Dr. V. K. Vijayakumar

Dr. V. K. Vijayakumar

The Great Recession of 2008-09 was the worst global economic crisis after the Great Depression of 1930s. The ‘sub-prime crisis’ in the U S housing market was the epicenter of the catastrophe that led to a global financial meltdown. The collapse of the large investment bank, Lehman Brothers, led to a contagion, impacting financial institutions. Globally, stock markets and currency markets crashed. Credit contracted hugely and business confidence was impacted. The global economy slipped into a massive recession. Global GDP contracted by 2 percent in 2009. US suffered an economic contraction of 5 percent and job losses of 10 million. Europe was severely impacted with contraction of the European economy by 4 percent. Southern Europe particularly Portugal, Ireland, Italy, Greece and Spain were severely impacted pushing Europe into a debt crisis by 2010. International trade contracted by 13 percent in 2009. Asia was one of the least affected regions. China and India were least affected even though both countries experienced decline in growth rates.

Unprecedented global economic co-operation

The global financial crisis witnessed unprecedented global co-operation and synchronized monetary policy initiatives. G7 and G20 groups met frequently. For the first time in global negotiations, emerging economies like India were taken seriously. President Obama, in the G20 meetings, listened to our economist Prime Minister Manmohan Singh with a lot of respect. Globally, central banks cut interest rates in a synchronized manner. The European Central Bank and central banks in US, UK and Japan, in an unprecedented move, cut interest rates to near zero levels. In India, the RBI, in the severest cut in interest rate in history, cut the repo rate from 9 percent in 2007 to 3.5 percent over the next 3 years.

Even though global growth remained sluggish for many years after the crisis, presently the global economy is in the pink of health. The US is presently going through one of the longest periods of economic expansion in history. Europe has recovered from the debt crisis and is growing at a decent rate. Some of the emerging economies like Argentina and Turkey are in trouble due to sharp depreciation in their currencies. China has slowed down its growth rate substantially. Indian economy has recovered from the twin shocks of demonetization and GST implementation. In spite of the depreciation in INR this year, the Indian economy is doing well.

India and the global recession

India was one of the few large economies that were not impacted by the crisis. India’s well-regulated banking system played an important role in insulating the Indian economy from the global financial crisis. But it is also a fact that some of the excesses during the crisis later led to severe banking distress that India is going through now. And this crisis has become a huge NPA mess of more than Rs 10 lakh crores.

When a major recession, like the 2008 recession happens the standard economic response is to provide monetary and fiscal stimulus to revive the economy. Monetary response is to cut the interest rate and the fiscal response is to cut taxes and increase government spending. Like all other governments, India too did this. This was the right thing to do under those circumstances. But in retrospect we have to say that our response was a bit too excessive. The stimulus provided by the RBI and the government did succeed in reviving the economy. India’s growth rate, which had slumped to less than 5 percent in 2007-08, quickly recovered and rebounded to more than 8 percent growth in 2009-10 and 2010-11. But the economy had to pay a heavy price for this stimulus.

Bad decisions during good times

The global boom of 2003-07 emboldened businessmen to make reckless investments. Banks, flush with funds, were chasing industrialists to borrow from them. Later, the government, as part of its fiscal stimulus package, encouraged public sector banks to lend massively to large projects. Huge investments were made, particularly, in steel and power projects. PSU banks, with very little expertise in financing such projects, lent money to such projects, without due diligence. Result? Most of these loans became NPAs. The Chinese policy of dumping steel impacted the steel industry globally. India too was impacted. The Supreme Court verdict cancelling coal allocations inflicted a massive blow to the power sector. Even though the loans given to Vijay Malaya and Nirav Modi are prominent in public discourse, the worst blow to the Indian banking system was delivered by these loans to the steel and power sectors.

The excessive fiscal and monetary stimulus following the Great Recession also led to very high inflation in 2012 and 2013 forcing the RBI to steeply hike interest rates. This, along with the slowdown in global trade, impacted India’s growth rate. The collapse of demand and the excess capacity in industry led to sharp fall in private investment. To prevent further slowdown in the economy, the central government had to step up public investment and recapitalize the PSU banks, which had eroded a substantial part of their capital. The oil bonanza that the government received from the crude crash in 2014 had to be largely used for this.

Lessons from market crashes: history repeats

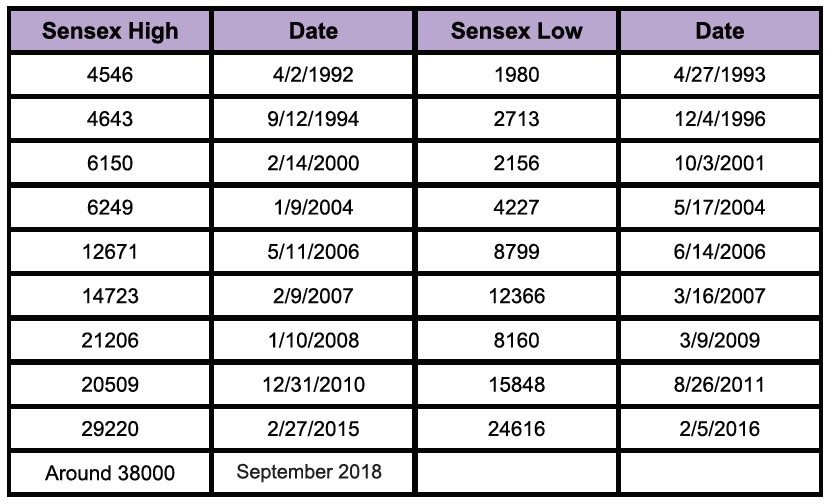

Globally, the stock markets have rebounded smartly from the crash and most markets are now at all time highs. S &P 500 has more than quadrupled from the low of 666 recorded in March 2009 to the present levels of around 2700. The Sensex, too, has more than quadrupled from the 2009 March low of 8160 to above 37000 presently. The important lesson from the market crash, and the later rebound, is that smart investment strategy is ‘buy on bad news’. Market tends to overreact and this over-reaction provides buying opportunities. Take a look at the crashes and rebounds in the Indian stock market during the last 25 years.

It is clear that all major corrections were great buying opportunities. Investors who bought “when there was blood on the streets” laughed all the way to the bank when calm returned to the market. Of course, it is difficult to identify the top and catch the bottom of the market. It is enough to be cautious at very high levels of valuations and buy when the market stabilizes following a crash and then wait with a lot of patience. As Warren Buffet famously said, “panic when everybody is greedy; be greedy when every one is panicking.”