By Dr. V. K. Vijayakumar

By Dr. V. K. Vijayakumar

Taxation impacts the returns from investment. Union budget 2018 has some important provisions, which will have implications for investment in stocks and mutual funds.

Stocks

For stocks, till now, Long Term Capital Gains (gains from selling stocks after holding for a minimum of one year) have been exempted from taxation. Budget 2018 changes this. LTCGs beyond 1 lakh will be taxed at 10 % without indexation. All capital gains till 31st January 2018 will be grandfathered, that is, LTCGs till 31st January 2018 will be exempt from taxation. There are no changes in Short Term Capital Gains (STCG) tax, which will continue at 15 % and dividends from stocks up to Rs 10 lakhs a year will continue to be tax free.

Mutual funds

There are changes in taxation of mutual funds also. LTCGs from equity funds, hybrid funds (funds which invest 65 % or higher in equity) and equity savings funds were exempt from tax. Dividend from these funds was also exempt from tax. Budget 2018 removes these exemptions. LTCGs from these funds will be subject to 10 % LTCG tax. Here also, the grandfathering treatment will be available, that is, LTCGs up to 31 January 2018 will be exempt from taxation. STCGs will be taxed at 15 %. Dividends will be subject to 10 % tax.

For debt funds/ debt oriented income funds like MIPs there are no changes in taxation.

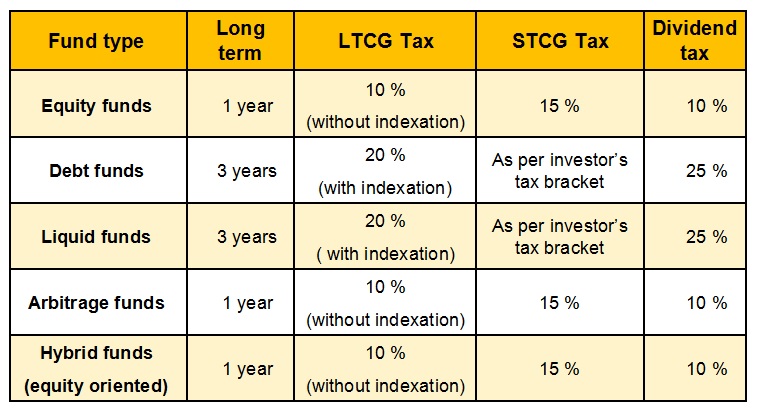

The tax structure wef 1st April 2018 for mutual funds can be summarized as follows.

Tax benefit U/S 80C for ELSS (Equity Linked Savings Scheme) continues without change.

Even though the favorable tax treatment for equity and equity oriented mutual funds has been slightly reduced by this budget, they continue to get better tax treatment compared to other asset classes. Exemption of equity dividend up to Rs 10 lakh from tax, definition of long-term for equity/ equity oriented funds as 1 year, LTCG tax at 10 %, exemption of LTCGs up to Rs 1 lakh a year from tax and the grand fathering provision continue to be favorable tax treatment. When we consider the superior returns from equity, the new tax proposals will have only marginal impact. During the last 38 years (from Sensex 100 in 1979 to Sensex around 34000 presently), equity, as measured by the index, has delivered Compound Annual Growth Rate (CAGR) of more than 15 %. If we assume similar returns in future too, even after LTCG tax of 10 %, investors will get an annual CAGR of 13.5 %. This is hugely superior to returns from other asset classes.