You would have been hearing about diversification from day one of starting your investments. Advisors chant the diversification ‘mantra’ year around to reduce the ‘risk’ of downside in the portfolio. But how to arrive at the right diversification numbers and earn optimal returns? Is diversification a function of just choice of assets? Do we always maintain a holistic view on our portfolio or do you curse negative returns in one asset by neglecting positive return from other investments? Let’s probe into the extent of triviality in this activity and find an easy way out.

You would have been hearing about diversification from day one of starting your investments. Advisors chant the diversification ‘mantra’ year around to reduce the ‘risk’ of downside in the portfolio. But how to arrive at the right diversification numbers and earn optimal returns? Is diversification a function of just choice of assets? Do we always maintain a holistic view on our portfolio or do you curse negative returns in one asset by neglecting positive return from other investments? Let’s probe into the extent of triviality in this activity and find an easy way out.

A preamble to our discussion is that diversification is not all about hedging risk. Hedging as we know, would be an investment that works in reverse to the characteristic of the parent portfolio. But diversification may not always nullify the negative returns of an accompanying asset as hedging does. Albeit having low correlated assets or negatively correlated assets in the portfolio (we shall discuss this jargon in a later part of this reading), complete hedge of downside is not possible through diversification. Then why to diversify?

First, one can put all eggs in one basket if he feels that the eggs are insignificant part of his routine diet or when he feels the basket is shock proof. But since the pain of loss is same for all, people resort to diversification. Only the degree of risk tolerance varies between investors. And this degree of risk tolerance is the primary factor determining level of diversification. So the first step in diversification is getting more baskets. Now if all baskets are of similar material, then probability of damage would be same for all. Therefore, though we have increased the number of baskets and brought in diversification, if all baskets are made of glass, they carry same risk of breakage during a shock. Now what if a few are made of steel and a further few others feature thick cushions inside? This is the second step in diversification. Introduce variety of baskets and this increases safety. Hence diversification primarily aims at protecting downside risk, the risk of damaging existing eggs.

Now to the second question is how to multiply the number of eggs. Here the safety feature of diversification joins hand with return expectation from the assets. Diversification introduces numerous assets to the portfolio which have diverse risk-reward characteristics. Each asset class exhibits unique behaviour in a given market situation and this helps in adding spice to the portfolio and ultimately yielding better and stable results. How?

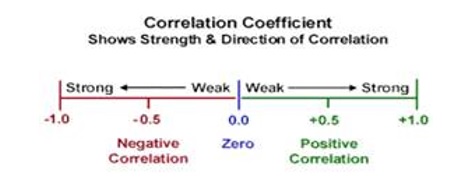

Here comes the role of correlation. Any word if prefixed by ‘co’ means at least two or more than one as we mean in co-operation. Correlation measures the relation between return characteristics of two assets.

If two assets are positively correlated, then their behaviour would be similar (If one performs, the other will also perform, and vice versa). And if they are negatively correlated, their returns move in opposite direction in response to a market event. So negative correlation boosts diversification. Gold and Equity are two such negatively correlated assets. Cash is a neutral asset which is rather an inevitable part of any portfolio. The more two assets are positively correlated, the diversification effect fades off.

Mutual fund schemes bring in diversification through diligent asset allocation. The four major asset classes they cater to are equity, debt, gold and cash. Though majority schemes are equity oriented, off late there has been an inclination to gold, which is evident from new multi asset portfolio schemes been introduced into the market. Of the entire gamut of equity schemes, multi cap funds feature the most meaningful diversification. Rather than having so many funds, one can own a couple of multi cap fund and boast to cover the entire set of listed stocks in the market and to some extend cash.

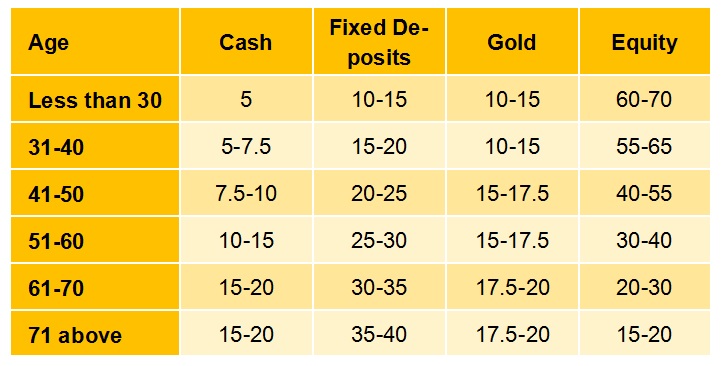

A final point would complete our discussion on diversification. What is the percentage of each common asset recommended for one’s portfolio? The following table could be used as a quick guide for portfolio construction. The percentages is that of total assets (Excluding property).

Here in the table, there is a fine allocation of cash, gold and debt against equity. Debt (fixed deposits) is slightly positively correlated to equity, Cash is neutral, and gold is negative. Real estate and Equity are positively correlated to a degree more than debt. Hence the effect of diversification is less. The overall portfolio depicted above ensures that the downside risk is reduced effectively and the room for returns is wide spread.

Recipes result in a tasty dish supported by right ratio of ingredients mixed and cooked up to requisite time. Same theory is applicable in portfolio construction. A right mix of asset classes and stipulated investment horizon will yield optimal returns. Having chicken raw is primitive behaviour. Browsing for a recipe is diversification. Getting the mix right and preparing the dish is asset allocation.

Geojit online financial planning platform helps you manage your personal finances on your own. This user friendly module will help you define your goals, income, expenses, loans and wisely manage them to get the right mix of asset allocation through informed decision making.

Posted: September 2017

Good reading and informative. Very useful

Good article.

Excellent analytical presentation and explanation. Such article enhances the knowledge who seek to do so.

Excellent article

Thank you Sir! Your comparison of assets are well and valuable !!.

How to reap more returns?

Hai sir if possible can u get me ur watsup number

You may contact Vijay on vijayanandaprabhu_u@geojit.com

GOOD ARTICLE

excellent report for the young guys and i had sent this message to my young children for thier future benefit and knoweledge

It is very good and authentic analysis and presentation for different age groups. Worth following as a Geojit admirer.

A commendable presentation.

Informative and good

Can the Geojet be The first to publish absolute return of portfolio vs till date inflation effects

You question is not clear. Please feel free to write to us at insights@geojit.com and we will be happy to help you.