The Indian economy has slowed down sharply. The slowdown, much worse than expected, has led to downgrades of the FY 20 growth targets by domestic as well as international agencies. The GDP growth rate of 6.8 percent for FY 2019 is an 8-year low and the Q1 growth rate of 5.8 percent is a 25-quarter low. Leading indicators point to poor growth in Q2 too. We are likely to end FY 20 with a growth rate slightly above 5 percent. The slowdown is, indeed, sharp and crucial sectors like automobiles and real estate are facing major demand slump. Jobs data paint a dismal picture and, thanks to the falling tax revenue, fiscal deficit is rising. In brief, the macroeconomic horizon is dominated by dark clouds.

The Indian economy has slowed down sharply. The slowdown, much worse than expected, has led to downgrades of the FY 20 growth targets by domestic as well as international agencies. The GDP growth rate of 6.8 percent for FY 2019 is an 8-year low and the Q1 growth rate of 5.8 percent is a 25-quarter low. Leading indicators point to poor growth in Q2 too. We are likely to end FY 20 with a growth rate slightly above 5 percent. The slowdown is, indeed, sharp and crucial sectors like automobiles and real estate are facing major demand slump. Jobs data paint a dismal picture and, thanks to the falling tax revenue, fiscal deficit is rising. In brief, the macroeconomic horizon is dominated by dark clouds.

Meanwhile, apparently paradoxically, the stock markets are scaling new peaks. Sensex is setting new records and Nifty is hovering near all-time highs. How do we explain this paradox?

It is important to appreciate the fact that globally stock markets are in a bull run. This bull run is not driven by prospects of high global growth and corporate earnings, but by a ‘risk on’ triggered by the accommodative monetary stance of all the leading central banks of the world. For the first time in 10 years, 20 leading central banks have cut interest rates in 2019. This synchronized rate cut has made money ultra cheap triggering the risk-on in financial assets like equity.

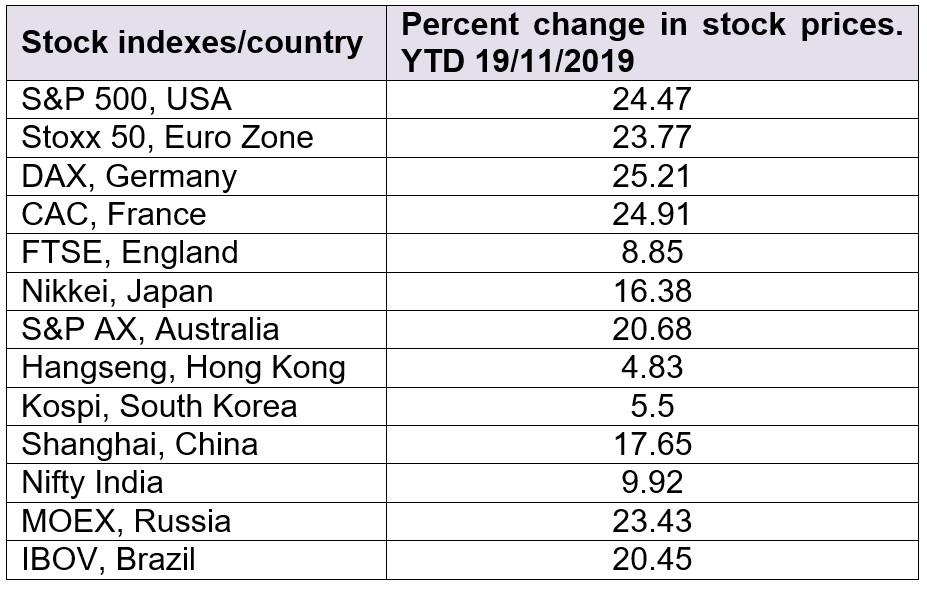

Some background: Following the global financial meltdown of 2008 and the Great Recession, the leading central banks resorted to unconventional monetary policy – Quantitative Easing – to stimulate economic growth. Quantitative Easing – printing money and buying bonds – led to the creation of unprecedented humongous liquidity, which became part of the global financial system. Under normal circumstances, this huge liquidity would have led to high inflation, forcing central banks to raise rates. But the unprecedented low levels of inflation, particularly in the Developed world, enabled central banks to continue the low interest regime. This huge liquidity circulating in the global financial system has altered the normal correlation between economic performance and stock price behaviour. Weakening of economies, instead of pushing stock prices down, is raising stock prices because too much cheap money is chasing stocks. This is the simple explanation of the paradox of ‘slowing economies and rising markets’. It is important to understand that this is a global phenomenon. See the table:

US is slowing down; Euro Zone is extremely weak; Japan is struggling; Germany is on the verge of a recession and England is in all sorts of political and economic troubles. But look at the performance of their stock markets? Cheap money and risk-on in global markets is behind this paradox.

How should investors respond to this paradox?

Too much money chasing stocks, in the absence of corresponding earnings growth has pushed up stock valuations to high levels. The margin of safety is low for many high-priced stocks. Therefore, investors have to be cautious. Chasing this momentum would be risky. At the same time some beaten down stocks among large-caps and quality mid-caps offer long-term value. Discerning investors have opportunities here.

very good analysis.. thanks team Geojit

Nicely explained as usual Dr. Vijay.

V true go for good stable companies showing all time low in stock market. Also study how the sectors will behave in future

Excellent analysis. Timely and Useful Thanks!

Excellent new year warning messages for the equity investor by Dr Vijay. Thanks