Nifty 50 had fallen to a new intraday low of 7,511, on 24th of March. Post that the market had a bounce or a bear rally. Initially, this rally was supported by monetary stimulus undertaken by RBI and improvement in global market which reduced selling by FIIs and DIIs. This rally was holding longer in anticipation of fiscal stimulus and re-opening of the economy. The announced package will help the country to manage nutrition and minimum income in this stressful period, especially for sections at the bottom of the pyramid. It will also add sustenance to the economy, MSMEs, farmers and financial market, but it will not add growth to corporate earnings. The vulnerability in some sections of the economy is high like banks, transportation, hospitality and discretionary spending. As a result, the strength of the market will diminish unless we find positive development to tackle this world health crisis, tax benefit to equity and ability to re-open the economy to minimise the impact to corporates.

Overall, it is a good package but lacks stimulus to corporate and market…

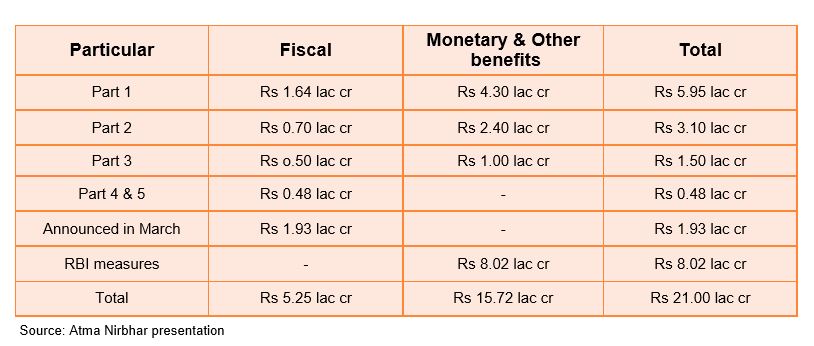

The total package is 10.5% of the forecasted GDP of FY21. This can be divided into fiscal and other benefits accounting for 2.6% and 7.5%, respectively. Fiscal benefits will lead to actual outflow from government of India, increasing the fiscal deficit. As per various reports, the actual fiscal impact from the total package is in a range of Rs1.5 lakh crore to Rs3.0 lakh crore, increasing fiscal target to 4.25% – 5% from earlier forecast of 3.5% for FY21.

The real winners are rural and urban underprivileged sections. Also the stimulus is positive for rural job creation, small re-finance, agriculture, MSMEs, NBFCs and banks. The package will add sustainability to the poor sections of the economy while corporates will have no direct benefit. No plans for highly sensitive consumer discretionary spending sectors will be a huge negative. Though banks are supported with liquidity, the outlook of sector will come down due to rise in NPAs in-spite of moratorium as willingness to repay will be lower.

Q4 quarterly results, commentary and outlook is weak…

Q4 results are much below the expectation, which could not be a big negative surprise for the market. But the commentary and outlook is also bleak which is adding confusion in the market in-terms of how to forecast the financial performance, especially for the next 2-3 quarters. Some sectors are looking promising like FMCG, agri oriented business, pharma and chemicals.

Our analysis has downgraded financials to an extent of 10 to 20% in terms of top line and bottom-line which is fairly factored in the market today. But the accuracy of forecasting for the next two quarters may be low which add pressure for further downside, as per the development. Q1 is expected to be a washout in many segments. Based on latest economic and corporate data, the market is concerned about the cascading effect on domestic economy and corporate earnings in the future, for FY21.

We have already started seeing economic consequences like collapse in oil prices, commodities, huge unemployment, and closure of schemes and fall in businesses, the financial implication of which the world will have to bear going forward.

Few sectors with positive view…

One sector in India, which is largely unaffected in-terms of outlook is agriculture due to exemption from lockdown. Of course, there are sections of the work which will be impacted like shortage of labor, low wholesale markets and disruption in supply and demand. But given the essential nature of the work, and considering the supportive measures undertaken by central and state governments for rural market, it is a safe sector. According to the latest statistics, sowing of summer crops has increased 38% compared to last year. Water reservoirs are at higher level than last year and normal monsoon is forecasted this year. The central government is also in discussions to bring agricultural reforms. This includes replacing archaic laws, reforming agri marketing, raising farm-gate prices and unifying domestic markets, please note these measures are not expected in the near-term. The outlook for the sector is positive in the short and long-term due to combination of favorable weather conditions, sustaining demand and reforms in the future. In terms of stocks, companies with large domestic presence and strong balance sheet in agri-inputs, crop protection, chemicals, tractors and FMCG should be considered.

Pharma has been outperforming which we expect to continue for long. Due to the health crisis, the outlook for healthcare sector has improved including pharma, clinics, health products manufacturers and services providers. Pharma sector has been underperforming in the last 5 years due to pricing issues in the US, fall in brand value and businesses in US during which valuation had decreased. However, this issue is getting relaxed because higher spending and demand is expected for health this year. The demand for pharmaceutical products has been largely unaffected during the lockdown period. Therefore, companies with strong domestic and export presence have benefited during this period. Although export restrictions were placed for few drugs, exports for other drugs have been able to continue, thereby benefiting companies, especially with the depreciation of rupee. Due to supply disruptions from China, which is the world’s largest manufacturer of APIs, there has been a shortage of raw materials. Although a few companies have stated that they have had sufficient inventory for the quarter, this disruption may impact margins in the short term. Attractive valuations for many pharma companies could also be seen as reason for the recent rally. We have two pharma stocks in our model portfolio: Torrent Pharma and Biocon.

Banking sector woes impact the market more

Nifty50 is not providing the correct picture of the market while banks which are in tandem with the economy is the correct indicator. In the last three months, Nifty50 is down by 27% while BankNifty is down by 45%, as on 20th May.

Banking sector is heavily impacted due to fall in credit growth, profitability and rise in new NPAs. As per data, credit growth fell to 6.1% in FY20 and is expected to be negative in FY21 during Q1 and Q2. Banks are expected to underperform the market in the short to medium term until business outlook improves and business risk reduces. The stimulus to unprivileged, rural, NBFCs and MSMEs will provide relief to banks. But concerns will prevail like cashflow management, post ending of moratorium (non MSME) and new NPAs. Recent quarterly numbers from large private sector banks have not been encouraging as higher provisions and credit cost have hurt the overall performance. Currently, for the short to medium-term we should be cautious on banking sector. For the long-term, the valuation has reduced but is not cheap enough, as seen in the last crisis of 2008-2009. So, buying on dips could be an advisable strategy for long-term investment.

NBFCs are in a better position today in terms of liquidity as banks are extending moratorium. But the outlook for business continues to be weak with higher funding cost. Housing finance will be affected with weak real estate outlook, fall in prices and low construction activities. However, in the gold loan space, we expect business to be less impacted due to rising gold prices and favorable LTV ratio (75% loan to value), which acts as a hedge to the companies. The positivity is that valuation of the NBFC has become cheap for long-term.

The market is not in a positive position to take decisive moves…

The bear rally is under downfall. The market had rallied by more than 30% but the fundamentals have not improved. The main factors impacting the market now is effectiveness of re-opening the economy, new trade-war between US and China and hope that a new vaccine will add positivity in global market.

The market is unable to take decisive direction and is pondering on a broad range with volatility. Our view is that, in the short-term, the market will be range bound, at about 1,000 points between 8,600 and 9,600, for Nifty 50. Within which the level of 8,900 to 9,050 is very crucial in the near-term.

We have to note that the final direction of the market could be higher or lower depending on the world’s health developments. We should not presume much with a safety of last low and be vigilant, not greedy and too optimistic. It will be better to accumulate in dips and maintain SIPs. We should be reasonable, assuming that this period of accumulation could be for a period of more than a year. The stable places to hide and add are Pharma, FMCG, Chemicals, IT and strong domestic oriented companies like finance and consumption.