Integrated Solar EPC and Solutions Provider

Solarworld Energy Solutions Ltd (SESL) is an integrated solar EPC and solutions provider incorporated in 2013, offering turnkey engineering, procurement, and construction services for solar power projects. It caters primarily to public sector undertakings (80% FY25 revenue) and industrial clients across India. Its business model includes rooftop and ground-mounted solar installations, along with operations and maintenance services.

Key Highlights

India’s solar EPC sector is witnessing rapid growth, fueled by supportive government policies such as the Approved List of Models and Manufacturers (ALMM), Basic Customs Duty (BCD), and the Production Linked Incentive (PLI) scheme for solar panel manufacturing. The country is projected to add 150–170 GW of solar capacity between FY26 and FY30, supported by growing energy demand and ongoing decarbonisation efforts. (Source: CRISIL Intelligence)

SESL’s revenue grew sharply from ₹233cr in FY23 to ₹545cr in FY25, achieving a CAGR of 53%. Over the same period, PAT rose significantly to ₹77cr, corresponding to a CAGR of 128% between FY23 and FY25.

Solarworld delivered a robust EBITDA margin of 20.1% in FY25, surpassing most peers in the solar EPC sector. The company also sustained a healthy PAT margin of 14.1%, reflecting strong profitability.

As of July 2025, SESL’s order book stood at ₹2,527.8cr, providing strong revenue visibility at 4.6x FY25 revenue, with contributions from EPC (47%), battery energy storage systems (BESS)(50%), and O&M segments.

SESL exhibits strong capital efficiency, reporting an ROE of 24.9%, ROCE of 29.2%, and a low debt-to-equity ratio of 0.37x.

SESL undertook a Pre-IPO placement of 3,124,548 equity shares at ₹352.05 per share raising ₹110cr on November 21, 2024.

Solarworld, through its subsidiary, is establishing a 1.2 GW TopCon solar module and 2 GW BESS manufacturing facility in Haridwar, in partnership with ZNSHINE PV-Tech, a Bloomberg NEF Tier-1 solar panel supplier, funded through internal accruals and debt.

SESL also plans to set up a 1.2 GW TopCon solar cell facility in Madhya Pradesh via its subsidiary, partly funded by IPO proceeds.

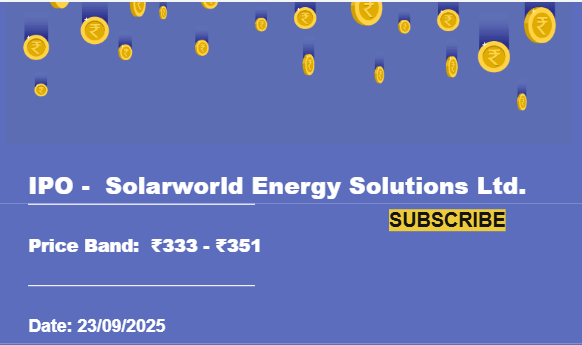

At the upper price band of ₹351, SESL is valued at 39× FY25 PE, which appears reasonable given its robust financial performance. Despite relatively smaller size of revenue, the company’s asset-light model, low leverage, and consistent profitability underscore its operational strength. With backward integration, strategic expansion plans, and a focused EPC approach, SESL is well-positioned in India’s solar sector. Hence, we recommend a ‘Subscribe’ rating for long-term investors.

For detailed report