“Ideally, governments should collect taxes like a honeybee, which sucks just the right amount of honey from the flower, so that both can survive.” Chanakya in Arthashastra

Chanakya’s words of wisdom pertain to an ideal situation. But modern day societies are far from ideal. Governments face many challenges that require them to spend increasing amounts of money. Public expenditure on law and order, defence, education, health care, infrastructure development and welfare is steadily increasing. This necessitates higher tax revenues too. Therefore, citizens should, ideally, look at taxation as a moral responsibility. At the same time they can explore all avenues of tax planning and minimization of tax burden.

How can we minimize our tax burden?

In India personal income tax is imposed on gross income. Gross income is the total income earned by a person in a year. It falls under 5 heads:

Income from salary

Income from property (residential/commercial)

Income from business/profession (profits and gains from business/profession)

Income from capital gains

Income from other sources (other than the four mentioned above)

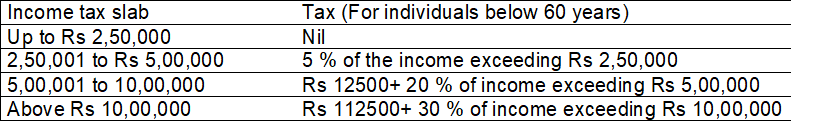

Personal Income Tax: slabs and rates (FY 2018-19)

For senior citizens (60 years and above) the exemption limit is Rs 3 lakhs and for very senior citizens (80 years and above), the exemption limit is Rs 5 lakhs. For those with an income of Rs 3.5 lakhs or below, income tax rebate of Rs 2500 (section 87A) is available. Interest income from savings bank deposits is exempt upto Rs 10000.

Apart from the tax, 10% surcharge is applicable on income tax if income exceeds Rs 50 lakhs but upto Rs 1 crore. If income exceeds 1 crore, surcharge is 15%. There is a cess of 4 percent on income tax. For the salaried sections, standard deduction of Rs 40000 is available. For senior citizens, interest income upto Rs 50000 a year from banks and post office deposits is exempted from tax.

Changes introduced by the Interim Budget 2019

The interim budget presented in February 2019 raised the tax rebate to Rs 12500 for those with a taxable income of Rs 5 lakhs and standard deduction was raised to Rs 50000.

Claim your deductions

Taxpayers can claim deductions under different heads to reduce their tax liability. Lets look at the various deductions available.

Section 80C

Section 80C provides deductions for investment up to Rs 1.5 lakhs. The various financial products that qualify for deduction u/s 80C are:

Life Insurance premium payment

Home loan principal repaid

Employees Provident Fund (EPF)

Tuition fees for up to two children

Contributions to the Public Provident Fund (PPF)

Investments in the senior citizens savings scheme

FDs in scheduled banks with a lock-in period of five years

National Savings Certificates

Investments in tax planning mutual funds: Equity-Linked Savings Scheme (ELSS)

Investments in pension plans

Investment in Sukanya Samriddhi Yojana

Apart from the Rs1.5 lakh deduction allowed under 80C, an additional Rs 50000 deduction is available on investment in National Pension System (NPS).

Other Deductions

Section 80D: Premium payments towards medical insurance for self, spouse, children and parents are eligible for deduction.

Section 24: Interest on home loan (maximum deduction of Rs 2 lakh a year)

Section 80G: Donations to funds and charities from 50 or 100 per cent of the donated amount, depending on the charity.

There are other deduction eligibilities too, like Section 80 DD, which allows deduction for medical treatment of a person with disability and Section 80 DDB, which allows deduction for treatment of certain specified illness.

Timely tax planning utilizing the various deductions available will help in minimizing the tax burden.

Useful information

Section 80D :- Not mentioned that how much amount can be claimed?

80D: An individual can claim up to Rs.25000 on the health insurance premium paid for self, spouse and dependent children. If any one of the member is senior citizen, then the limit is up to Rs.50000. In such case, an additional policy taken in the name of any parent(s) will qualify for added premium deduction over and above the previous claim.

Please highlight the advantages of PPF

Risk free return: PPF investments are risk free and provide decent return ,current return is 8% .

PPF

Tax benefit: Upto 1.5 lakh income tax deduction can be claimed under section 80c and also no tax burden on the interest income and maturity value of the PPF investment.

Loan facility : Loan facility is available in PPF investment.

Valuable information given in a concise but simple manner. Changes proposed in the Interim budget are only indicative and not to be effective as of now.

Very useful post.

Extremely informative and educative for tax planming.

Good information. Would appreciate your kindly naming the schemes for ‘Investment in the senior citizen savings scheme’ and with whom these investments can be done to avail of 80c benefits.

Senior Citizens Savings Scheme is a scheme for senior citizens.The eligibility criteria for investing this scheme are Senior citizen of India aged above 60 or any individual, who has opted for a voluntary retirement scheme or retired between the age group 55 and 60 years, can opt for this scheme within one month of retirement. For defence personnel ,this age restriction is 50 years and more.

Valuable information precisely given

Very useful information explained in a simple way. Thank you.