The slow growth of tax collection in the current fiscal year is an area of concern for the government finances. As per the data released by Controller General Accounts, tax revenue collection (net) up to October’19 stands at ₹6.8 lakh crores, whereas the budget estimate for FY20 is at ₹16.5 lakh crore (excluding the states’ share in the tax revenue). It shows that the tax revenue collected up to October is only around 41 percent of the target. Additionally, the GST collection for most of the months in the current fiscal was below the target of ₹1 lakh crore.

The slow growth of tax collection in the current fiscal year is an area of concern for the government finances. As per the data released by Controller General Accounts, tax revenue collection (net) up to October’19 stands at ₹6.8 lakh crores, whereas the budget estimate for FY20 is at ₹16.5 lakh crore (excluding the states’ share in the tax revenue). It shows that the tax revenue collected up to October is only around 41 percent of the target. Additionally, the GST collection for most of the months in the current fiscal was below the target of ₹1 lakh crore.

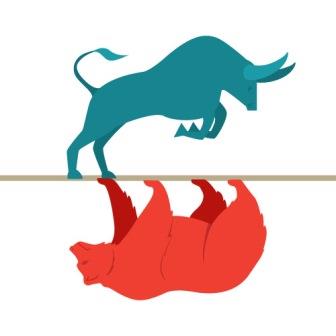

With an estimated tax revenue of around ₹16 lakh crores for FY20, government is expecting tax revenue to register a YoY growth rate of around 12 percent. In terms of the revenue receipts, YoY growth rate of around 13 percent, and total expenditure growth rate also at 13 percent is expected. In the current scenario, it looks like the government will have a tough run in achieving the fiscal deficit target. The fiscal deficit for FY20 is pegged at 3.3 percent of the GDP.

The transfer of RBI surplus brought in some relief to the exchequer. The government got an extra Rs 55,000 crore from the RBI that was not budgeted. Amid the economic slowdown, it was anticipated that the RBI surplus transfer would help the government to achieve the fiscal deficit target. However, its effect was nullified with the revenue foregone from the corporate tax cut. It is estimated that the revenue foregone from the corporate tax cut would be ₹1.48 lakh crore.

In addition, the disinvestment target for FY20 is at ₹1.05 lakh crore. As per the data furnished by Department of Investment and Public Asset Management (DIPAM), the achievement so far is only ₹17,364 crore. It shows that the achievement is only 17 percent of the target. Though the government is actively pushing for the strategic disinvestment of a number of PSUs, it is unlikely that the strategic sale will happen in the current fiscal. The current economic environment is also not conducive for the government to successfully carry out the strategic sales of PSUs.

Similarly, the buzz is also going around that the GST council will consider increasing the GST tax rates and rationalising the tax slabs to mop up the tax collection. The simplification of GST tax structure will be beneficial to the economy in the long run. However, the timing of its implementation is also important. In the current economic situation, it could do more harm than good.

In this background, the fiscal deficit will likely shoot above the target of 3.3 percent. The market is expecting the fiscal deficit to be above 30-50 bps from the target. However, the final figure will be known on 1st February 2020 when the Finance Minister presents the Union budget for FY21.