Investing in the equity financial market can seem difficult and unsettling, especially if you don’t have the time or resources for researching, managing, and rebalancing your portfolio. If, like most investors, you don’t have the time or knack for finding the next multi-bagger, you might want to consider investing in a well- designed managed portfolio,where experienced fund manager makes decisions for you and give your portfolio broad exposure.

Investing in the equity financial market can seem difficult and unsettling, especially if you don’t have the time or resources for researching, managing, and rebalancing your portfolio. If, like most investors, you don’t have the time or knack for finding the next multi-bagger, you might want to consider investing in a well- designed managed portfolio,where experienced fund manager makes decisions for you and give your portfolio broad exposure.

Geojit’s Dakshin portfolio, offers you the perfect opportunity to invest in stocks of 25 fundamentally sound businesses headquartered in the five south Indian states.

What is special about a portfolio of South Indian stocks?

South Indian states have registered higher than national average growth over the past three decades. And according to the Confederation of Indian Industry (CII) report, South India presents an unprecedented opportunity for wealth creation as the five states have a combined GDP $300 billion and when put together are among the top 30 economies of the world, contributing over 22 percent of India’s GDP and 28 percent of India’s employment. It is projected that South India will become $1,200 billion economy by 2020.

What are the key features of Dakshin Portfolio?

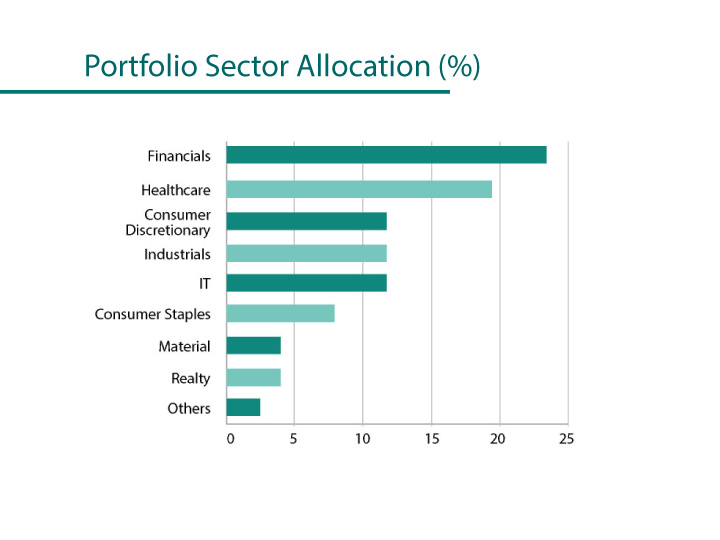

Dakshin is a diversified equity based, open ended multi-cap growth portfolio that will invest only in stocks of 25 well-established companies headquartered in South Indian states.The portfolio will be benchmarked against broader index Nifty 500.

The portfolio is based on the customised index — MSCI South India Domestic High Quality 25 Index has been constructed by global agency MSCI Inc, for Geojit. Each stock included in the fund will carry equal weight. And it is the first of its kind portfolio offered in India and the minimum subscription limit of Rs 25 lakh.

How do we select the stocks?

The index constituents are picked from MSCI India Domestic IMI Index which has around 350 stocks. For these securities in the parent index, Dakshin portfolio includes only companies headquartered in the states of Karnataka, Kerala, Andhra Pradesh, Telengana and Tamil Nadu. Furthermore, this portfolio will exclude securities with full market capitalization above Rs. 50000 Crores. Then the top 25 companies are selected/ filtered based on domestic inclusion factor and sector relative quality score ranking.

The portfolio is closely monitored and rebalanced to reduce investment gaps. The constituent rebalancing is effective at inception and coinciding with each Semi-annual Index Rebalancing (SAIR). Between rebalancing, the security weights will fluctuate according to market movements.

What is the role of MSCI?

MSCI Inc. is a global provider of Equity, Fixed Income, Hedge stock market indices. Dakshin Portfolio was custom made index for Geojit. It is first of its kind in the country. The concept as well as the theme.

With Dakshin portfolio, our clients can take advantage of investing in the best of South India based companies and benefit from it in the long term.

To know more you can write to us at pms@geojit.com or call us on our toll-free numbers : 1800 425 5501 / 1800 103 5501.

I’m interested

To know more please click Geojit PMS. You can also write to us at pms@geojit.com.

How can your services for portfolio management be availed.

What are the charges?

To know more please click Geojit PMS. You can also write to us at pms@geojit.com.

Nice initiative

Appears promising

attractive reading at first sight, bait is good, switch,sell. it made me go through

write up, let me firm up in time,,, thanks.