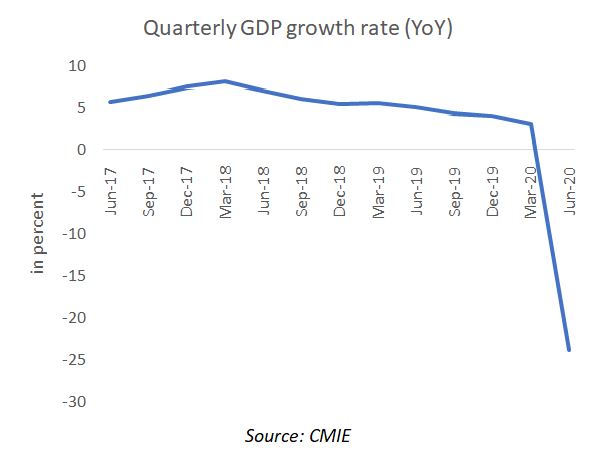

GDP

- Indian economy contracted by 23.9 percent in Q1FY21

- Private Final Consumption Expenditure (PFCE) measuring consumption demand registered a contraction of 27 percent in Q1FY21.

- Investment demand as measured by the Gross Fixed Capital Formation (GFCF) registered a sharp contraction of 47 percent in Q1FY21.

- Exports of goods and services contracted by 20 percent, whereas imports contracted by 40 percent.

- Government Final Consumption Expenditure (GFCE) was the only component that registered a positive growth rate at 16.3 percent.

- In terms of Gross Value Added (GVA), construction sector registered the highest contraction at 50 percent, whereas agriculture sector was the only sector that registered a positive growth rate at 3.3 percent.

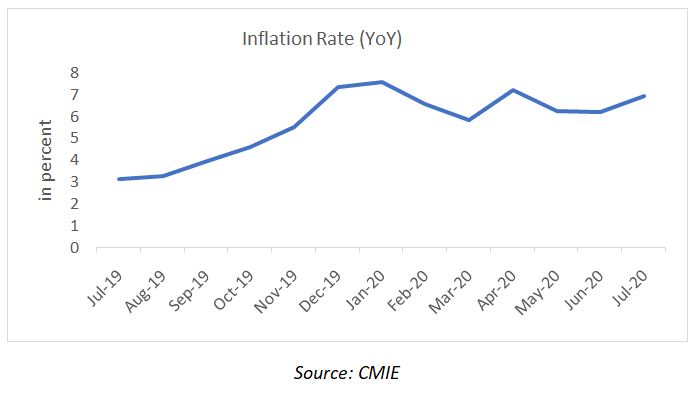

Inflation

- In July, inflation rate as measured by Consumer Price Index (CPI) was at 6.93 percent, breaching the upper band of 6 percent under the inflation target framework of the RBI.

- Food inflation rate spiked to 9.62 percent.

- Vegetable prices clocked a doubt-digit growth rate of 11.3 percent in July, driving the food inflation rate upwards.

- Core inflation also inched upwards to 5.9 percent in July.

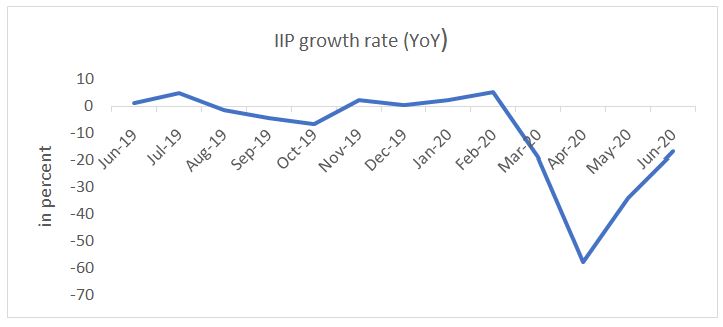

Industrial Output

- Index of Industrial Production (IIP) recorded a contraction of 16.63 percent in June’20. However, the performance was better, when compared to the previous three months.

- Mining and quarrying registered a contraction of 19.8 percent, whereas manufacturing contracted by 17.13 percent and electricity by 10.02 percent in June’20.

- Core sector output contracted by 9.58 percent in July’20, compared to 12.95 percent in June’20

- Manufacturing PMI in July’20 remained below the 50-mark at 46.

External Sector

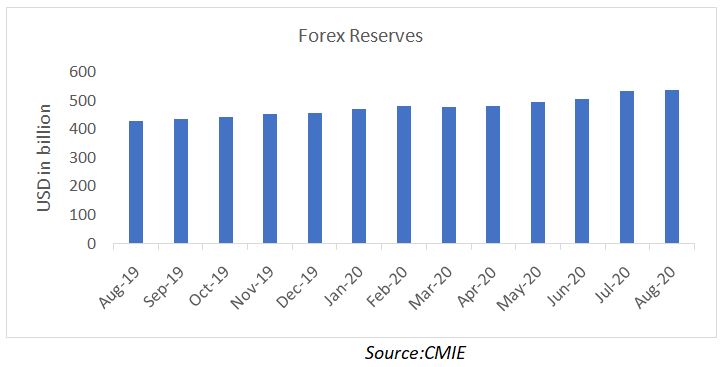

- As on 21st August’20, India’s forex reserves reached a historical high of USD 537.5 billion.

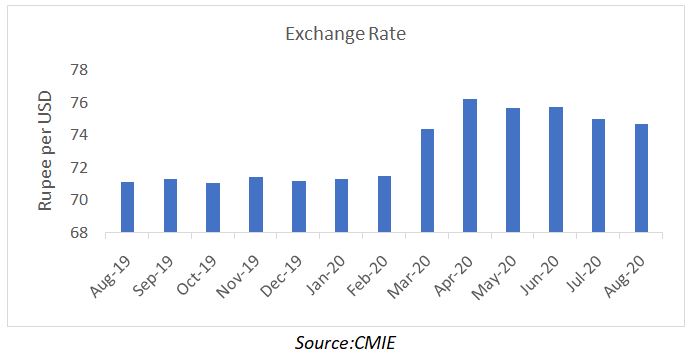

- Rupee strengthened against USD in August’20 at Rs 74.67 per dollar compared to Rs 74.99 per dollar in July’20.

- Weak dollar and FII inflows supported the appreciation of rupee.

Foreign Trade

- India registered a trade deficit of USD 4.8 billion in July’20.

- In July’20, exports registered a contraction of 10.2 percent (YoY), whereas imports contracted by 28.3 percent (YoY).

Capital Market

- In August’20, SENSEX rose by 2.7 percent to end the month at 38,628, whereas NIFTY rose by 2.8 percent to end at 11,387.

- FIIs/FPIs remained net buyers in the Indian market with the net investment in equity and debt market at USD 6.7 billion

- The net investment by mutual funds in equity and debt market stood at USD 2.1 billion in August’20

- The 10-year G-sec yield rose sharply to 5.99 percent in August’20. RBI announced Open Market Operation (OMOs) worth Rs 20,000 crores to cool off the bond yields.

Fiscal Scenario

- Revenue receipts of the Central government up to July’20 stood at Rs 2.2 lakh crore, which is 11.3 percent of the budget estimate for FY21

- Revenue expenditure stood at Rs 9.4 lakh crore making it 35.8 percent of the budget estimate for FY21. Capital expenditure up to July’20 stood at Rs 1.1 lakh crore, which is 27.1 percent of the budget estimate.

- Fiscal deficit shot to Rs8.2 lakh crore in July’20, making it 103 percent of the budget estimate for FY21.