by Mahesh Vyas

by Mahesh Vyas

Financial markets in India have been somewhat strained in recent months. Interest rates have risen across the term spectrum albeit at different rates. Spreads have worsened at the lower end of the term spectrum to reflect tighter liquidity conditions. But, spreads have not increased similarly at the higher end of the term spectrum or across risk levels. Risks from the financial markets had increased following some defaults, but these seem to be contained for now.

Interest rates have been rising since March 2017 although the increase is pronounced only since March 2018.

The Weighted Average Call Rate (WACR) has been rising since May 2018. Partly its rise reflects the increase in policy rates. RBI raised the repo from 6 percent in May 2018 to 6.25 percent in June and then 6.5 percent in August 2018. But, the WACR has risen faster. As a result, the spread between the WACR and the repo narrowed down to just 7 basis points in September 2018. This is the lowest spread since October 2016.

The spread between monthly average yields of 31-day T-bills and 364-day T-bills have been rising unusually in the past six months. This spread has averaged at 27 basis points with a max spread of 63 bps over the past five years. In May 2018 it inched up to 75 basis points and has since kept rising to reach over 100 bps in October 2018.

Issuance of commercial paper has grown rapidly in the past five years. Non-banking finance companies are the main issuers of CPs. NBFCs have become an important source of credit. Bank loans to NBFCs have also increased rapidly.

Reflecting partly the increased demand for CPs and partly the general tightening of interest rates, average CP rates reached a 5-year high of 11.18 percent in September 2018. Rates have risen further in October. The high rate during the first fortnight of the month reached a peak of 17.5 percent. This is much higher than the recent high rates that were all below 16 percent.

Risk perception from financial markets has increased after IL&FS defaulted on its scheduled debt servicing obligations in August and September. Fears of a ‘default’ contagion triggered some panic selling of debt securities by mutual funds following redemption pressures.

The contagion has been contained by government interventions. On October 19, the RBI eased bank lending to NBFCs by raising the exposure to a single NBFC that does not finance infrastructure to 15 percent of capital from 10 percent earlier. The relaxation is available only till the end of the calendar year. Earlier, the RBI conducted two open market operations of Rs.100 billion each in the second half of September and then two in mid-October of Rs.120 billion each to address liquidity concerns of the market.

By late October, the RBI was confident that there was no systemic risk and ruled out any special liquidity window for NBFCs as was reportedly desired by the ministry of finance.

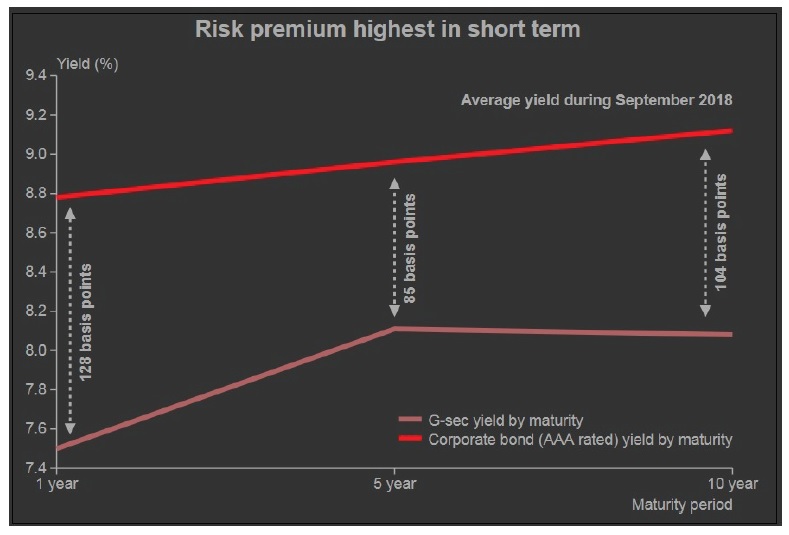

This was evident from the corporate bond markets that have not shown much strain post the IL&FS default led scare. In September, the spread between 10-year AAA corporate bonds and 10-year G-Secs was 104 bps which was lower than the 107 bps spread in August. The spread has reduced further in October. The spread between 10-year AA corporate bonds and 10-year G-Secs fell more – from 171 bps to 141 bps.

While the spreads have not worsened, a rise in interest rates is seen in the yields of both, G-Secs as well as corporate bonds. In September 2018, the average 10-year G-Sec yield at 8.08 percent and the AAA corporate bond yield at 9.12 percent were at their 4-year highs.

Bank borrowing rates have moved, albeit much more slowly. The weighted average lending rate for fresh loans by commercial banks during July-August 2018 was 9.64 percent which was the highest rate in the past 12 months. Lending rates were much higher before that.