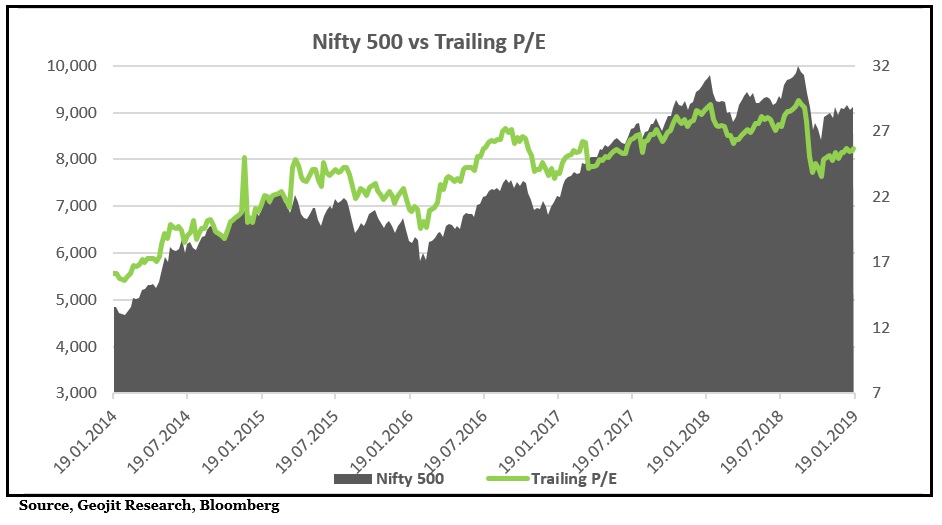

The ongoing volatility is expected to continue in the near-term as valuation of the broad market is maintained at high levels. For example, NSE 500 is currently trading at a trailing P/E of 26x which is marginally above the last five-year average. The possibility of maintaining this high range is less as the domestic economy is slowing down. The five-year range is 30x and 15x.

As per Central Statistics Office (CSO), the economy is expected to slowdown in H2FY19 to a GDP growth of 6.8% compared to 7.6% in the first half. In the same manner, market is downgrading earnings expectations on a step-by-step basis as each result season approaches. Now they have a muted expectation on Q3 and Q4, impacting valuation further.

Start to Q3 below par, but long-term outlook maintained…

Q3 results season have started (dated 18th January), and the initial results are below expectation, impacting the market momentum. The Nifty50 PAT is estimated to grow by around 5% on a YoY basis for Q3FY19. If we adjust the loss-making Oil Marketing Companies (OMC), (due to recent government policy) the YoY PAT growth will be 15%. This growth is mainly expected from Financials, Metals, Pharma and Infra sectors. The financial sector is expected to perform well as challenges related to stress assets have passed the peak, leading to moderation in provisioning and improvement in credit growth while reduction in bond yield is leading to higher treasury income.

IT sector initiated the results well. The market has a stable outlook for the sector owing to continued momentum in core verticals and scale up in digital business. Digital business is performing well with revenue contribution increasing for TCS and Infosys. This is driven by strong traction in demand across cloud, IoT (Internet of Things), cyber and data analytics. A solid revenue growth of 17% (Nifty IT index) for the industry and rupee tailwinds aided margin expansion for the quarter. The industry is expected to deliver double digit growth in H2FY19 buoyed by recovery in BFSI (especially in North America) due to structural improvement in demand and strong order book. On a one-year forward basis, the Nifty IT index is trading at 15x which is reasonable compared to three-year average. However, strengthening of the rupee from its peak of Rs75/$ to Rs69.8/$ by December end is expected to induce some volatility in the near term. In addition to that the negative surprise from higher offshore subcontracting and employee cost due to H1B issue, impacted the sector. EBITDA margin declined by 100bps (QoQ) which is expected to be maintained in the near-term. Overall, the results were mixed since they marginally cut the expectation on profitability while maintaining a positive outlook on business. Our long-term outlook for IT sector is intact with focus on the large caps. Digital business for the quarter continued to perform well with revenue contribution increasing to 30% (28% Q2FY19) for TCS and 33% (31% in Q2FY19) for Infosys. Revenue growth was solid at 20% for both Infosys and TCS. Infosys has revised their constant currency revenue estimate to 8.5-9% YoY (6-8% earlier) while TCS maintained their double-digit growth guidance.

On a similar note, the start to banking sector results was mixed; lending and deposit growth rates are high but NPAs continue to popup more than expected. Bandhan and IndusInd grew lending by 46% and 35% YoY. For Karnataka bank and J&K bank, the loan growth was 20% YoY. At the same time, deposits have grown by around 30% and 20% for Bandhan and IndusInd respectively. These numbers cater well for higher top line growth and brighter outlook in the long-term; the issue in the short-term is hike in NPA. As per the RBI data, the lending activity has increased by 15.1% YoY in December, while deposits grew by 9.2% YoY during the same period, with credit-to-deposit ratio reaching 47 year high of 78.6%. Lending to NBFCs by banks has increased during the tight liquidity situation.

In pharma, shift into complex generics, specialty products and stability in US pricing is aiding performance. Infra sector is expected to do better on a QoQ basis led by Cement and Construction segment. On the other hand, de-growth in profitability is expected in Telecom, NBFCs and Auto sectors. In telecom, aggressive competition and lower Average Revenue Per User (ARPUs) are impacting business while asset quality, liquidity, higher cost of funds and slowdown in business are plaguing NBFCs and Auto sector.

OMC’s are underperforming in recent times as government has asked them to forgo a portion of their marketing margins in October as Brent crude prices hit high of $86.7/barrel. Post this, though Brent crude has dropped by 33%, OMCs continue to underperform due to expectation of weak earnings in the near term and general elections. Going ahead, re-rating of the sector will largely depend on the policy adopted by the new government post elections.

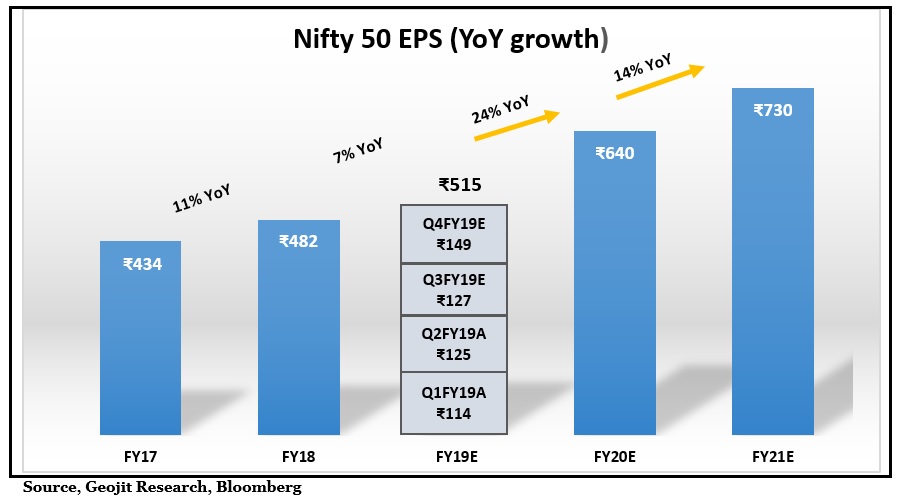

Cut in earnings in the near-term… Expectation for FY20 looks solid

The market was expecting 15% and 22% growth in Nifty50 EPS for FY19 and FY20 respectively. The actual EPS growth in H1 is about 8% and given a slowdown in business in H2, this expectation is at risk with downgrade in earnings growth. We understand that this expectation will taper to sub 10% and 20% respectively.

The other point of concern is that liquidity in the domestic and global market has reduced impacting equity as a class of investment in the short to medium term. The pace of interest rate hike and consolidation in quantitative easing can continue in US for the near-term, since the economy is still very solid. This will impact the performance of Emerging Markets. And lastly, US and China have to settle the trade war.

These are the risks; but they are all well-known. They have been factored by the market to a good level though not completely. Central banks and governments are working on it to address the situation. We believe that as the year matures we will have better investment opportunities in between. The main reasons are:

- We hope that earnings growth will be very good in FY20 especially in the second half compared to the subdued earnings in the last three years due to a host of reforms, which came one after another. We are bound to have a positive lag effect in the economy from these reforms in the long-term.

- Indian fiscal is at risk in FY19 but overall it is still very good compared to the past and will be better in FY20 with additional support coming from lower oil prices.

- Inflation has been brought under control and will lead to lower interest rate in India for the next six months.

- Relationship between RBI and the Government has improved and both are working to improve the liquidity situation in the financial markets, which will be very positive for equity market.

- The pace of interest rate hike in the US will normalize in the second half of 2019 calendar year.

- Recently US and China had a meeting which closed on a positive note providing hope of a resolution of the trade war.

These are the main reasons why we feel that 2019 will be better than 2018, with a chance to use this as an opportunity to develop wealth portfolio. We continue to believe that investment in large-caps should be more than in mid and small caps in the near-term, given the undergoing domestic and global risk. Currently, we suggest a mix of 82.5% for large-caps and 17.5% for mid and small-caps, which can be increased in the future as risk subsides. The focus should be more towards stable domestic stories like consumption, IT, chemicals and export-oriented companies. Value stocks in Pharma, NBFCs, Cement and Infra should also be added.

Recently the market is inching up supported by some stability in the global market and tax and rate cut in China. Importantly, domestic market is supported by the huge ease in CPI inflation to 2.19% (Dec). Fall in 10-year yield and moderation in inflation is providing hope in the market that RBI will ease its monetary policy. Having said that, RBI had recently confined its stance to ‘calibrated tightening’ in expectation of volatility in global bond yield, oil prices and lack of domestic liquidity. Changing this stance so early may be tricky. But with the new chief at RBI, better relationship between the central bank and the government and supporting data, it would be interesting to see how the monetary policy evolves.

Information provided by Giogit is very helpful for investors