By Vinod Nair

The rally of last year is continuing… budget and Q3 eyed…

Start to the year has been good, Nifty 50 and Sensex has rallied by 2.7% and 3.5% respectively (till Jan18th). There was a growing expectation that Jan may be lacklustre given the usual volatility seen at the start of the year, a breach in the strong rally seen in 2017 and a likely slowdown in liquidity. But the trend remained positive given favourable global cues, strong case of revival in Q3 earnings and expectations on the union budget. The best performer sectors were, IT, Capital Goods, Consumer durables, Metals and Banks.

Budget Expectations

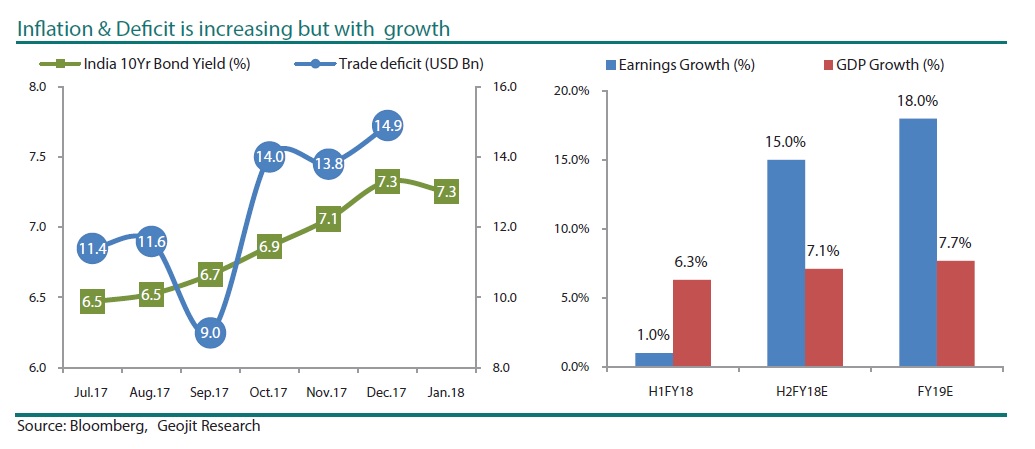

The expectation from this budget may be lesser than what market had over the last 2-3yrs. It will be considered a good budget even if they reach an effective balance between fiscal and growth. Market is very curious to see whether the government will be able to manage the fiscal deficit target of 3.2% and 3.0% for FY 2018 and FY 2019 respectively. Government bond yields are rapidly inching up in the last 3-6months. Rural will be the focus of the budget, specific measures will be towards remunerative prices on agri produce, credit benefits, agri infrastructure like irrigation, social security to farmers, rural infrastructure and fertilizers. If the Government offers overwhelming benefits to the rural and agriculture segments due to reduction in poll confidence primarily on account of difficulties caused by Demonetisation and GST, it may revert as a risk to the market.

Having almost completed the indirect tax reform (GST), we can expect a shift to direct tax reform. The Government had earlier suggested cutting the corporate tax rate to 25% in the union budget of 2015-16 and therefore we can expect some implementation in this regard. However given the disruption caused by GST implementation, the timing of the action in this behalf will be based on government’s confidence in the resultant fiscal projections.

There are expectations regarding cutting GST rates on food and non food items, but how much of that will be addressed in this budget may be limited, since it has to be processed under the GST council. LTCG tax (removing STT) is likely to be introduced in India for sure (as a part of direct taxation reform) but whether it will be introduced in the upcoming budget is a point to ponder. If so, it may have a short-term impact on the market.

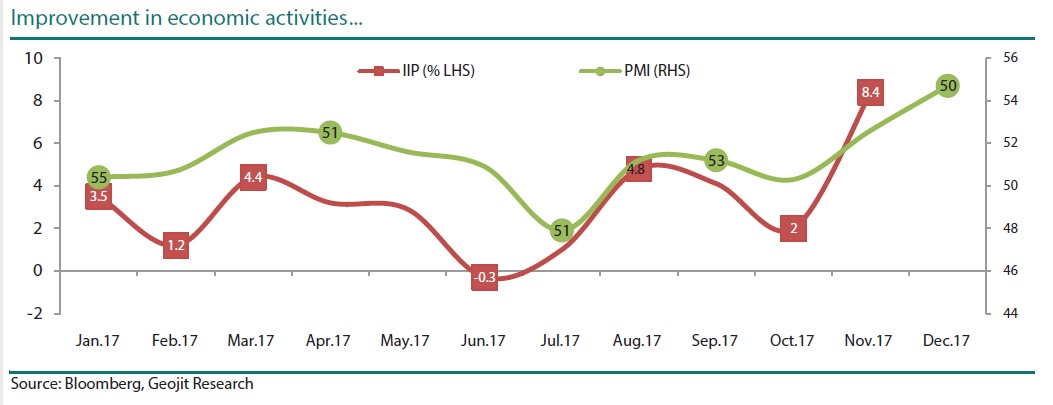

A turn in earnings from Q3

Market is anticipating a sea change in the earnings trend starting from Q3 results. This is an extension of the marginal improvement we had seen in Q2. In Q2 adjusted PAT grew by about 4 to 5% for indices like Nifty50 and Sensex. And this time market is anticipating a strong growth of 15-20% in PAT led by revamp in businesses and low base effect. The turnaround in business is visible from the strong growth in revenue in a range of 15%. As a result, the second half of FY18 is likely to be much better at 10 to 15% growth in profitability compared to zero growth in H1FY18. Economic data like WPI, IIP and PMI are also suggesting improvement in pricing and volume growth. This trend is expected to improve to FY19 – 20, a main reason for the market to be buoyant.

Growth comes with a cost…

Growth comes with a cost…

In the short-term the continuity of this domestic trend will not only depend on the outcome of budget, but the confidence of the global market and the fallout of the third quarter to the future earnings outlook. The market may need a breather before hurdling over to the long-term trend which is looking positive.

Few important domestic macros which has slipped in the recent times are: fiscal slippage, increase in bond yield, spike in oil prices and hike in CPI. As a consequence of higher costs, government 10yrs yield has risen by 93bps over the last 6months to 7.38%. These can bring some hiccups in growth, profitability,current account deficit and fiscal slippages which will impact market’s sentiments and premium valuation. This is likely to impact in the short to medium-term, but GDP is expected to improve from Q3 FY18 onwards. The expected trajectory of the GDP growth is 6.3% in Q2FY18 (Actual), 7.1% in H2FY18 and7.7% in FY19.

The valuation of small and midcaps are high but may not be in terms of premium. Actually the whole market is trading at high valuation, Nifty50 is currently valued at P/E of 21 times on a one year forward basis while Nifty Midcap 100 and Smallcap 100 are valued at 22 – 23 times. Valuation has expanded as market risk reduced, economy confidence increased, turnaround in businesses, higher liquidity and earnings growth. The broad trend in the market will be maintained as the risk appetite is maintained. In the very short-term it will be fair to have a moderate expectation on return and shift more towards defensive stocks and sectors like IT, Pharma, Telecom, FMCG and export oriented companies as a safer bet. We have a moderately positive outlook on the main indexes this year but vibrancy of the broad market is likely to be maintained. Stocks and sectors in Mid and Small caps which can provide an extra edge in return are: companies under NCLT (National Company Law Tribunal) resolution, Chemicals, Textiles, PSUBs, Metals, Home Building Segments, Infra and Capital Goods. We are also positive on Defence and Cement sectors.

The valuation of small and midcaps are high but may not be in terms of premium. Actually the whole market is trading at high valuation, Nifty50 is currently valued at P/E of 21 times on a one year forward basis while Nifty Midcap 100 and Smallcap 100 are valued at 22 – 23 times. Valuation has expanded as market risk reduced, economy confidence increased, turnaround in businesses, higher liquidity and earnings growth. The broad trend in the market will be maintained as the risk appetite is maintained. In the very short-term it will be fair to have a moderate expectation on return and shift more towards defensive stocks and sectors like IT, Pharma, Telecom, FMCG and export oriented companies as a safer bet. We have a moderately positive outlook on the main indexes this year but vibrancy of the broad market is likely to be maintained. Stocks and sectors in Mid and Small caps which can provide an extra edge in return are: companies under NCLT (National Company Law Tribunal) resolution, Chemicals, Textiles, PSUBs, Metals, Home Building Segments, Infra and Capital Goods. We are also positive on Defence and Cement sectors.