output after the US President urged the group to tame surging oil prices.

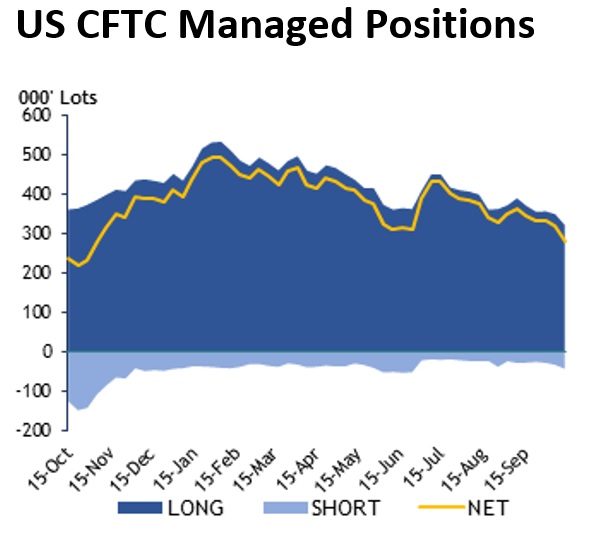

Increase in long positions in futures and option contracts

Managed positions were more bullish on Brent futures rather than WTI recently. Combined net long positions in futures and options contracts of ICE Brent has increased from 389,066 contracts to 496,343 lots and increase of 27.6 percent in the last month. A sharp rally in price supported the sentiments. More bullish activity in derivative contracts usually signifies short term positive outlook on a commodity. Meanwhile, bullish bets in NYMEX WTI contracts has decreased by almost 5.5 percent.

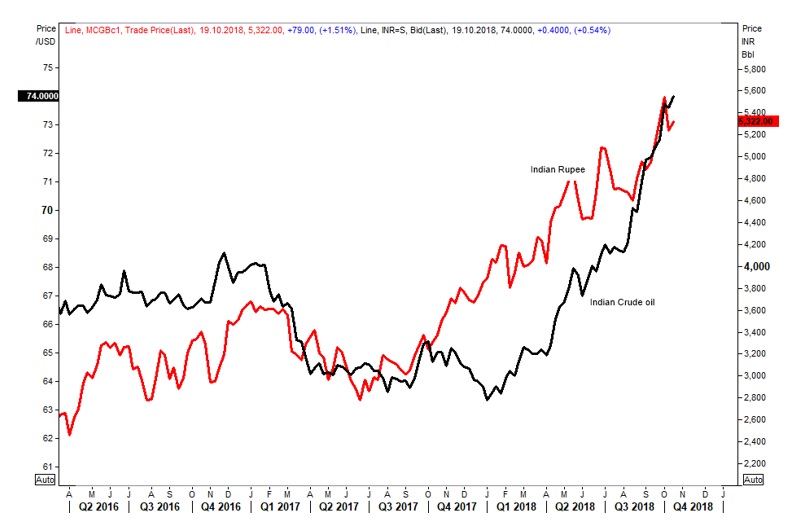

Weak INR and multi-year high domestic oil prices

High overseas prices coupled with weak INR led to a sharp jump in domestic oil prices. Now petrol and diesel oil prices in the country are running at record levels due to high import cost along with additional taxes and levies. A fragile currency could lift the landed cost of commodities, which are imported to a country. Domestic oil prices jumped more than 40 per cent since the start of the year, while its corresponding international prices gained only 20 per cent during the period. The Indian rupee has weakened about 17 per cent since the beginning of this year. Meanwhile, since we meet about 80 percent of our oil demand by imports, prolong bullishness in oil prices are likely to hit our economy.

Recently, the US dollar strengthened against most of the emerging market currencies, while it held steady against its major counterpart. U.S Fed’s faster monetary tightening continued supporting the US dollar even as there are concerns over trade tensions with the worlds’ second largest economy. Euro too held firm. Meanwhile, emerging market currencies remained under pressure with Argentinian Peso, Turkish Lira and Indian Rupee topping the list.

Weak INR and its impact on Indian Crude oil

The positive outlook of oil is likely to remain intact unless the key fundamentals change. Growing tensions between US and Saudi Arabia are likely to prompt more speculative action on oil prices. However, the OPEC’s assurance of more oil supply and a likely lackluster global demand may weigh on further upside potential. A feeble Indian rupee would perhaps put pressure on domestic oil prices further. Any sudden recovery in rupee would bring the price down; otherwise, the momentum may continue.