Cotton is a widely grown fiber crop and is the main raw material for textile industry. It accounts for around 35% of total textile fiber. The soft fluffy staple fiber comes under the genus gossypium sp. and belongs to the family Malvaceae. Cotton is extensively used as fabric since the beginning of Indus Valley civilization. Now, it is one of the important and largest traded commodities in the world. Due to its special features, it is the most popular clothing material in the world. It has immense importance in other industries as well. Cottonseed, when crushed, is used to make cottonseed oil cake, which is one of the major ingredients in manufacturing livestock feed. Also, cottonseed oil is the fifth major edible oil consumed in the world.

Cotton is a widely grown fiber crop and is the main raw material for textile industry. It accounts for around 35% of total textile fiber. The soft fluffy staple fiber comes under the genus gossypium sp. and belongs to the family Malvaceae. Cotton is extensively used as fabric since the beginning of Indus Valley civilization. Now, it is one of the important and largest traded commodities in the world. Due to its special features, it is the most popular clothing material in the world. It has immense importance in other industries as well. Cottonseed, when crushed, is used to make cottonseed oil cake, which is one of the major ingredients in manufacturing livestock feed. Also, cottonseed oil is the fifth major edible oil consumed in the world.

Classification:

India is home to many varieties of cotton and there are several indigenous and hybrid varieties cultivated across the country. This has led to diverse grade or specifications in this fiber.

Cotton is classified according to the staple, grade, and character of each bale.

1) Staple: refers to the fiber length.

2) Grade: ranges from coarse to premium and is a function of colour, brightness and purity.

3) Character: refers to the fiber’s strength and uniformity.

Generally, spinners pay a higher price for longer, finer and more resistant fiber, which is white, bright and fully mature. Hence, cotton prices vary based on the specifications, apart from this several other factors also affect the prices.

Present Scenario:

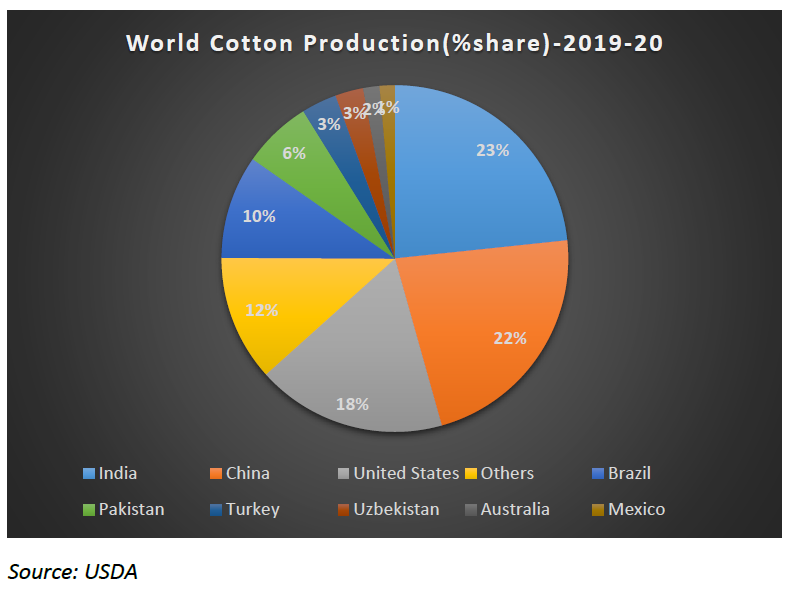

Cotton is native to India but this annual shrub is cultivated across the world. According to the United States Department of Agriculture (USDA), world cotton production is around 125.61 million bales (1 US bale = 218 kg). India is the largest producer and the second largest consumer of cotton. India contributes 23.1% of total world production, followed by China, US, Brazil and Pakistan. China and India together constitute more than fifty percent of the world’s demand. But, most of India’s demand is largely met domestically with meager imports. On the other hand, China’s demand is mostly covered by imports, especially from the US.

US is the world’s largest exporter of cotton. Around eighty percent of total US production is exported to different countries and a major chunk goes to China. Growth in domestic demand for textiles and apparels is the major driving force for Chinese cotton consumption.

In India, cotton is one of the leading cash crops and plays an important role in the Indian economy. The textile industry contributes 10% to manufacturing production, 2% to India’s GDP and 13% to the country’s export earnings.

Indian Cotton Balance Sheet

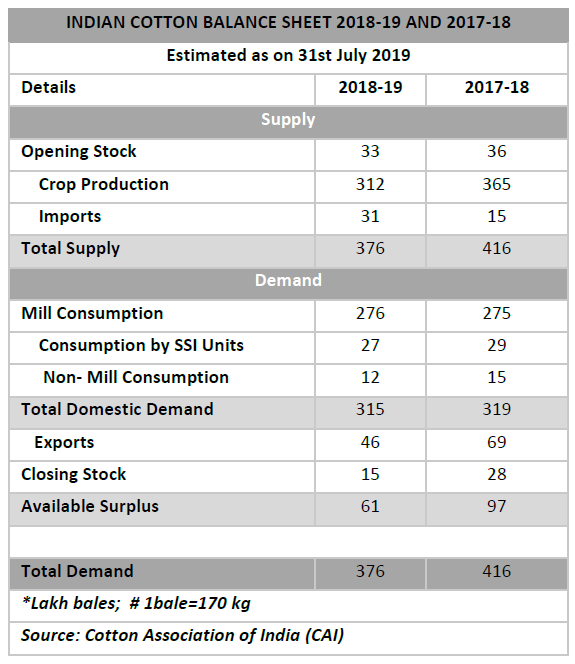

According to Cotton Association of India (CAI), India is expected to produce around 312 lakh bales (1 bale=170 kg) of cotton during 2018-19, of which around 26 %, i.e. 87 lakh bales is produced in Gujarat, followed by Maharashtra and Telangana with 70.5 and 38 lakh bales respectively. Total cotton supply during the period from October 2018 to July 2019 is expected to be 376 lakh bales, which consists of imports of 15.28 lakh bales up to 31st July 2019 while balance 15.72 lakh bales are estimated to arrive during the period from August to the end of the MY (Marketing Year). The opening stock is estimated at 33 lakh bales at the beginning of the season. The Marketing Year for cotton generally commences from October and stretch till September next year. While on the demand side, cotton consumption during the current marketing year is at 315 lakh bales, the export of cotton as estimated by CAI is 44.5 lakh bales and balance 1.5 lakh bales will be shipped within the MY. This may result in 15 lakh bales of excess carryover stocks at the end of this season. Even though stocks are a bit tight compared to the last year due to fall in production, prices have been reeling under pressure in both domestic and International markets.

Recent Trend in Prices

A combination of lingering trade tensions between the US and China, low global economic growth and rising stocks have affected cotton prices.

Following the imposition of 25 percent retaliatory tariff on the US origin cotton by China, the world’s largest importer of white gold, U.S. International Continental Exchange (ICE) cotton no: 2 futures prices have been under bearish grip since July 2018 and it declined to a 3-year low on Aug 2019 to about 57 cents a pound, shedding around 34 percent this year so far. Similar is the case of Cotlook A Index, a representative index of cotton markets, which dropped over 25%, from 99.5 cents per pound in August 2018 to 74 cents in July 2019 on back of uncertainties related to trade.

Early in August this year, the US had proposed to impose another 10 percent additional tariff on rest of the Chinese imports including clothing to take effect from September. This has now been postponed to December. As China is the major supplier of cotton garments to the US, any extra tariffs on these goods is likely to diminish the export competency of Chinese cotton wears. This will further hamper China’s consumption, which could eventually put downward pressure on International cotton prices in the coming months.

As the trade tensions between the two largest economies are worsening, it is unlikely to see any action on trade negotiations from both sides in the near future. At this juncture, fear of global economic slowdown is also impairing the demand for finished cotton garments, which impacted exports from China. According to IMF’s World’s Economic Outlook released in July, global growth is projected at 3.2 percent for 2019 with subdued outlook. The IMF has also forecast further softening of global trade.

Meanwhile, the decline in synthetic fiber prices, an alternative to cotton fiber, driven by lower crude oil prices also placed huge competitive pressure on world cotton markets.

With global production seen higher and consumption seemingly lower, the net effect is an increase in the estimate of global stocks. The figure for world ending stocks is expected to rise during 2019-20 MY by nearly three per cent to 82.45 million bales.

The fall in international prices has mirrored in the domestic markets too, with Indian MCX Cotton futures prices tumbling nearly 20 percent from 24280 to 19520 per bale so far this year. Cheaper imports, poor export demand and expectation of higher kharif output also accelerated the decline in Indian cotton prices. The fall in international cotton prices coupled with lower domestic production estimate have increased the pace of imports during April-June. But, a major fall in Indian cotton prices was arrested as the output during 2018-19 was trimmed on back of drought in Gujarat, Maharashtra and Karnataka along with bollworm infestation in other growing areas.

India lost export competiveness in both raw cotton and yarn. Yarn is one of the products of cotton, used in weaving cloth. China imports a substantial amount of cotton yarn from India, as the cost of production in that country is higher, owing to high cotton prices. However, this year, yarn exports are likely to see a declining trend. According to Texprocil, exports during the last quarter fell by 33 percent from 338 million kg to 226 million kg compared to the same period last year. This is on back of higher domestic cotton prices compared to international prices, which led to shifting of exports markets to Bangladesh, Vietnam and Pakistan.

Moreover, all India cotton acreage is expected to increase during the current kharif season. Generally, sowing starts in irrigated areas of North Indian states such as Punjab and Haryana during late April to Mid May. But, around 70% of India’s cotton acreage is still dependent on monsoon rains. Ample rains in key cotton growing areas led to increased sowing. According to Agriculture Ministry, cotton acreage has risen by 5.4% to 11.87 million ha compared to last period. Except Gujarat and Tamilnadu, all other states are witnessing better crop coverage. The acreage in Gujarat was 7% lower on year at 2.47 mln ha. While in Maharashtra, acreage was at 4.28 mln ha, up by 7.8% from the previous year and Telangana at 1.72 mln ha.

Going forward, amidst burgeoning stocks, if the current declining trend in demand for both cotton and yarn continues, it will affect the prospects of the cotton industry thereby placing further stress on the already weak market. Till any reforms announced by the government in textile industry, reports of crop damage, trade restrictions in cotton and their products as well as developments in ongoing trade negotiations between US and China will be the major factors that will dictate the price trend in the coming days.