The correction in the market has been quick and large because the health risk posed by Covid-19 to the world economy is unprecedented. In a span of less than two months, the main indices like Sensex, Midcap, and Small cap corrected by -40%, -47% and -57% respectively. Post which we are in bear rally due to the improvement in global view led by stagnation in the number of new Covid-19 cases being reported, huge monetary and fiscal stimulus announced across the world. The sustainability of this rally depends on the reopening of the world and the domestic economy. Today the general consensus is that economy will revert to normality by June 2020. If this hypothesis gets a stronghold, which is possible, based on the current progress in the world and domestic health meter, then the April-June quarter could be the worst period for the economy. It will then improve on a QoQ basis. Based on the pre-emptive way in which the equity market works, by reacting three to six months in anticipation of the final event, then this could be the best time to accumulate stocks and sectors which have business visibility. The volatility will prevail for the time being which will reverse as soon it is clear to the market that we will have a successful lockdown, public health, fiscal and monetary stimulus.

The market is in a bear rally…

A bear rally was triggered by squaring-off and reduction in FII selling due to positive momentum in the global market. This change in strategy was post the heavy selling in February and March which took the market to the oversold region. At the same time, some reduction was noticed in the rate of new viruses in developed countries due to the imposition of lockdown and also in expectation of further stimulus by FED to boost the economy. In India, the report of lockdown is encouraging with pockets of hotspots being points of concern. But still, India is expected to reopen the economy in a phase-wise manner.

Currently, the market momentum is heavily dependent on technical factors and future market momentum since fundamental are weak. Nifty 50 range has upgraded positively from 8,000 to 8,500 in March to 8,500 to 9,600. This new range will continue until FII’s strategy is maintained based on positivity over the global market and hope for a successful lockdown and Quantitative Easing.

Big monetary and fiscal stimulus is helping the market…

This rally and future trend of the market will depend a lot on the stimulus, which is providing safety to the financial market today. The ground reality is weak with washout in revenue and profitability in the short to medium-term. The stimulus announced till date for the “Great Lockdown” is higher than the one announced in “Financial Crisis 2008”, hence the recovery will be swift as the health situation improves.

Example: Quantitative Easing announced by US FED

| Stimulus announced in 2008 Financial Crisis: Fiscal Measures: $ 787 billion of stimulus package. Monetary Measures: Interest rate cut to near zero percent.Quantitative Easing was conducted in three phases, nearly for six years; (from December 2008 until March 2010, from November 2010 until June 2011, from October 2012 until October 2014). By the end of QE, US balance sheet had reached $4.48 trillion. Stimulus in Great Lockdown Fiscal Measures: $ 2 trillion stimulus package. Monetary measures: Interest cut to nearly zero percent. QE worth of $700 billion announced.More stimuli are expected. |

Similar measures, with record sizes are announced in the rest of the world. In India, fiscal and monetary packages announced on 18th April are about 4.5% of GDP. Optimism is that a second economic package bigger than the Rs1.7 lakh crores announced in March is underway. The last fiscal package focused on free food, direct cash benefits and job safety for the BPL section. This time the relaxation will be with tax benefits and relief for daily workers, MSMEs and farmers. No specific benefit is expected for corp orates. However, phased opening of the economy itself will provide positivity for the demand for staples, healthcare and banking services.

Q1FY21 could be the time of accumulation…

In January 2020, IMF downgraded world GDP growth forecast merely by 0.1% to 3.1% for CY2020. In April IMF’s view, completely changed and they declared it as the biggest economic threat “like no other” because never in history had the world come to a standstill as in the “Great Lockdown”. The global growth forecast has been cut to -3% for CY2020.

The world will get through this, but how fast and effective will depend on the actions. In the last similar equity cycle, world GDP growth was 4.2% in 2007, which slowly collapsed in the next two years to 1.8% in 2008 and -1.7% in 2009. The forecast for world GDP in CY19 was 2.5%, we can expect an immediate collapse in CY20 in which Q2CY20 would be the worst period. Based on the best-case scenario we can expect improvement in the economy on a QoQ basis as the economy opens up in a phased manner. In India, it could be 3rd May with some restrictions while the final openings maybe post June.

Market reacts ahead based on foresight…

Equity market momentum is about one to two quarters ahead of the economy. And since the financial market is in the hold of huge liquidity we can expect a strong reversal though volatility may prevail in the short-term. For a retail investor, this is the time to be patient, adopting a wait and watch approach and maintain their SIP investments. We are sure to overcome this “Great Lockdown” while the time will depend on the measures, the success of lockdown, treatment, and vaccination. Long-term investors can use accumulation as a strategy during this period of lockdown. Today the market hopes that economy will start to improve from Q2FY21. The sectors which can outperform in the situation are Staples, FMCG, Pharma, and Healthcare. Traders can capitalize on this bounce in the market to square-off their position as per their risk appetite.

Which stocks and sectors to invest in?

Currently, the market is attractive on a long-term basis since the intrinsic value of many stocks is below the present value of their future cash flows. The market tends to overvalue and undervalue stocks. Presently the market is weak due to the risk of a big recession and massive selling by FPIs. The market had tolerated such and even worse scenarios in history like World Wars I and II to Global Crisis-2008.

We suggest buying and accumulating stocks and sectors for long-term gains and strengthening your model portfolio. The stock ideas are based on criteria’s like:

- Strong business models that have generated brands and leadership in the industries, products or niche segments.

- Businesses which stay safe and flourish after challenges.

- Healthy track record of existence and growth under any cycle of the economy.

- Tremendous cash flow generation and a lucrative dividend pay-out record.

- A healthy balance sheet with zero/negligible net-debt.

- Credential of the management, No pledging and strong shareholding by recognised institutions.

- Attractive valuation and parameters like business growth, margin, RoE, and RoI.

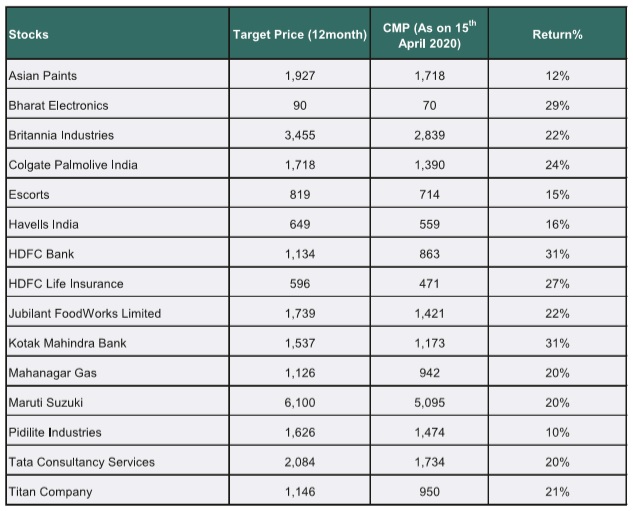

Our stock ideas are:

The detailed research reports are available on Geojit Selfie- our advanced trading and investment platform.

Thanks for the valuable information and suggestions.

I am a beginner in this trade, but been with Geojit for the last 12 years. Believes in Long term investments. I have a good amount trapped in MFs, which I cant sell right now. Iam ready to invest just about a lakh in some good shares, nee not be blue chip, looking for stocks under 50.00 which can go up. Hope you understood my requirement. Expecting some good suggestions from you as you are very experienced.