It is an undeniable fact that the Indian economy is slowing down. The GDP growth rate slipped to 5 percent in Q1 FY20, one of the lowest rates in the last 25 quarters. Though there is a consensus on the slowdown in the economy, pundits are still figuring out on what caused the slowdown. Debate is also going high on the structural and cyclical nature of the slowdown.

It is an undeniable fact that the Indian economy is slowing down. The GDP growth rate slipped to 5 percent in Q1 FY20, one of the lowest rates in the last 25 quarters. Though there is a consensus on the slowdown in the economy, pundits are still figuring out on what caused the slowdown. Debate is also going high on the structural and cyclical nature of the slowdown.

Lack of aggregate demand in the economy is the major factor for the current slowdown. Different schools of economic thought consider various reasons for the deficiency in aggregate demand. In the same way, policy prescriptions also vary. For instance, the Keynesian school believe that economic slump can be addressed by influencing aggregate demand through the expansionary policies of the government. Keynesians believe that the Great Depression in 1930s was due to lack of aggregate demand, and advocated increased government expenditure to stimulate the economy.

On the other hand, Monetarists believe that the Great Depression was due to the contraction in money supply, which caused a slump in the aggregate demand. Monetarists believes that money supply in an economy is the primary driver of economic growth. Let’s analyse, Indian economy’s current economic scenario from the perspective of Monetarists.

The central theme of monetarism is Milton Friedman’s ‘Quantity Theory of Money’. It states that money supply multiplied by the velocity of money equals the nominal expenditure in the economy. The formula is given as:

MV=PQ

where;

M=Money supply

V=Velocity

P= Average price of goods and services

Q=Quantity of goods and services sold

Assuming velocity as constant, monetarists believe that changes in M is the driver of the equation. In short, money supply is the major factor influencing GDP or economic growth. Monetarists believe that variation in money supply affect prices in the long run and economic output in the short term.

Let’s analyse the trend of money supply in India. Generally, M1 is used as the measure of money supply. M1, narrow money, is the sum of currency held by public (C), demand deposits in banks (DD), and other deposits in RBI (OD).

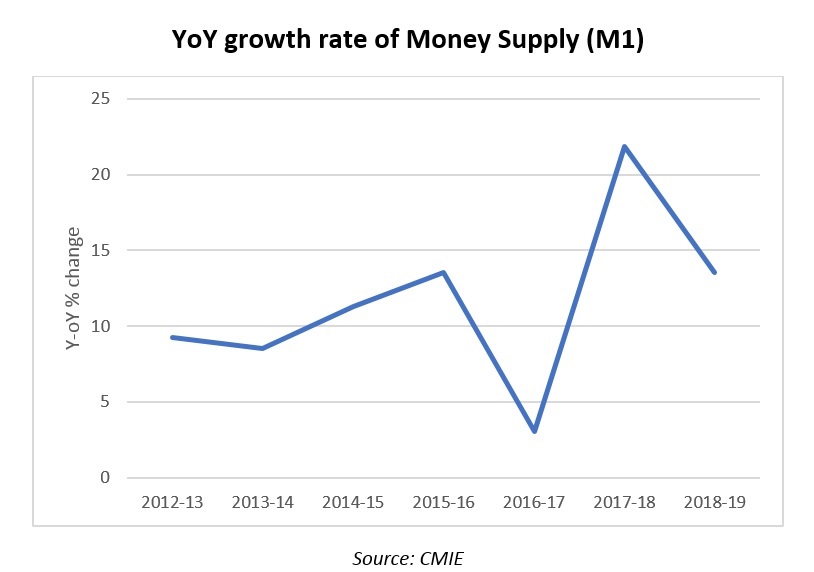

The below graph shows the trend in money supply (M1) from 2012-13 to 2018-19. It can be seen that there is a dip in the growth rate of money supply in 2016-17 at 3.05 percent, compared to 13.53 percent in 2015-16.

The fall in money supply in 2016-17 could be attributed to the impact of demonetisation. For instance, between Nov’16 and Feb’17 the YoY growth rate of money supply was negative before it turned positive in the month of March. The YoY growth rate of the money supply was -13 percent, -19 percent, -14 percent, and -10 percent in Nov’16, Dec’16, Jan’17, and Feb’17 respectively. It again slipped to negative growth rate in April’17 and May’17, and climbed to 1.34 percent in June’17. The negative growth rate of money supply is an unusual phenomenon in any economy.

Monetarists led by Milton Friedman argued that money supply should grow at a constant rate to have positive impact on the overall economy. In the Indian scenario, this relation was broken, and the growth rate in money supply even slipped to negative in certain months. If we go by the Monetarist argument, the fall in money supply in 2016-17 could have negatively impacted the economic output in the country. However, with the growth rate of money supply climbing back and at 14 percent in 2018-19, it is expected that there will be a positive influence on the economy in the coming years.

Monetarism is also not free from criticism. However, it is important to understand all factors that influence economic growth, and initiate steps to recoup the economy.