New investments worth a trillion rupees were proposed during the quarter ended December 2018. This is less than half the value of proposals made in the September 2018 quarter and even the corresponding quarter of 2017.

New investments worth a trillion rupees were proposed during the quarter ended December 2018. This is less than half the value of proposals made in the September 2018 quarter and even the corresponding quarter of 2017.

As additional information flows in during the coming weeks, we expect the current estimate of a trillion rupees to rise to about Rs.1.4 trillion. But even at this revised level, new investments during the quarter ended December 2018 would be among the lowest recorded in well over a decade.

The recent decline in new investment proposals began around the quarter of June 2015. So, we are currently in the fourth year of this declining phase. The earlier decline lasted for two-and-half years – from 2012 to mid-2014. That fall was short but steep as new investment proposals fell from nearly Rs.7 trillion a quarter to Rs.2.5 trillion. In the current phase, the peak was at Rs.5.5 trillion and the fall is to around Rs.2.5 trillion a quarter so far. (These are trailing four quarter averages.)

Given that capacity utilisation levels are still quite low, it is unlikely that new investment proposals on the aggregate would pick up soon.

Revival of projects that were stalled for some reason are not sufficient to offset the decline in new investment proposals. After six quarters of tepid revivals, the December 2018 quarter witnessed an increase in revival of projects to Rs.830 billion from the average of Rs.310 billion in the preceding six quarters.

While new investment proposals and revivals are low, there is an increase in projects being abandoned, shelved or stalled.

The quarter of December 2018 was particularly sobering in this respect as a Rs.3 trillion mega refinery project slated to come up in Konkan Maharashtra was stalled. The project was announced in December 2015 but has not been able to get off the ground. Implementation was stalled apparently following land acquisition problems. Besides this mega refinery project, two more projects were stalled in the same quarter because of land acquisition problems. Two of the three projects are government projects. The refinery was promoted by the Ministry of Petroleum & Natural Gas. And, a state government promoted furniture hub in Kalamassery in Kerala was also stalled because of land acquisition problems. Besides, a Rs.10 billion cement plant in Rewa, Madhya Pradesh was also stalled because of land acquisition problems. Government-promoted, Madurai NIPER project was stalled because of lack of clearances.

Total projects stalled during the December 2018 quarter add up to Rs.3.1 trillion. Rs.0.8 trillion worth of projects were completed during the quarter. As a result, against an addition of less than two trillion worth of projects (about a trillion rupees worth of new projects and Rs.0.8 trillion of revivals), nearly four trillion worth of projects were reduced from the stock of outstanding projects. As a result, the stock of outstanding projects has declined.

Outstanding value of all projects has been declining since the September 2017 quarter.

The stock of investment projects has declined by Rs.9 trillion from a peak of Rs.194 trillion as of September 2017 to Rs.185 trillion as of December 2018.

The largest contributor to this decline is the removal of projects worth Rs.14.5 trillion because there was no update or new information or response to our reaching out to them for several years. Besides, Rs.8.2 trillion worth projects were abandoned, stalled or shelved during this period. In the face of this depletion, accretion from new projects has been weak to offset the decline.

The net additions ratio is a useful indicator to see the net impact of additions and deletions to the stock of projects. It is defined as the ratio of new investment proposals and revivals to the sum of projects completed, abandoned, stalled and with no updates/information. This ratio dipped below one in the quarter of June 2017 and has remained below one since then.

This is not a sudden fall. The net additions ratio has been close to one since mid-2011. But, it has flipped on either of unity and averaged close to one. From mid-2017, the ratio has been consistently and substantially below one.

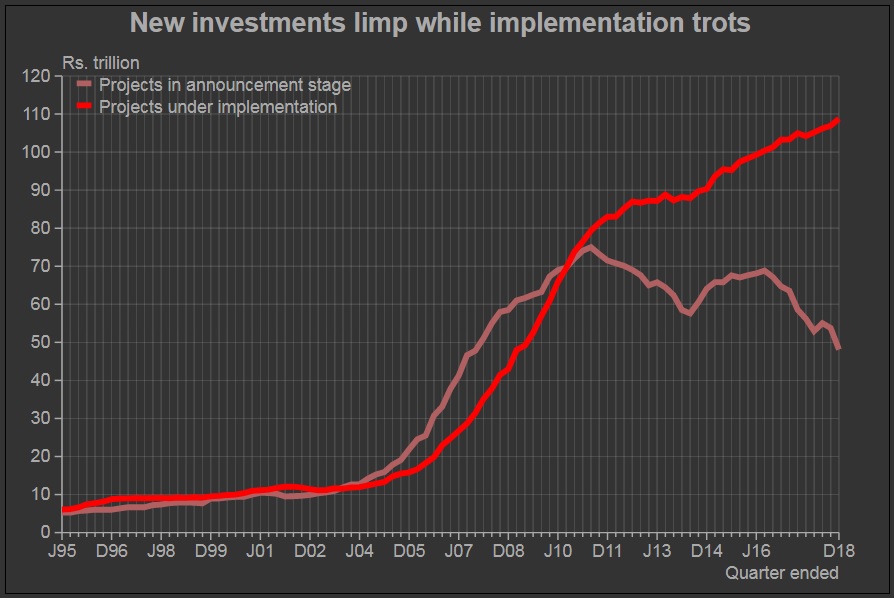

While the stock of investment projects is declining, the proportion of projects under implementation is rising. Projects under implementation are those that have moved beyond the stage of a mere announcement and little tangible progress in terms of implementation.

As of December 2018, nearly 59 per cent of the total stock of projects were under implementation. This is the highest ratio seen since the mid-1990s. But, this rise of the share of under-implementation is also a reflection of lower new announcements and a consequent fall in projects in the announcement stage.