by C. J. George

The year 2017 was a very good year for equity investors as most created significant wealth through their investments. The continuing surge in the AUM of Mutual Funds and the index hitting new highs repeatedly are indications of the strong bullish mood in the markets.

However, given the nature of the markets, it is advisable for all investors to have a re-look at their portfolio and check for over exposure to equities, when the going is so good rather than later. This thought stems from the fact that valuation of equity assets is exceptionally high although the Q3 results have been better compared to the comparable quarter. But Q3 of 2016-17 was also the demonetization quarter!

Hence, the year 2018 throws open a great opportunity to re-balance investor’s portfolio of assets. In case they are over exposed, it is a good time to reduce exposure by booking profits in equity assets, especially as the small cap/mid cap segment has been going through unprecedented valuation levels. One should consider allocating their money to other assets like well diversified funds, balanced funds, debt funds, Gold ETF etc., thus reducing the risk associated with this relatively illiquid sector.

As every investor’s risk appetite varies, the exposure to equity market should be compared only with the individual’s risk taking capacity and take asset allocation decisions accordingly.

The year 2018 is a year of many potential headwinds for the markets. The steady flow of liquidity into the equity market and the positive sentiment in the market have been driven by a strong government in the country post the 2014 elections. Hence, 2018 is singularly important for investors as there are assembly elections in a few major states from where the ruling party has a strong presence in the parliament and these elections are treated as the harbinger of early 2019 General elections. Any political upset in these states may lead to disproportionate impact in the market. Therefore, it is a great opportunity, particularly for investors who have made huge gains in the last few years to review their risk appetite and rebalance their portfolio of assets.

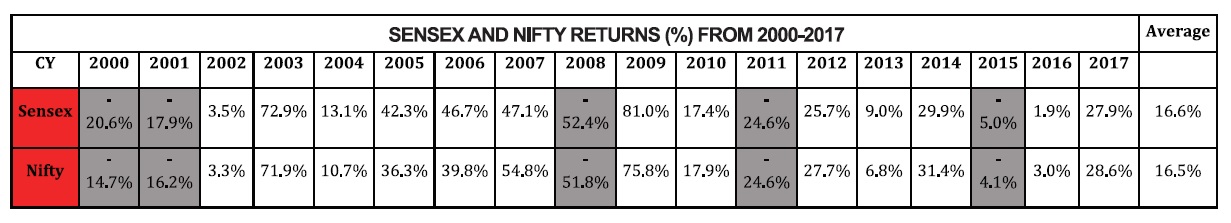

As the table shows, equity investors in the long term have made superior returns compared to any other asset class despite many crashes (some of them were very steep), in the past 17 years. Hence, this is a good time to review the portfolio dispassionately to see whether a correction (also different intensity of corrections) can create heart burns in 2018. Based on one’s evaluation one can decide whether it is time to book some profits. Large investors can also look at protective strategies in the derivatives market, thanks to a very liquid and vibrant derivatives market in the country.

As the table shows, equity investors in the long term have made superior returns compared to any other asset class despite many crashes (some of them were very steep), in the past 17 years. Hence, this is a good time to review the portfolio dispassionately to see whether a correction (also different intensity of corrections) can create heart burns in 2018. Based on one’s evaluation one can decide whether it is time to book some profits. Large investors can also look at protective strategies in the derivatives market, thanks to a very liquid and vibrant derivatives market in the country.

If one is not well versed with the market, then it is better to depend on advice from experts, invest via Mutual Funds/PMS. They are relatively safer than investing directly in the market, as trained experts like fund managers are better able to assess returns and manage risk. There is also the factor of diversification.

Whereas, SIP investors must know the basic rule that SIPs are often small investment plans and hence should be a long term wealth creation instrument. One must continue the SIPs without any break to gain from market volatility. In case, SIPs are purchased with disproportionate expectations or some amount of greed to make fast money from the market or were mis-sold SIPs by distributors (this is not what SIPs are intended for) they should also look at their risk appetite and rebalance the portfolio.

Most of all, it is important to maintain faith in the India growth story. By all measures, the Indian economy has good potential and a lot of space to grow. I urge you to continue reading Geojit Insights for extensive analysis of the markets and economy. This is the first anniversary of our magazine’s launch and let me pledge that we shall continue to offer our readers, high quality analysis, diverse views and expert insights through Geojit Insights.