Companies, when in need of capital (to expand its business, build a new plant, buy machinery, buy new land to build a factory, or even purchase another company) can either approach the equity or the debt market. When investors purchase a government/corporate bond, they are effectively lending the government/company, money.

A bond is a debt obligation. Company A issues 100 bonds with a face value of Rs.1000. The company raises Rs.100,000 with the issuance of this tranche of bonds. As an investor, if you have bought a bond, you have basically lent the company Rs.1000, in return for which the company owes you interest. This is exactly like individuals taking loan from a bank and paying interest on it, except that in this case the company is the borrower and the bond that you have bought is the loan that they have taken from you. The company makes a legal commitment to pay interest on the principal and to return the principal at the end of a specified period.

Just like banks conduct a check on your repayment capacity, companies also have credit ratings assigned to them, a credit score to understand the risk of your investment. Usually a AAA rated (highest credit rating) bond indicates bonds issued by companies with high level of credit worthiness and strongest capacity to repay investors who have invested in their bonds. Now just like loans have different payment periods, bonds also have different maturity periods and the interest paid and the risk will depend on the maturity period of the bonds and also on the credit ratings of companies. Usually, higher the rating means lower the returns. Lower the rating implies higher risk, so the return is higher to compensate for the risk taken.

Tax-free bonds are typically long maturity papers that government-owned companies had issued (no new issues recently), but investors can buy them on an exchange from those who had subscribed to these bonds. Some of the companies which issued tax-free bonds include National Highways Authority of India (NHAI), Housing & Urban Development Corporation Limited (HUDCO), Indian Railway Finance Corporation Limited (IRFC), Power Finance Corporation Limited (PFC), National Highways Authority of India (NHAI), NTPC Limited, REC Limited, NABARD, and India Infrastructure Finance Company Limited (IIFCL). They issued bonds for their upcoming infrastructure spending. So when you buy their bonds, you are lending money to these government-held companies, which means safety is almost assured. Even though these tax-free bonds are offered by state-run companies, ratings are still important and that ratings can change. The current rating is not constant. Credit rating companies may change the rating whenever there is an issue with the company’s financial health.

The coupon rates on these bonds vary between 7.5% and 9.0%. But an investor needs to check the yield-to-maturity (YTM) of the bonds before buying. YTM shows the total return a person will receive if the bond is held till maturity, which includes interest payment plus any gain (if you purchase at a discount) or loss (if you purchase at a premium). It depends on the price the investor is willing to pay for the bond or the price it is available for in the secondary market.

Features of Tax free bonds

Tax-exemption

In the case of tax-free bonds, the interest income is entirely tax-exempt which means that the interest income that you will receive from such bonds will be tax-free. Hence, there is no concept of TDS – tax deducted at source. However, if you sell the bonds in the secondary market, your transaction will be subject to tax. If the holding period is less than 12 months, capital gains on the sale of tax-free bonds are taxed as per the income slab of the investor. If bonds are held for more than 12 months, the gains are taxed at 10%, and there is no benefit of indexation provided.

Risk factors

Chances of defaulting on interest payment are very low as these schemes are from the government itself.

Liquidity

You cannot liquidate tax-free bonds as quickly as, say, debt funds. Since government bonds are long-term investments and have more extended lock-in periods, liquidation of the bonds may not be that easy. Tax-free bonds are long-term holdings, with maturity usually being 10, 15 or 20 years. You cannot withdraw your bond before 10-20 years, but only trade it on stock exchanges to another investor. Depending on the demand and volumes on the exchange, you may be able to liquidate your holding instantly.

Interest

The rate of interest offered on tax-free bonds is fairly attractive when considering the tax exemption on these bonds. On maturity, you will get the initial amount invested. But the interest will be directly credited to your bank account annually.

Ease of buying

If the company issues the bonds, it can be purchased from them (primary market). As of now, there are no such offerings in the primary market. Hence, the only option is to buy them from the secondary market – National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

Most people earlier confused Tax-free bonds with the Tax-savings bonds. For tax-free bonds the interest earned is exempt from tax under Section 10 of the IT act, while for Tax-savings bonds, only the initial investment was tax exempt, and falls under Section 80CCF of IT act.

Let us understand how these tax-free bonds are considered to be beneficial. Assume you buy a bond issued by a company in the primary market.

Assumptions

Face Value, which is the initial amount you pay per bond and is similar to Face Value of a share = Rs.1000.

Coupon Rate, which is the interest rate per annum = 8% (Rs.80 interest on Rs.1000 Face Value)

Price of the bond = Rs.1000 (same as face value)

So with the above assumptions; Yield = 8% p.a. (Rs.80 interest on Rs.1000 bond price)

Now assume that interest rates in the economy rise and one can get bonds offering more than 8% p.a., then the demand for these existing bonds will fall. If you want to sell it (in the secondary market), you will have to make it attractive which means that the price of this bond will have to fall (face value and coupon rate stays the same) but price of the bond is assumed to fall to Rs.900 (this is how much a buyer will pay). Yield will now become 8.8% (Rs.80 interest p.a. on an investment of Rs.900). Bond price and yield of a bond are inversely related. If the price of the bond is lesser than the face value, then the yield for holding such bonds will be higher. If the price of the bond is more than the face value, then the yield of holding such bonds will be lesser.

The earlier falling interest rate scenario made some bonds attractive because they were offering a better return than what was available and what was coming up. In the current scenario, the tax free bond prices have run up, because they were a good substitute for the low FD rates and the general market volatility. The tax-free returns on the current yield of around 4.55% may be attractive, depending on how you choose to look at it. If you assume a 6% per annum rate on a fixed deposit, the post-tax returns will be even lower. Interest income is taxable as per your tax slab. Assume that you fall under the 30% tax bracket, the return of a 4.55% p.a. yielding tax-free bond is same as that of holding a bank fixed deposit returning 6% p.a. before tax.

Should you invest in such bonds?

Investing in tax-free bonds is beneficial for those in the higher tax bracket. If you are looking at wealth creation over the long term, this is no substitute for equity. But if you are looking for safe, tax-free, long-term, annual pay outs, then this is a good avenue to consider. Being tax free, there is no TDS, as would be the case in a bank fixed deposit. If interest rates dip more in the future, your bond price will go up. In this case if you decide to sell it in the secondary market, you will earn more than what you invested. But, if interest rates go up, which seems to be the outlook, the demand for your bonds will decrease, along with the price. But this will affect only if you are looking to exit midway. Since the maturity is for the long term, buy with caution because even though you can sell them in the secondary market, the price you get will depend on the demand from buyers and the interest rate scenario. So ideally it should be for conservative investors in the higher tax bracket and ideally for those who expect to hold till maturity.

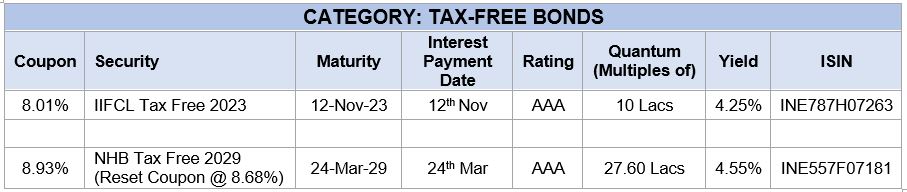

Tax-free bonds available in the secondary market now are as below: