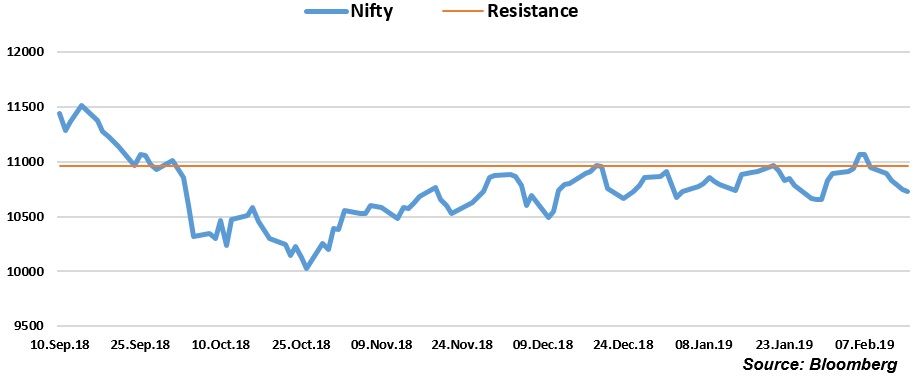

Though elections have never impacted the long-term trend of the market, they do have important short-term implications. Last month, after a long-time, the market attempted to cross into a new zone, but held its sentiments, perhaps to see the final outcome of the crucial general election, which many believe will have a long-lasting implication on the country’s political stance. We believe that this short-term trend will have a slight inclination to the election outcome rather than to the continuity of reforms and global factors. We feel that these uncertainties will be over in a few months and the market will start responding to fundamentals.

Currently investors are cautious on India

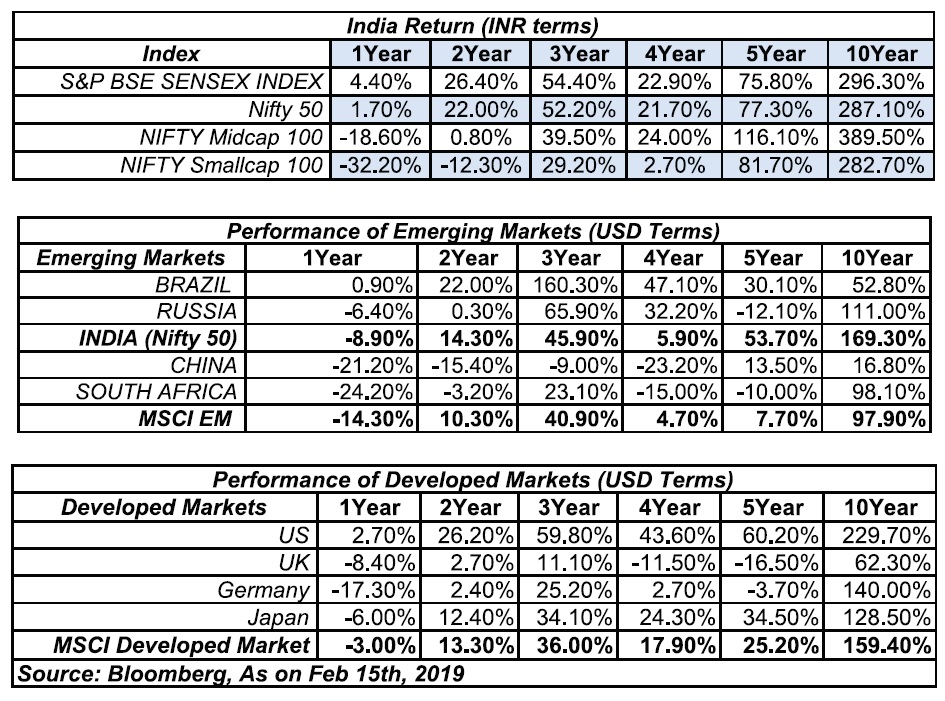

India’s long-term performance is very solid, second only to the US market; but the last one-year return has been negative. In the very short-term, India has started to underperform emerging markets with a huge gap. Three and six-month return of MSCI-India is 0.2% and -9.5% respectively compared to 4.5% and 0.8% by MSCI-EM.

India is underperforming other emerging markets due to a set of domestic developments which has impacted the market. Muted quarterly results have not enthused the market, which is indicating that earnings forecast will be cut atleast in the near future. Nifty50 PAT growth is about 7% on a YoY basis which means the nine-month EPS growth will be at 9%, while the market was hoping for 15% for FY19, leading to downgrade in earnings. SEBI has tightened the margin funding requirement in anticipation of higher volatility in the near future due to the interim budget and the general election. Also, other stringent measures of SEBI relating to small and microcap like ASM and investment by mutual funds in such stocks have impacted their performance. Nifty is facing stiff resistance at the level of 10,950, and trading between a narrow range of 10,600 to 10,950.

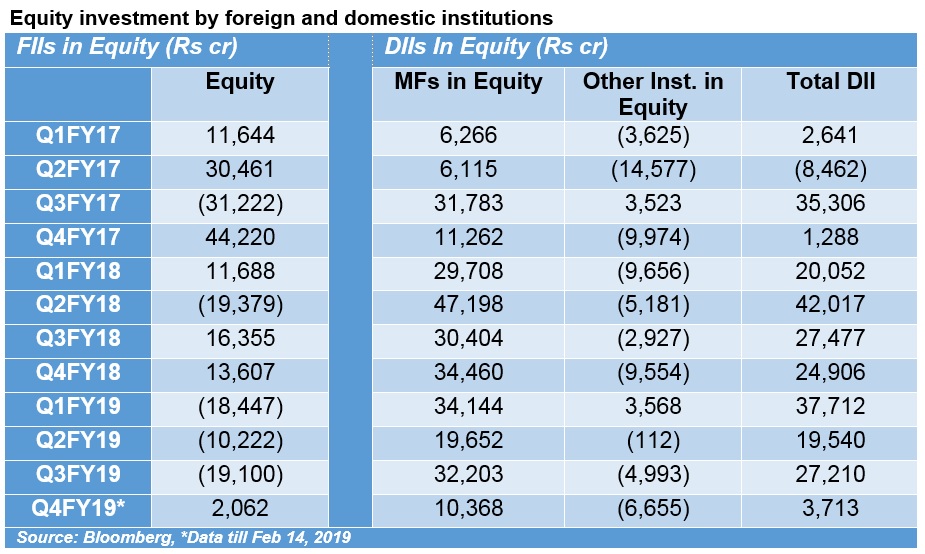

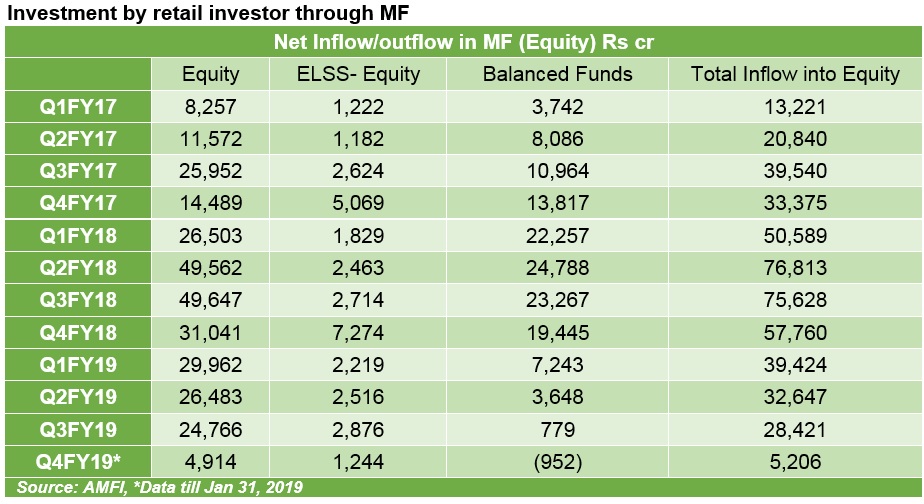

FIIs have been cautious on India in the last one year due to premium valuation and lack of earnings growth. But MFs supported the market aided by strong inflows from retail investors. However, during the last 45 days of Q4 FY19 the inflow was much below the average of last eight quarters. Other institutions like insurance and banks continue to have negative flows.

Inflow from retail investors through mutual funds had peaked in Q2FY18. This declined by four-tenth by Q3 FY19. The trend for Q4FY19 looks subdued further based on January 2019 data. This is excluding SIP data which continued to increase to an all-time high of Rs8, 064cr in January.

Constructive effect of interim budget and RBI policy

We had muted expectations from the interim budget and monetary policy which were actually better than expected. Market attempted to stretch its gains and move to a new level. Nifty50 crossed 11,000 for the first time which saw a stiff resistance in the last three months. Even though main indices like Nifty50 were positive, the broad market was negative impacting the wealth of small investors. Few segments have done well like IT (9%), consumer durables (5%), banks (2%) and FMCG (1%). It is skewed to domestic focused companies, oriented to consumption like FMCG, consumer staples, discretionary and private banks. IT stocks are doing well due to the cautious nature of the market given the downgrade in earnings, as economy is slowing down while sector outlook has improved and INR is depreciating. Bargain opportunities emerged in interest sensitive stocks like auto and finance due to dovish policy stance.

The budget was watched on three factors: 1. What will be the sops for small farmers and how big will they be? 2. What will be the incentives for the common man? and 3. Will it be fiscally prudent? Overall it was a fair package including all these factors providing a good signal that event risk is over. Agriculture, rural economy and increase in disposable income were the themes of the budget. Real estate can also benefit given sensible tax measures for individuals and corporates. FY19 deficit was marginally up to 3.4% from 3.3% targeted earlier. This was better than what the market anticipated, which was mentally prepared for 3.5%. The forecast for FY20 has been increased to 3.4% from the earlier target of 3.2%, which is marginally higher than expected.

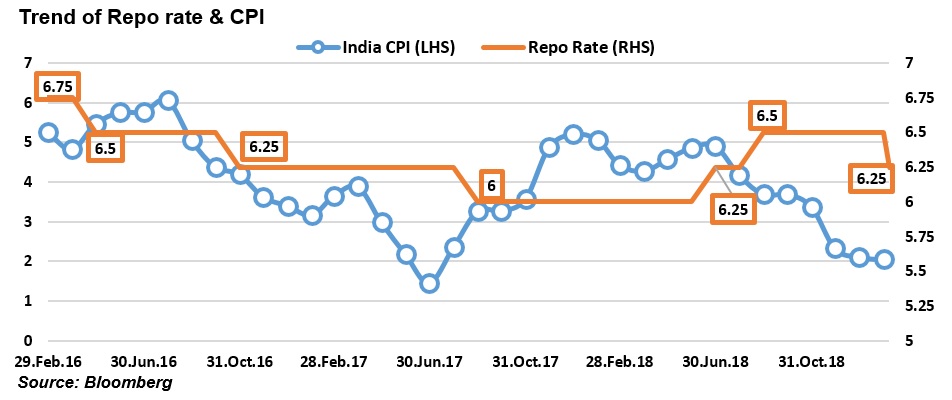

Market’s expectation from RBI has been increasing since the new governor assumed office. The last stance was not supporting a rate cut and the market believed that the repo rate was much above the inflation trend. Hence the expectation was that RBI will change its stance from ‘Calibrated Tightening’ to ‘Neutral’. At the same time, the market believed that since the change of guard was very recent, the RBI would avoid a quick turnaround cutting rates. But it completely surprised the market with a 25bp rate cut. The market now expects two more rate cuts of 25 bps each in 2019-20.

A case to gain fabulous returns in mid and small caps in the long-term

Mid and small caps have been underperforming as the risk averseness of the domestic market increased in the last one year. Mid and small caps have been impacted by selling from mutual funds and FIIs due to premium valuation, stringent measures from SEBI, slowdown in the economy and downgrade in earnings. India has been underperforming, within which mid and small caps have been butchered.

The trend of the midcap stocks is expected to be muted in the near-term due to downgrade in earnings and reduction in liquidity. We can expect a reversal in this trend as domestic market stabilizes by the general election with a stable outcome. India’s underperformance to emerging markets will also reduce if a positive development in the trade deal between US and China happens as an additional trigger for the market. The ongoing geo-political instability between India and Pakistan due to the terrorist attack is a point of concern for the market.

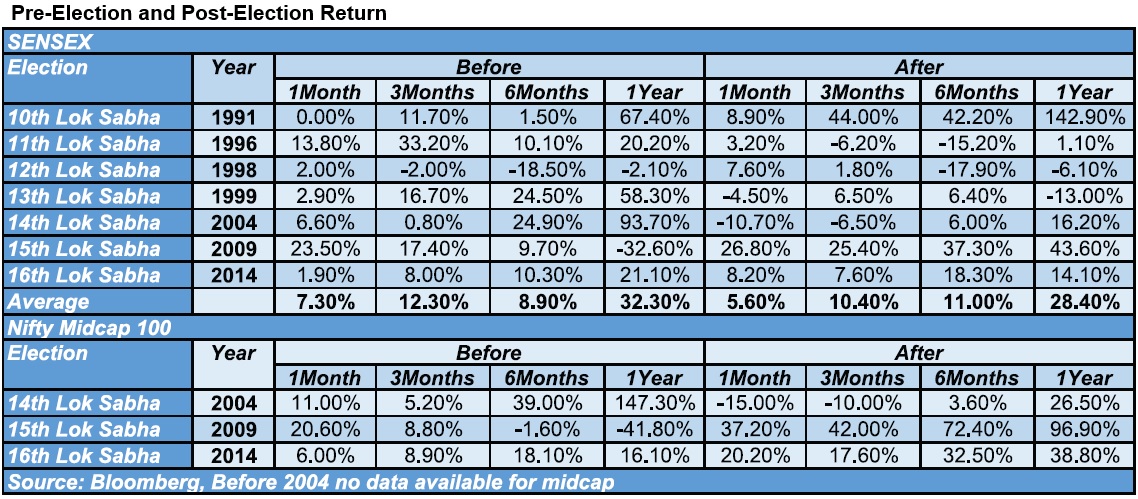

Sensex data since 1991 suggest that the best time to invest is one year before the election date. The total average return from one year before to one year after election is a delightful 61%, an absolute return in two years. There were only two occasions of negative returns before the elections: 12th (lack of majority) and 15th Lok Sabha (2009 global crisis) elections in which the best time to invest was one month before the elections. And regarding the negative return after election we have had only two instances – 12th and 13th Lok Sabhas. In all these cases returns were always positive during a total period of 2 years, excluding the instability following the 12th general election.

The performance of the last one year has been weak. We feel that elections have a low relation to the performance of mid and small caps. Other than generating short-term volatility due to risk of a slowdown in economic activity and policy decisions, election has never impacted the long-term trend of the market. This time, the pre-election volatility has been high due to unprecedented global factors and non-stop implementation of a bunch of domestic reforms like demonetization, GST and IBC impacting the growth of domestic economy given the short-term disruptive nature of such reforms. In spite of muted earnings growth, the valuations continue to be on the premium side showing the interest of foreign and domestic investors as these reforms are expected to improve the growth of the economy in the long-term.

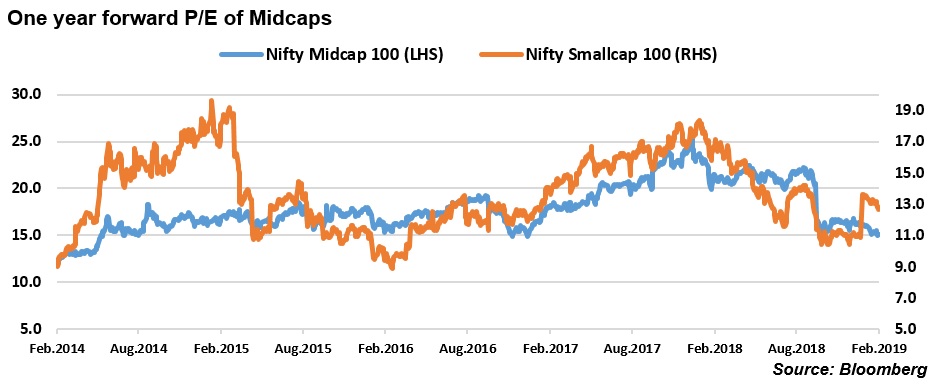

We feel that the valuations of mid and small cap stocks have become attractive. The current valuation is below the five year average creating an excellent opportunity to invest in mid and small caps using the SIP method to capture potential supernormal gains in the long-term. For example, the one year forward P/E of indices like Nifty-Midcap100 has reduced to 15x from a high of 25x while the low was 13x. The current dull momentum will reverse as the broad domestic economy is expected to improve in the next two to three quarters with stability in the global market.