by Manu Jacob

by Manu Jacob

Copper, the most industrially significant base metal has perked up in major markets recently recovering some of its previous year’s losses. Hopes of a successful US-China trade deal and subsequent demand for base metals from the world’s top metal consumer China and bargain hunting at lower levels supported the red metal. Meanwhile traders stay cautious on global cues, predominantly on the China-US trade disputes, which have been rattling the world economy since early 2018.

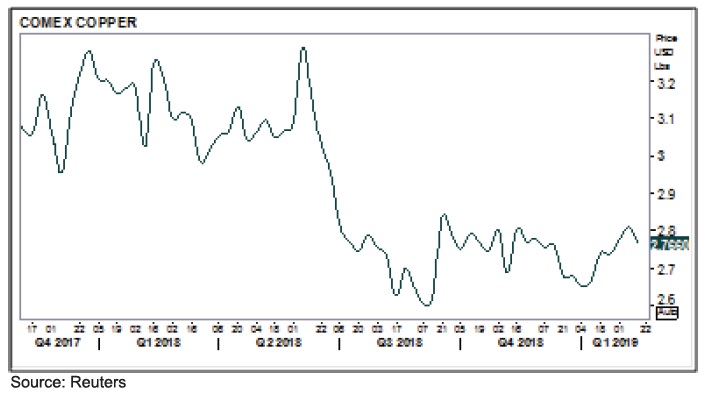

In COMEX, copper prices held at a four year high of $3.297/lbs in June last year and later collapsed shedding around 19 percent by December on broad risk aversion after being pressured on the trade war bottlenecks.Recovery in US dollar further accelerated the fall during that period. In the domestic market, copper prices slumped as well tracking global sentiments.

In a well-informed market, commodity prices tend to be largely agile to the changing economic conditions. Signs of escalating weakness in China and its impact on global economy is weighing on prices of the base metal. The recent economic releases from the world’s top base metal consumer shows that the trade dispute with US has put strain on their economy.A weak global growth forecast by IMF for a second time in a row hinting enduring trade war between the world’s top two economies is fueling worries about risk to the global economy as well.

Copper – Role on Global Economy and Supply Demand Scenario

Copper-related industries have a pivotal role in world’s economic growth considering their contribution to global GDP. Use of the red metal is significant in the development of infrastructure and public transport and in meeting energy demand.The primary applicability of copper is in electrification employing its high thermal and electrical conductivity. In mature economies, the metal’s major contribution is in construction sector followed by automobiles, appliances and in animating electronic devices.

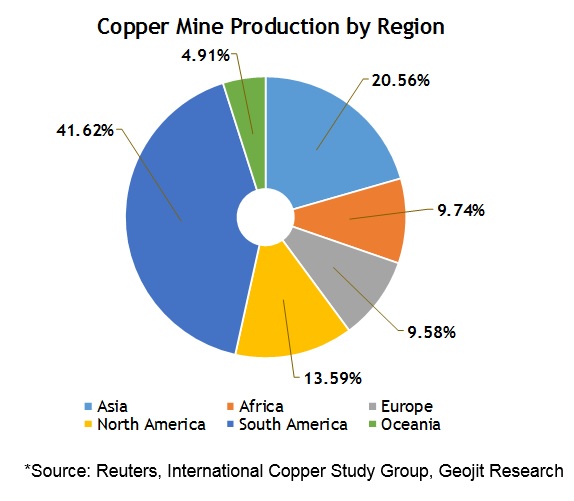

The world’s consumption of copper has increased at an annual rate of 3 percent over the past decade, although it has the slowest rate of consumption growth within the base metal complex.Chile is the largest producer of the red metal with seven copper mines operating in the country. Escondida mine in Chile is the largest copper mine in the world with a production capacity of 1.37 million metric tonnes. Second largest mine is Indonesia’s Grasberg mine with a production capacity of 0.7 million metric tonnes.

China is the world’s top copper consumer with consumption growing rapidly due to higher urbanization and industrialisation. The country is the largest importer of the commodity as well. Chile and Peru, being the key origins, together accounts 60 percent of China’s copper imports. According to ICSG (International Copper Study Group) statistics, China’s copper consumption accounts nearly 46 percent of worlds consumption followed by European Union and United States. India is the sixth largest copper consumer comprising 2.14 percent of the global demand.

Factors influencing the price

There are multiple factors influencing the copper prices ranging from mine discovery or closure, stock movement in warehouses, energy prices, political disruptions, financial instability, trade regulation and central bank decisions from major economies. In recent years, several factors have been influencing the trend of copper including crude oil prices, labour issues, strikes in mines and the most prominent of all the trade tension between the world’s major economies.

Early in 2016, copper prices were floundering at multiyear low until late November when the crude oil prices surged substantially. The energy prices have an impact on the price movement of industrial metals as their production process consume considerable units of energy in turn adding it to their cost. Subsequently, copper prices surged along with the rising crude oil prices and settled higher.

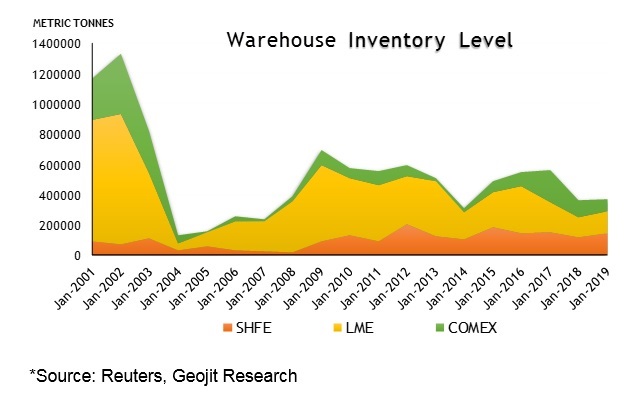

Supply worries are lingering in the market since last couple of years mainly due to a series of supply disruptions in major mines and China’s winter output restrictions on environmental reasons.Despite a greater amount of identified copper resources, lack of new mine projects constrained the supplies from meeting growing industrial demand for the red metal.At the same time, copper inventories in London Metal Exchange registered warehouses declined by around 69 percent in the last ten years.

Impact of Trade War

A retrospective analysis on the China-US trade war that shattered world economic health could manifest the onset of bearish run in copper prices. The protectionist measure adopted by US administration by imposing tariffs on some selected imports had put a whammy on Chinese industries. Remarkably, even the economies having trade relations with either nations felt the heat from an eccentric trade friction that culminated eventually between the two major economies.

Initially following the announcement of tariffs, China witnessed a hasty movement in inventories in its manufacturing sector as well as in foreign trades as manufacturers and traders resorted to an exigency measure to safeguard their business before the tariffs started to bite.Reading from the economic indicators from US and China during second quarter would offer a vindication of this scenario.Burdened by tariffs, industrial activity in China gradually declined since third quarter onwards. In January 2019, China’s Manufacturing PMI stood near a three-year low. Industrial output growth was also at near the slowest pace in three years in both November and December of 2018, showing 5.4 percent and 5.7 percent YoY respectively.

Automotive industry in both countries were badly affected. Several American automakers who built their cars in Chinese manufacturing facilities were impacted by tariff threats. In the absence of a favourable trade deal, many automakers would be forced to return to their domestic production facilities.

To alleviate the tariff threats and revamp the metal demand China’s authorities have planned counter cyclical adjustments in the economic policy through tax cuts, increased government spending and increased local bond issuance in 2019.

Indian Scenario

India is the sixth largest copper consumer and the net exporter of refined copper. India use copper scraps for refining and smelting due to the limited availability of mined copper. Hindustan Copper Limited (HCL), a public sector firm, is one of the major players sharing India’s copper industry in primary sector with Hindalco Limited and Vedanta Industries Limited. Recently, Vedanta’s large Sterlite smelter that was functioning in Tamil Nadu was forced to shut down on allegations on violating the environmental rules.

India has emerged in end-use manufacturing of copper predominantly in electrical industry. Nation’s large railway network uses copper and copper alloys for locomotive electrification, overhead electrification and in signalling system. Advancement in die casting technology for manufacturing energy efficient rotors, motors and motor systems also accounts the metal demand in India’s electrical industry.

The lack lustre industrial growth in China due to an unsettled trade war will be the biggest headwind for copper prices this year. In addition, supply tightness from the top producers may defy to meet the industrial demand of the commodity.Nevertheless, a revival in China’s manufacturing sector from the proposed infrastructure spending amid existing supply constraints could offer some ground for copper prices from trade friction in the upcoming months.