Financial theory assumes investor as a “rational wealth maximiser”. The rational investor takes decisions based on fundamentals and financial reasoning. But, in reality, the investor is far from rational; he/she is often guided by emotions far removed from financial logic. This is the reason why markets often become “manic-depressive”, driven by greed and fear. This emotional reaction of investors manifests more in retail investor behaviour. Retail investors are unduly influenced by herd instinct, and therefore, they move with the crowd even when the crowd-behaviour becomes irrational.

Financial theory assumes investor as a “rational wealth maximiser”. The rational investor takes decisions based on fundamentals and financial reasoning. But, in reality, the investor is far from rational; he/she is often guided by emotions far removed from financial logic. This is the reason why markets often become “manic-depressive”, driven by greed and fear. This emotional reaction of investors manifests more in retail investor behaviour. Retail investors are unduly influenced by herd instinct, and therefore, they move with the crowd even when the crowd-behaviour becomes irrational.

Herd behaviour is wrong investment strategy

A significant trend in retail investor behaviour is aggressive buying when the market is bullish. When the market sets new records and stories of investors making fortunes become attention-grabbing news, retail investors jump in and invest indiscriminately, often in low-grade stocks. Then the inevitable crash happens and poor quality mid and small caps get slaughtered. In the market crash, blue chips would have become very attractive, warranting selective buying. But retail investors sell everything at huge losses and flee in panic, only to return at the height of the next bull market.

Successful investors are mostly contrarians. They buy when the crowd sells, and sell when the crowd resorts to irrational buying. Only a minority of retail investors moves away from the herd. Majority swims with the current and gets lost. The mid and small cap frenzy of 2017 was a classic manifestation of this irrational herd instinct. We had warned investors about the bubble in mid and small caps and had advised switching to safe large caps.

Fortunately, there are some signs of healthy trends in investor behaviour. Investors sustaining with their SIPs in mutual funds is a healthy trend. But there are signs of some retail investors stopping their SIPs, planning to restart when bullishness returns to the market. This would be a big mistake. As we have communicated innumerable times, it is impossible to time the market. The only way to make money is through disciplined long-term investment. Sometimes the market will test investors’ patience. Remember the saying, “to be successful in the stock market you need only one person’s intelligence, but ten persons’ patience”. Let me share with our readers the following trends in the economy and markets and also some random thoughts, which might be useful in managing the market volatility.

India is underperforming global markets

There is a risk-on in global markets in 2019. The most important trigger that ignited this risk-on is the change in the monetary stance of the US central bank. The FOMC meet held during end January not only kept interest rates unchanged, but also indicated that rate increase was on hold due to concerns over global growth. The US 10-year yield fell to 2.66 percent from the high of 3.26 percent during last October and the dollar index weakened.

This dovish Fed stance has facilitated a resumption of investment in risky assets like equity, corporate bonds, EM equities and some currencies. As I write, MSCI US up by 11 percent for CY 2019. MSCI EM Index is up by 7.6%; but MSCI India is down by 4.6%. The underperformance is huge in mid and small caps. This underperformance is largely due to the uncertainty associated with the general elections and most recently by fears of escalation of tensions between India and Pakistan following the tragic event in Pulwama.

Many retail investors have been catching falling knives

Averaging down would turn out to be a successful strategy if the stock that is falling is a quality stock falling due to some short-term challenges. But if a stock is steadily declining due to structural issues and there is no scope for business revival, the stock should be avoided even if it is available “very cheap”. A stock that has corrected by 90 percent is cheap only in optics; in reality the distress price reflects business failure. Unfortunately, retail investors buy these stocks looking only at the price correction. During the last one-year many small caps have corrected by more than 60 percent; some have corrected even more than that. The correction has been caused by many factors like deep structural problems, auditor exits, excessive share pledging by overleveraged promoters and corporate governance issues. While institutions have been exiting these stocks, retail investors have been steadily accumulating them. This is like catching falling knives; catchers would bleed.

The HRITHIK dance

Market commentators are now describing the resilience of the Nifty as HRITHIK dance. HRITHIK stands for the seven bluechips – HDFC Bank, Reliance, Infosys, TCS, HDFC, ITC and Kotak Bank. Presently these seven stocks account for 48.5 percent weightage in Nifty. If we add ICICI to this list the weightage would be 53.3 percent. Nifty’s impressive performance is due to the strength of these stocks. Most retail investors are not enjoying this HRITHIK dance since HRITHIK is conspicuous by its absence in their portfolios.

The logic behind the HRITHIK dance is simple. These are high quality stocks with clear earnings visibility. The net profit of these companies in FY20 is almost predictable and major divergences would be remote. But in the case of most mid and small caps this predictability is difficult and the divergence between the expected and the actual can be huge. Consequently, the share prices would react – both positively and negatively- depending on the outcome.

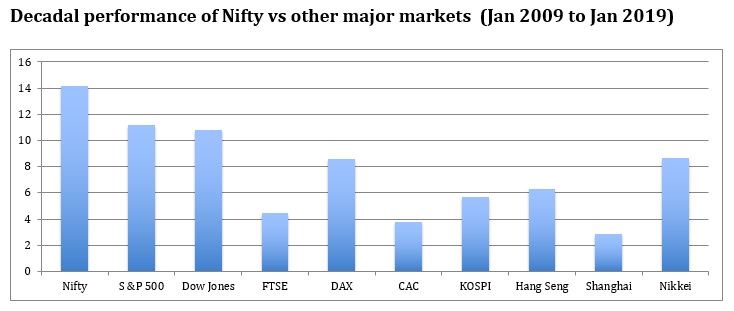

India’s long-term outperformance

The short-term underperformance of the Indian market is cyclical. Since the initiation of liberalization in 1991 India’s GDP has multiplied more than 10 times and the Sensex has multiplied 36 times. If we take the last 10 years – 2009 to 2019 – India has outperformed other markets. Nifty outperformed other major markets with a CAGR OF 14.2 percent return.