By Vinod T.P.

India is the eighth largest agricultural exporter in the world. India exported agricultural products worth $39 billion in 2019 and is expected to rise in the coming years. Even though India is the largest agricultural exporter, we are still a key importer of edible oils, as consumption always surpasses the domestic production.

According to the US Department of Agriculture (USDA), during 2018-19, India produced around 7.4 million tons of edible oil against the total requirement of 24.4 million tons. The difference is being met by imports. Among these, palm oil, soy oil and sunflower oil are the major oils supplied to India. Solvent Extractors Association (SEA), an association to promote edible oil industry, reported that India’s edible oil imports rose by 13 percent in July to over 1.5 million ton as shipment remained highest in the last 11-months. However, overall imports from November to July were down by 11 percent to 9.6 million tons compared to the same period a year-ago due to fall in RBD palmolein import, which came under government’s restricted list since January 8 this year.

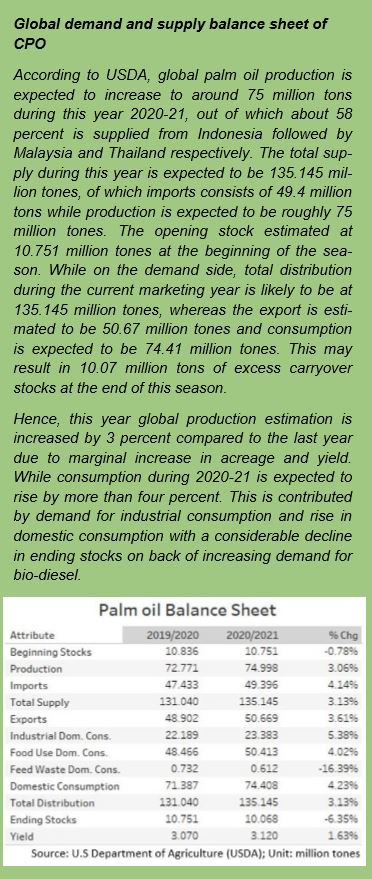

Recent trends in supply-demand and prices

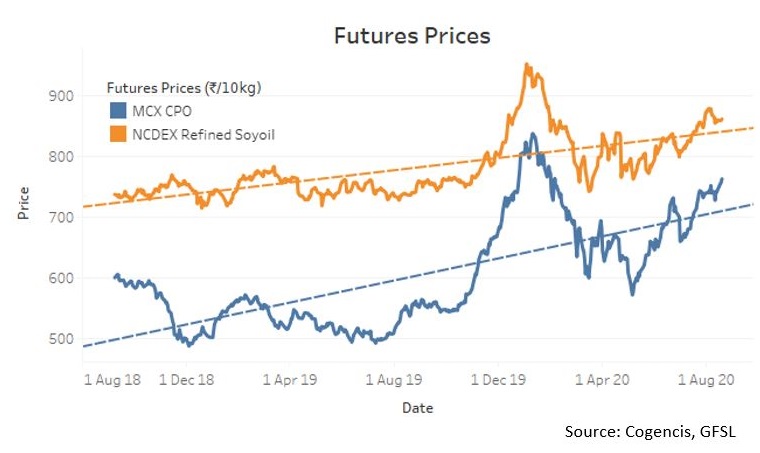

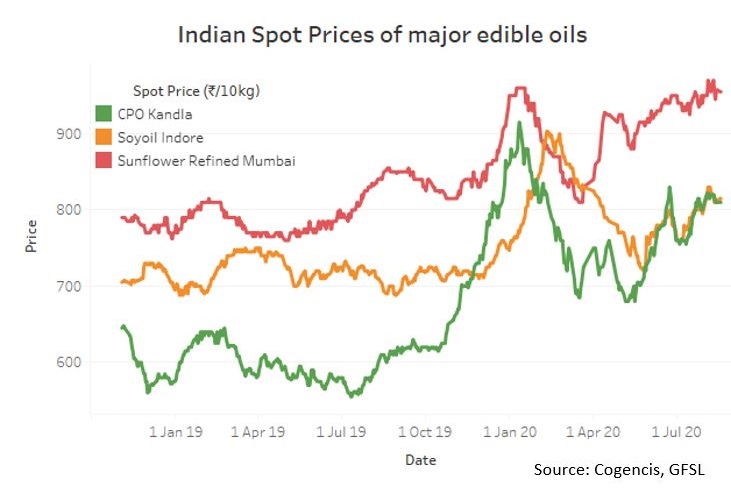

Edible oils in both international and domestic market recently rekindled its northward momentum after a brief period of selloffs that started from late December last year. Among all, prices of Crude Palm Oil (CPO) and refined soy oil witnessed a sturdy move.

MCX CPO prices rallied more than 31 percent after it made a low of Rs.567.3/10 kg in the month of May following the relaxations in lockdown in the Indian market. The rise in domestic palm oil prices was mainly propelled by the gains in BMD Malaysian CPO prices.

Malaysian palm oil prices increased on lower stocks and delay in harvest during peak production phase on shortage of laborers in Malaysia during lockdown there. Further, rise in export demand and weak Malaysian currency, Ringgit also contributed to the bullishness. The Malaysian Palm Oil Board (MPOB) reported that palm oil production in the month of July fell by 4.1 percent to 1.8 million tons reaching a three year low and, palm oil exports in July rose by 4.2 percent at around 1.8 million tons. Moreover, the total crude palm oil stocks reduced to 868,664 tons from 1.027 million tons and its biodiesel exports jumped to 38,947 tons against 16,022 tons in June. Indonesian Government’s plan to an incremental increase in blending palm oil to produce bio diesel excited the bulls as well.

Back home, apart from the cues from the overseas market and easing of lockdown measures by the GoI, pickup in demand during Ramzan month bolstered the CPO prices as well. According to SEA, crude palm oil imports rose by 50 percent in July to 8.24 lakh tons compared to same period a year ago.

In the meantime, despite the government partially allowing the opening of hotels, restaurants, and catering services in some parts of the country during unlock 1 phase, a significant change in patterns of eating style is being observed. Dining out has been now reduced considerably. Mostly, people are opting for self-cooked/home-cooked food and are trying out new recipes. This has led to a dip in palm oil consumption and a shift in demand towards other edible oils such as sunflower oil is seen as people are turning more health conscious. During the lockdown period, there was an increase in demand from households in edible oil packs of sunflower and soy oils. According to SEA, demand for sunflower oil from November 2019 rose by 17 percent to 2.1 million tons compared to 1.8 million tons in the same period last year. In case of Soy Oil, total import from November 2019 to July this year rose by 20 percent to 2 million tons, compared to the same period of previous year. For the month of July this year, imports surged by 51 percent to 4.84 lakh tones compared to the same period last year.

NCDEX Soy oil prices rose by 22 percent from the second half of April from Rs. 691.40/10kg after the panic selloffs that were witnessed early this year following the threat of COVID-19 virus across the globe. Soy oil regained strength supported by the gains in U.S CBOT soybean oil prices. The gain was flavoured by improved demand from the U.S, Brazil and the largest importer-China, after lifting lockdown in most of the provinces. Severe drought in South America supported the prices as well. In Brazil, largest producer, heat wave disrupted harvest in many parts which led to fall in output. Similar is the case with Argentina as well. Also, logistics disruption in Argentina created a shortage of supply to the market and thereby lowering the exports too. Meanwhile, in US, Soy oil stocks also fell despite higher crush of soybean and demand rose for biodiesel, feed, food and industrial purpose. Moreover, announcement of quantitative easing and stimulus package in the U.S and other leading economies and recovery in crude oil prices from sub-zero levels also assisted the gains in soybean oil prices, which is also used as a bio fuel in many countries, also augmented the revival.

On the domestic front, apart from the overseas market cues, the relaxation of lockdown and shortages in supply of mustard oil in to the market lent support. Most of the mustard farmers are unable sell the produce in the physical market due to lockdown restrictions, which supported the prices of substitute edible oils, like soy oil.

Looking ahead, imports are likely to pick up in India to pre-Covid levels within the next three to six months as festival season starts from September, which is likely to increase consumption. Yet, demand is expected to resume on full swing only once whole unlocking of the economy happens. Lower stocks in the ports and pipeline is likely to support the prices as well in the near term. However, expectation of higher soybean output during this kharif season may keep a lid on rise in domestic edible oil prices. Picking up of domestic demand for meal from poultry industry may increase the supply of soy oil in the local market in the long run. In the international front, vegetable oil supplies across the globe looks tight, as supply side disruption was seen in many regions. Moreover, lower palm oil stocks and higher exports from Malaysia are likely to prop up domestic prices too. Demand from biodiesel in Indonesia and Malaysia may keep the prices tight in the near term. Thus, demand is set to pick up as the pandemic situation gradually subsides. Meanwhile, global soybean output is seen on higher side, in spite of rise in second wave of corona virus in the US, which may keep soy oil prices under check. Still, higher demand for palm oil may lift substitute oils such as soy oil and sunflower oils in the near term.