Legendary American investor and fund manager Peter Lynch was born in 1944. His father passed away at an early age and it was his mother who raised him. In 1965, Lynch graduated from Boston College where he studied history, psychology and philosophy, and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968.

Legendary American investor and fund manager Peter Lynch was born in 1944. His father passed away at an early age and it was his mother who raised him. In 1965, Lynch graduated from Boston College where he studied history, psychology and philosophy, and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968.

In 1977, Lynch was named head of the then obscure Magellan Fund which had $18 million in assets. By the time Lynch resigned as a fund manager in 1990, the fund had grown to more than $14 billion in assets with more than 1,000 individual stock positions. He achieved this unbelievable success in just 13 years!

His investing principle was “invest in what you know”. He said, “In my investing career, the best gains usually have come in the third or fourth year, not in the third or fourth week, or the third or fourth month.”

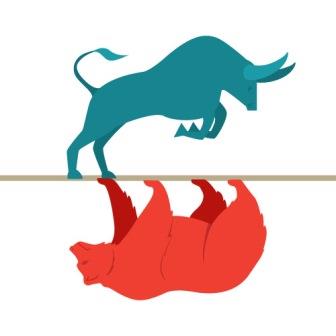

Lynch has also argued against market timing, stating: “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves.”

Peter Lynch divided stocks into six categories: –

- Fast growers – These are small aggressive companies who have the potential to grow around 20 to 25% a year. These are the favorite stocks of Peter Lynch.

- Stalwarts– These are Blue Chip companies which have room to grow. E.g. Coca Cola and Procter and Gamble.

- Slow Growers – These are companies which are past their prime. He avoids these stocks.

- Cyclicals– These are companies which rise and fall with economy.

- Turnarounds– These are fallen companies which turnaround and become successful.

- Asset Plays – These are companies that own overlooked assets. It is very difficult to determine and the investors should use their own knowledge of the industries to determine this category.

Lynch believes that investors should seek a company which has strong earning growth and reasonable valuations (PEG Ratio). The company should have good percentage growth of sales, strong cash flow and careful management of assets. This, according to Lynch, helps the company to succeed in all types of market environment.

After he retired, he wrote 3 bestselling books: ‘One Up On Wall Street’, ‘Beating the Street’ and ‘Learn to Earn’.

Some of his best-known quotes are:

- “Go for a business that any idiot can run – because sooner or later, any idiot is probably going to run it.”

- In stocks,as in romance, ease of divorce is not a sound basis for commitment.

- Behind every stock is a company. Find out what it’s doing.

- There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating.

- If you don’t study companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.

- In the long run, a portfolio of well-chosen stocks and/or equity mutual funds will always outperform a portfolio of bonds or a money-market account. In the long run, a portfolio of poorly chosen stocks won’t outperform the money left under the mattress.

- Equity mutual fundsare the perfect solution for people who want to own stocks without doing their own research.

Posted: April 2018