An investment approach that prioritises preservation of capital and regular income is the Fixed Income / guaranteed income investment approach. Fixed income investments definitely scores over variable income investments in terms of safety and reliability. They are comparatively less risky, provide stable and reliable returns when compared with stocks and other forms of investment which rely on variations in price to generate profit. This investment is especially suited for the risk averse, the retired and investors who need returns visibility.

The prices of the fixed income instruments need not bother an investor, since the primary motive would be to hold them till maturity and keep getting the regular interest.

The preferred mode of investment for most risk-averse investors, especially for retired and aged income seekers, would be Bank Fixed deposits. It is easy, safe and relatable for almost all Bank clients. There was a generation of investors who preferred Banks FDs or Post office deposits, simply because other avenues were limited or because access was difficult, including Equity investment and Mutual Funds.

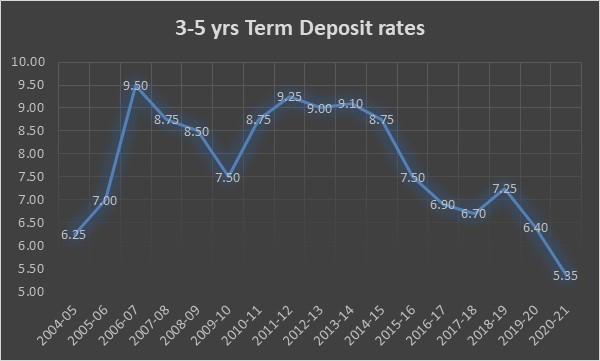

However, in spite of its safety we need to understand a major drawback of putting all your money into FDs. The FD rates have been falling over the last few years and it does not seem to be going up any time soon.

The below graph highlights the historical FD rates (as per RBI data) and depicts the highest rate of major 5 banks from 2004-05 to Sep 2020. From the highs of 2006-07 and 2011-12, when the rates were around 9.50% – 9.25%, the rates have steadily declined to the current rate of around 5%. To put it simply, a Rs.10 lakh depositor who used to get Rs.95000 per year as interest in 2006-07 would now be getting just above Rs.50000, assuming renewal. At the same time, inflation means that prices have actually gone up. Income coming down and prices going up means that ultimately you will have to dip into your savings.

Even assuming that interest rates start going up and tops at the 9-9.5% levels and if inflation stays high, the cost of living will also go up. The capital needs to grow to support but the FD interest will be fixed and will not vary according to the increasing requirements of the depositor. This situation could also mean utilizing the principal amount to meet requirements.

This is the reason why it is risky to depend solely on FDs for meeting retirement needs because low rates or fixed income (not in sync with inflation rates) can put a spanner in a retirement plan. This is why asset allocation becomes very important.

Now we understand that equity investment may not be for everybody. So we would advise to look at some other fixed income / guaranteed income schemes which would offer marginally higher rates than FDs.

* Senior Citizens Savings Scheme (SCSS): For investors 60 years and above. Maturity period 5 years with a provision to extend for 3 more years. Allows only one deposit not exceeding Rs.15lakh. Current Rate: 7.4%. Rates will be updated quarterly and shall be payable on 1st working day of April, July, October and January.

* Pradhan Mantri Vaya Vandana Yojana (PMVVY): Similar to SCSS in terms of eligibility and interest rates. The scheme offers pension income payable monthly, quarterly, half-yearly or yearly as opted. It is an immediate annuity and rate is updated annually. The minimum pension amount is Rs.1000 per month and maximum Rs 9,250 per month. The tenure of the scheme is 10 years. The scheme is available till March 31, 2023.

* RBI Floating Rate Savings Bonds: Maturity of seven years. The interest rate for the period July 1 to December 31, is 7.15% which will be payable on January 1. Interest is payable half yearly. The interest rate on RBI Floating Rate Savings Bond will be reset every six months. Interest on the RBI Floating Rate Savings Bond are fully taxable.

* Public Provident Fund: Maturity of 15 years and provision to extend for further 5 years. Allows premature withdrawals after five years, under certain circumstances. Current rate is 7.1% p.a., revised every quarter.

* Post Office Monthly Income Scheme: Maximum cap of ₹4.5 lakh under single ownership and ₹9 lakh under joint ownership. POMIS offers an interest rate of 6.6% payable monthly. POMIS has a maturity tenure of five years.

* National Savings Certificates (NSC):

Another post office savings scheme, at current interest rate of 6.8 % compounded annually but payable at maturity. Certificates can also be purchased on behalf of a minor above 10 years of age. The interest for first four years is reinvested however, the interest earned in the fifth year is taxable as per the applicable tax slab rate.

A risk averse investor can choose from the above options based on their investment time horizon and cash inflow requirements. PPF and RBI bonds are suitable for investors who do not need to withdraw the money immediately. Investors who require a monthly inflow of funds can pick and choose schemes which offer monthly payment of interest.

We have schemes like Sukanya Samriddhi Scheme for those investors with daughters and still in the accumulation phase. Current rate is 7.6% p.a., reset and compounded yearly. It allows to make deposits for up to 15 years from the date of opening the account. Partial withdrawal is allowed once the girl child attains 18 years of age. Account can be closed after the child completes 21 years.

Income can also be optimized by choosing corporate bonds, short term debt funds etc. However, investors need to be careful while choosing to invest in these and invest based on the credit rating, yields and maturity period. Some bonds and debt funds offer higher returns, but at the cost of its credit strength and repayment strength. Here too the equation is valid, more returns means more risk.

But the fact remains that fixed income might not always be the apt avenue to choose, if aiming at long term income, because its returns may not be enough to beat inflation. There are other options for younger investors with moderate risk appetite like National Pension Scheme, which offers market based returns during the accumulation phase. NPS, managed by the Pension Fund Regulatory and Development Authority (PFRDA), offers a mix of equity, fixed deposits, corporate bonds, liquid funds and government funds, among others. Based on your risk appetite, you can decide how much of your money can be invested in equities through NPS.

Interest rates will be maintained at the current low rates, at least for the short term. With the lockdown and the subsequent pressure on the economy, the government will look to help businesses raise funds at lower rates. A small exposure to equity is always advisable, with a long term perspective, to ensure inflation beating returns. Depending on the time horizon, risk appetite, the investor should have a diversified asset portfolio.