Ms. Nirmala Sitharaman in her first budget emphasized the fiscal consolidation path. In the full budget for FY20, the fiscal deficit target for FY20 was reduced from 3.4 percent announced in the interim budget to 3.3 percent. The Fiscal Responsibility and Budget Management (FRBM) Act enacted in 2003 had set targets for the fiscal deficit to be achieved by the government.

Ms. Nirmala Sitharaman in her first budget emphasized the fiscal consolidation path. In the full budget for FY20, the fiscal deficit target for FY20 was reduced from 3.4 percent announced in the interim budget to 3.3 percent. The Fiscal Responsibility and Budget Management (FRBM) Act enacted in 2003 had set targets for the fiscal deficit to be achieved by the government.

In 2016, the government set up a committee under NK Singh to review the FRBM act. The committee recommended that the government should set a fiscal deficit target of 3 percent till FY20, and then bring it down to 2.8 %, 2.6% and 2.5% in the subsequent years. Though the target of 3 percent has not been achieved till now, the process of reducing and aiming to achieve the target of 3 percent should be well appreciated. However, the question that arises at this juncture is whether the government will be successful in attaining the target of 3.3 percent for FY20.

With a budget size of Rs 27.86 lakh crore, a 25 percent growth rate in the revenue receipts is being expected by the government. The revenue receipts as per the provisional data for FY19 stands at Rs 15.632 lakh crore, whereas the target for FY20 is estimated at Rs 19.63 lakh crore. Within the revenue receipts, tax revenue and non-tax revenue are expected to grow at a rate of 25 percent and 27 percent respectively in FY20.

The government would be successful in meeting the non-tax revenue target through the transfer of surplus from the RBI to the exchequer. The recommendation of the Bimal Jalan committee would be crucial in this regard. The committee is expected to submit the report this month. However, it looks like the government has already factored in the increased transfer from the Central Bank, by expecting the non-tax revenue to grow by 27 percent.

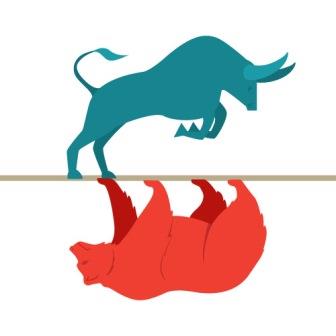

Same is not the case with tax revenue mobilisation, and it won’t be an easy walk for the government to achieve the tax revenue target for FY20. Tax collection to a great extent depends on how well the economy is performing. It is an undisputed fact that India is facing an economic slowdown. The slowing consumption in the economy has even forced many companies to cut down production in the current fiscal year. For instance, Maruti Suzuki has cut down its production for the fifth month in a row in June. In such a scenario, it looks ambitious to achieve a tax revenue growth rate of 25 percent.

Coming to capital receipts, the disinvestment target for FY20 has been set at Rs 1.05 lakh crore. Considering the present market sentiments, it would be difficult to carry out disinvestment in its true sense. Yet, the government may be successful in achieving the disinvestment target, with the transfer of its share from one PSU to another.

However, it should be noted that tax collection is the major component that helps in determining whether the government will be able to stick to the fiscal deficit target of 3.3 percent. It should be noted that tax revenue has a share of 84 percent of the total revenue receipts. Considering the present economic condition, it would be difficult to achieve the tax revenue target of Rs 16.49 lakh crore. In such a scenario, the government would either overshoot its fiscal deficit or will have to cut down expenditure to meet the target.

Posted on 25 July