By Laxmi Priya

By Laxmi Priya

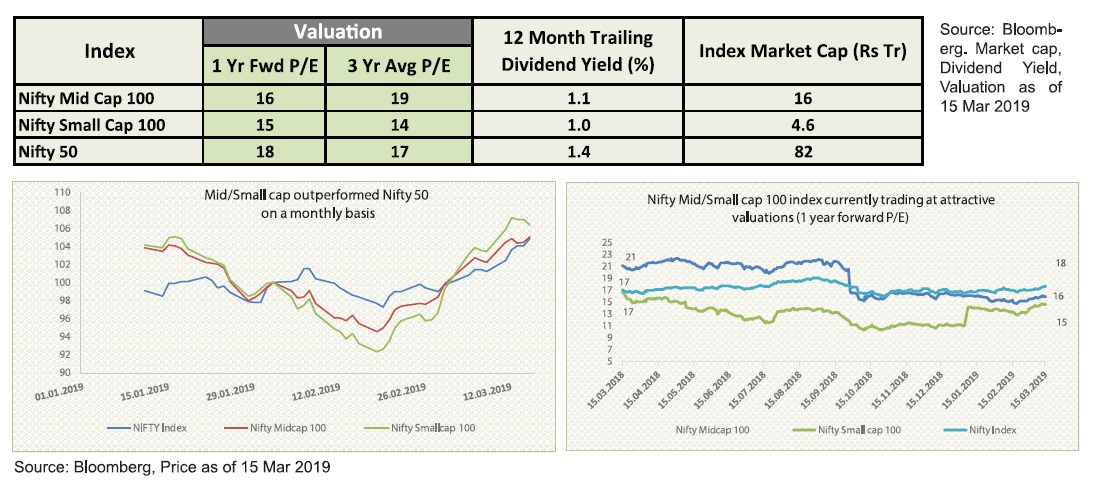

From the start of year 2018, investor’s favourite mid and small cap indices registered deep corrections compared to large cap indices largely on account of premium valuations, re-categorisation of mutual funds by SEBI, sell-off of pledged shares, and domestic macro headwinds. However, with the announcement of general election and expectation of a positive outcome (as per media) to the ruling party, mid and small indices witnessed strong gains. In the last one-month, Nifty gained 6% while Nifty mid-cap and small-cap 100 registered 10% and 15% rise respectively, outperforming other broader indices. On the valuation front, Nifty midcap/small cap 100 indices are trading at attractive levels of 16x/15x (1 year forward P/E basis) compared to 21x/17x during March 2018.

Regaining lost footing by the all-time favourite players

Regaining lost footing by the all-time favourite players

- In the last six months, all major benchmark indices registered negative returns with Nifty Small cap 100 and Nifty midcap 100 correcting the sharpest by 11% and 8% respectively.

- However, optimism was witnessed in the last three months on expectation of a market friendly general election output.

- In turn, a double digit growth was registered by the all-time investor favourite mid and small cap 100 indices whereby regaining their lost footing bolstered by financial services, media, infra, energy and cement stocks.

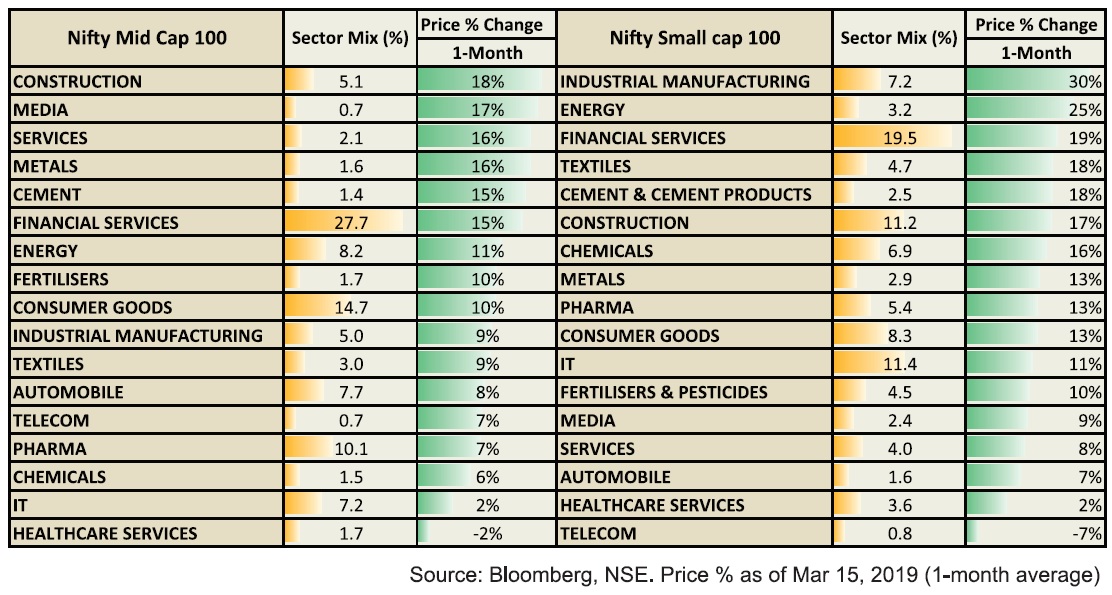

Sector specific price movement in mid/small cap space

Sector specific price movement in mid/small cap space

- Sectors like financials, industrials, energy, and consumer staples helped to drive the indices up in the last one month.

- In Mid cap, the best price performers were mainly from construction, media, services, metals, cement and financial services.

- In Small cap, best performers were from sectors like Industrial manufacturing, energy, financial services, textiles and cement.

- In Nifty Mid cap 100 index, higher contribution is shared mainly between financial services, consumer goods and pharma while in Small cap 100, major index heavyweights are financial services, IT, construction.

Below, we have given the performance of mid cap and small cap 100 stocks based on price movement, dividend yield, financial health (consistent PAT growth), promoter pledge and beta.

Below, we have given the performance of mid cap and small cap 100 stocks based on price movement, dividend yield, financial health (consistent PAT growth), promoter pledge and beta.

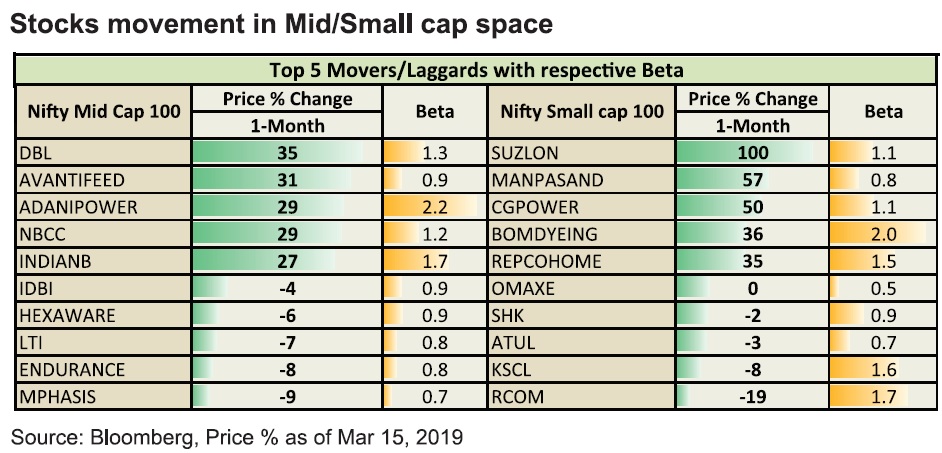

Stocks movement in Mid/Small cap space

- Among Midcap stocks, DBL and AVANTIFEED outperformed with more than 30% return in the last one-month.

- While main laggards were MPHASIS and ENDURANCE declining 9% and 8% respectively.

- SUZLON, MANPASAND and CGPOWER were best performers in terms of price movement in top 100 Small cap stocks.

- RCOM and KSCL registered steep correction with 19% and 8% decline in price in the last one month.

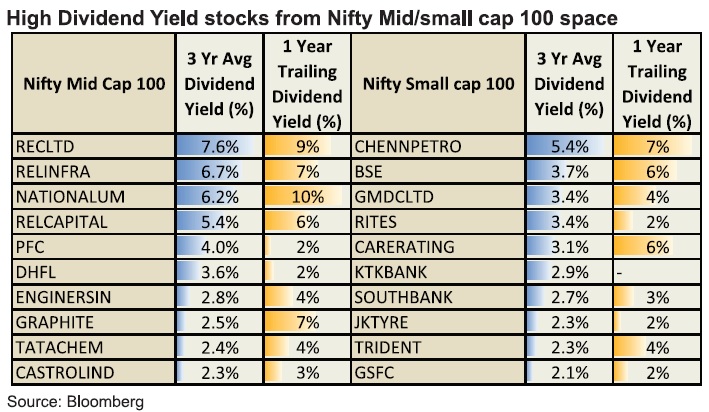

High Dividend Yield stocks from Nifty Mid/small cap 100 space

High Dividend Yield stocks from Nifty Mid/small cap 100 space

- Among Nifty Midcap 100 stocks RECLTD, RELINFRA and NATIONALUM topped the chart by distributing consistent dividend income to its shareholders.

- Among Nifty Smallcap 100 stocks, CHENNPETRO, BSE, GMDC and RITES gave above 3% dividend yield on 3 year average basis.

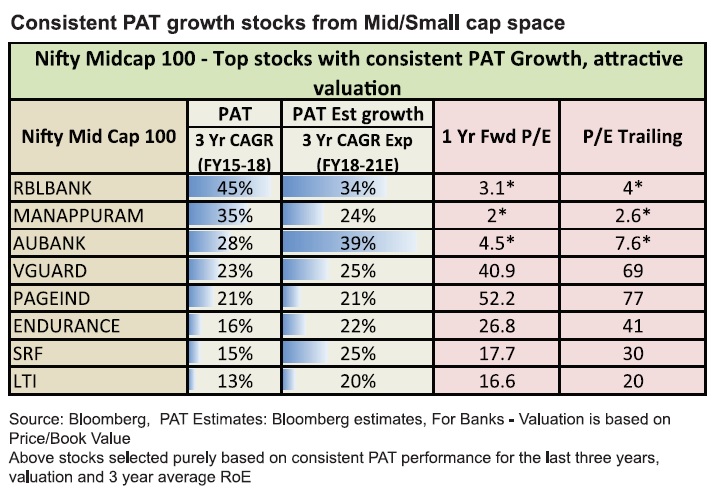

Consistent PAT growth stocks from Mid/Small cap space

For Mid cap

- In terms of historical PAT growth, best performers from Midcap space were RBLBANK, MANAPPURAM, AUBANK and VGUARD.

- Based on Bloomberg forecast (for PAT over FY18-21E), best performers are expected to be AUBANK, RBLBANK, SRF, and VGUARD.

- On the valuation side, the stocks trading at attractive valuations are AUBANK, VGUARD and SRF.

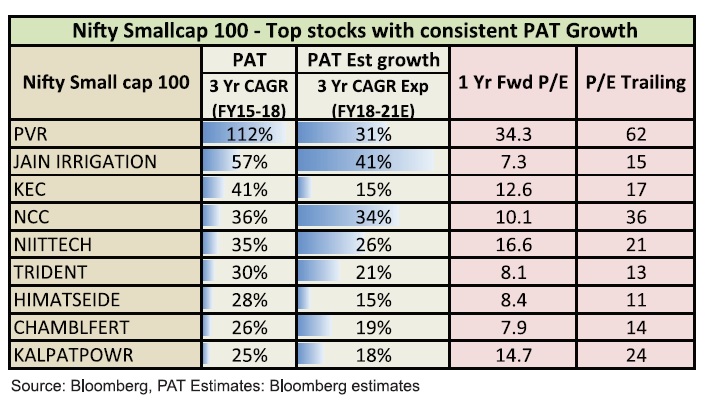

For Small cap

- The best 5 performers on the basis of consistent 3 year PAT growth over FY15-18 were PVR, JAIN IRRIGATION, KEC, NCC and NIITTECH.

- In terms of estimated PAT growth over FY18-21E, robust growth are expected from JAIN IRRIGATION, NCC and PVR.

- In terms of valuation, the stocks trading at a discount are NCC, JAIN IRRIGATION, PVR and CHAMBLFERT.

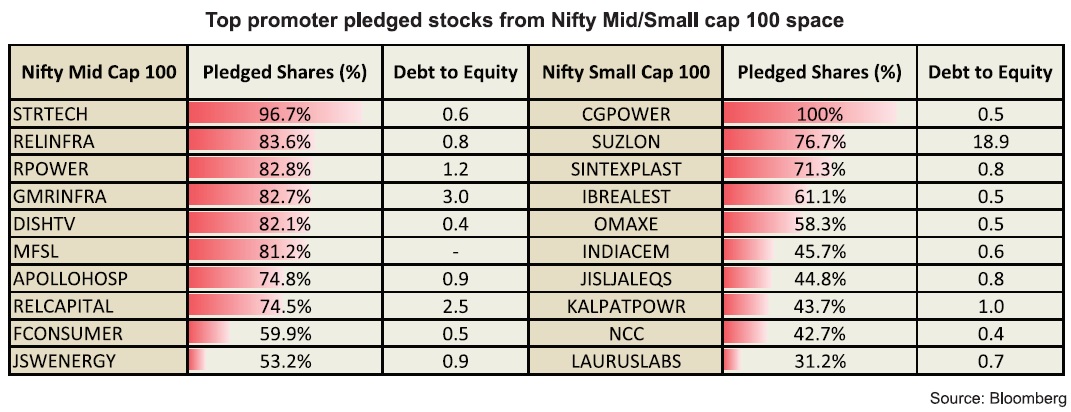

Top promoter pledged stocks from Nifty Mid/Small cap 100 space

- In terms of shares pledged by promoters, STRTECH topped the list with 96.7% in the midcap 100 space.

- While in the Nifty Small cap 100 space, CGPOWER topped with 100% promoter pledge.

- In terms of debt to equity, SUZLON and GMRINFRA topped with highest ratio of 18.9 and 3 respectively.

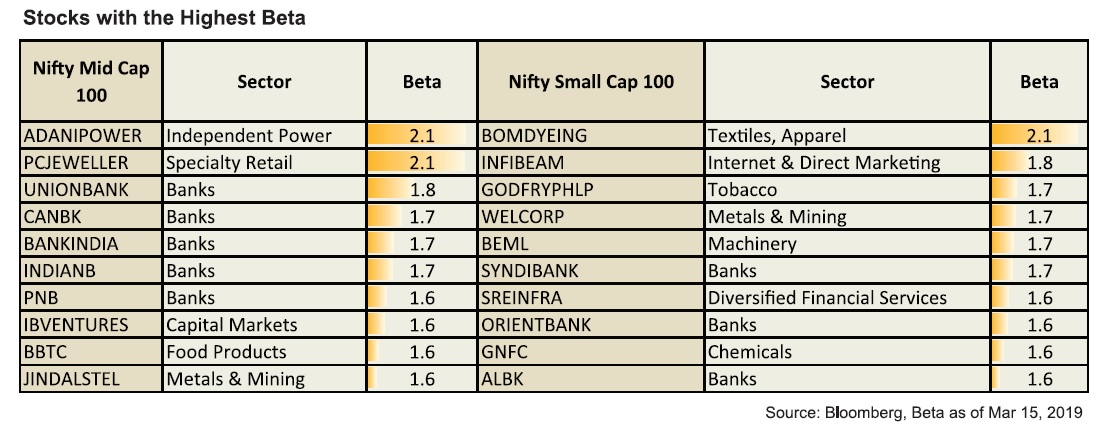

Stocks with the Highest Beta

- Beta refers to the measure of sensitivity of stock return to market returns.

- From the top midcap 100 stocks, ADANIPOWER and PCJEWELLER are currently having the highest beta of 2.1 each.

- While BOMDYEING, INFIBEAM tops the list in Nifty Smallcap 100 index with 2.1 and 1.8 beta respectively.