Consolidated revenue in Q2FY26 grew 10.4% to Rs. 67,984cr, driven by revenue growth in the energy (+47.5% YoY), hi-tech manufacturing (+30.1% YoY), and IT and technology services (+11.6% YoY) sectors. However, revenue from infrastructure projects declined 0.6% YoY.

Order inflow increased 45.0% YoY to Rs. 115,800cr owing to strong growth in both international and domestic orders, led by infrastructure and hydrocarbon energy projects.

The reported PAT increased by 14.0% to Rs. 4,687 crore, owing to higher EBITDA, non-operating income, and a drop in finance costs.

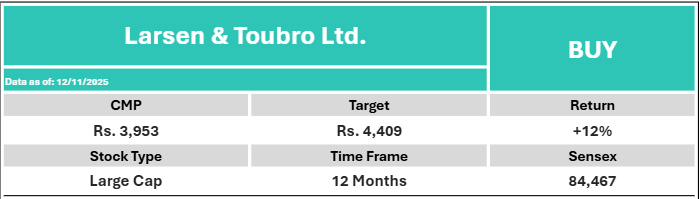

The company anticipates healthy revenue growth and a significant increase in order inflow, indicating a promising performance in the future. Furthermore, its healthy order book is expected to drive strong performance in the upcoming quarters. The government’s continued investment in infrastructure and the manufacturing sector is likely to provide substantial growth opportunities for the company, bolstering its prospects for sustained success. Recent strategic MOUs and partnerships in the company’s renewables, green energy, defense, and semiconductor businesses have laid a strong foundation for future growth, positioning the company for long-term success. Therefore, we reiterate our BUY rating on the stock with a revised target price of Rs. 4,409, based on SOTP valuation.