We know that equity as an asset class outperforms other asset classes in the long run, but it is always volatile. To gain from this volatility, it is important that investors should not stop SIPs when the market corrects. This is because those are the periods which help you buy more units of the mutual fund thus allowing you to take the advantage of rupee-cost averaging. This is one of the main benefits of starting a SIP. Let me explain this with an illustration given below.

Let’s start with the basics. What are the benefits of starting an SIP? One of the benefits are, equity markets are volatile in nature and one cannot predict its movement. Timing the market is not possible and is a risky proposition, instead invest regularly – say every month. Since we are investing a certain sum every month irrespective of the price or NAV, we buy more units when the market goes down and lesser units when the market goes up. This is called Cost Averaging and is a very important element in SIP investments. When the market appreciates over a period of time, reflecting the corporate earnings and broader economic fundamentals, the NAV will appreciate. Therefore you will stand to benefit from the power of compounding on all accumulated units.

Illustration explained

Illustration explained

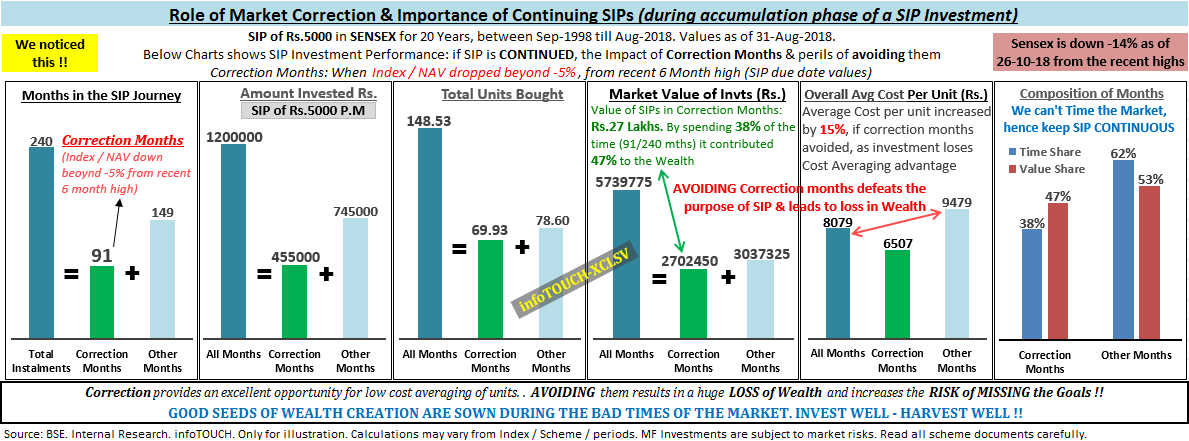

- It simulates an SIP of Rs.5000 per month in Sensex (a widely tracked Equity Large cap Index) for 20 years (Sep-1998 to Aug-2018)

- SIP investments were at the beginning of each month and the values are as of Aug’18 (just before the ongoing correction)

- The correction months are segregated – i.e. months when the Index / NAV dropped beyond 5% on an SIP due date, from the recent 6 months high (SIP purchase value)

- Out of 240 months, there were 91 such months

- The segregated analysis was done to understand the importance and contribution of correction months on the overall wealth creation process

Observations

If an investor started an SIP in Sensex and continued it without stopping or redeeming the investment for 20 years (240 months), then he/she would have invested Rs.12,00,000 and bought 148.53 units in total. And its market value as of Aug’18 was Rs.57,39,775. Out of the 240 months, the markets witnessed corrections in 91 months.

During those months 69.93 units were accumulated with a market value of Rs.27 Lakhs. In other words, it means, the months that witnessed market correction ( i.e. 38% of the time – 91/240 months) contributed to 47% of the wealth created (i.e. 27 lakhs of the total 57 lakhs). If the investor had not invested during market correction it would have resulted in a huge loss of wealth and risked meeting the goals.

Also, the average cost per unit is Rs 8079 (Rs.1200000 / 148.53 units) if SIP is continued for 20 years without stop. The average cost per unit would have gone up by 15% to Rs 9479 (Rs.745000 / 78.60 units) if the investor did not invest during the months that witnessed market correction, as the investor lost out on the Cost-Averaging advantage. This is a significant eye-opener.

A random thought might arise here, what if we double the investment amount only during the correction months and avoided other months? Again we are getting into the futile exercise and complexity of timing the markets. Rephrasing a line I read recently, “by any chance if investors comes across someone who could predict the markets correctly all the time, he is an absolute Nostradamus, hire him as your financial adviser immediately (yea – on a lighter note)”. Regular and continued SIPs does wonders than timing the entry and exit or a truncated SIP.

Also during the months that witnessed market correction, we noticed that on an average the SIP CAGR was down 8.24%; market value of investments were down 7% from the trailing 6 months best, and the average units accumulation went up 18.5%.

The SIP journey is a combination of bull and bear markets. There are months with sharp rallies and higher corrections. While investment value grows and CAGR remains high in good months, they turn sour during the bear market. Investor behaviour during market correction decides their investment experience, especially when the market recovers over a period of time. In times of correction, investors generally tend to compare the market value of their investments with those seen during the recent highs. Initially, they wait and watch for say, three to six months and if the market corrects further, price-wise and time-wise, they turn nervous and jump to unverified conclusions. Instead, for SIP investor’s market correction should be a welcome event, as that is one of the main purposes they started an SIP – LOW COST AVERAGING.

Transaction/account statement is a silent indicator of this. During times of correction, due to drop in NAV, one observes a drop in market value of investments and CAGR and get worried. On the other hand, what the investor misses to notice is that the units accumulated during those months are more than those purchased in the recent past. Look beyond the SIP CAGR to make the SIP journey a success.

Taking an analogy, think you are holding an umbrella anticipating rain. Will you close it when it actually rains? Stopping SIPs in times of correction is like closing an umbrella when it actually rains, it doesn’t sound sensible at all. Empirical study suggests that SIP is a time-tested strong umbrella that withstood heavy rains and thunders of the volatility.

Good seeds of wealth creation are sown during the bad times of the market. Invest Well – Harvest well!!

Posted: October 2018

Valuable advice for every investors. Thank you sir