“India is one of the most attractive retail markets in the world, given its size and growth rate” said Walmart’s president and CEO Doug McMillon.

The statement was made in the background of Walmart’s acquisition of Flipkart in 2018. India is the world’s second most populous country with a population of 1.3 billion. The annual population growth rate of India is around 1.1 percent, and it is estimated to become the most populous country in 2024.

With its size and growing middle class, India provides an enormous business potential. As per the World Economic Forum (WEF) report, India is poised to become the third-largest consumer market next to US and China by 2030. The report also states that the consumer spending in India is expected to grow to USD 6 trillion by 2030.

Consumption has always been the driving force and pillar of India’s growth story. For instance, presently, consumption has a share of 57 percent in the total GDP. It shows that consumption demand has a greater impact on the overall growth of the country. However, the consumption demand measured by Private Final Consumption Expenditure (PFCE) that has averaged around 7 percent over a decade, dipped to 3 percent and 5 percent (YoY growth rate) in the first and second quarter of FY20.

Capturing the consumption slowdown

The impact of this consumption slowdown is felt across the sectors, which is well captured by various indicators. The current consumption slowdown has badly affected the FMCG and automobile sector. For instance, as per the Nielsen report, the volume growth of the FMCG sector declined to 3.9 percent in Q2FY20 from 13.2 percent in Q2FY19. The slowdown is also reflected in the sales of the major FMCG companies.

For example, the sales growth rate (YoY) of HUL dipped to a single digit at 6.6 percent in the first two quarters of FY20. The sales growth rate (YoY) for the first two quarters of FY19 were at 11 percent. For Dabur, it declined from 19 percent in Q1FY19 to 10 percent in Q1FY20, and from 8 percent (Q2FY19) to 4 percent (Q2FY20). The other FMCG giant, ITC, also witnessed a decline in the first two quarters of FY20. The YoY growth rate slipped to 5 percent in the first two quarters of FY20, from 9 percent and 15 percent in Q1FY10 and Q2FY19 respectively.

The domestic car sales that marked improvement in October, mainly due to the festive season, registered a negative growth rate (YoY) of 10.83 percent in November. The two-wheeler and tractor sales that captures the spending of the rural economy also registered negative growth rate in November.

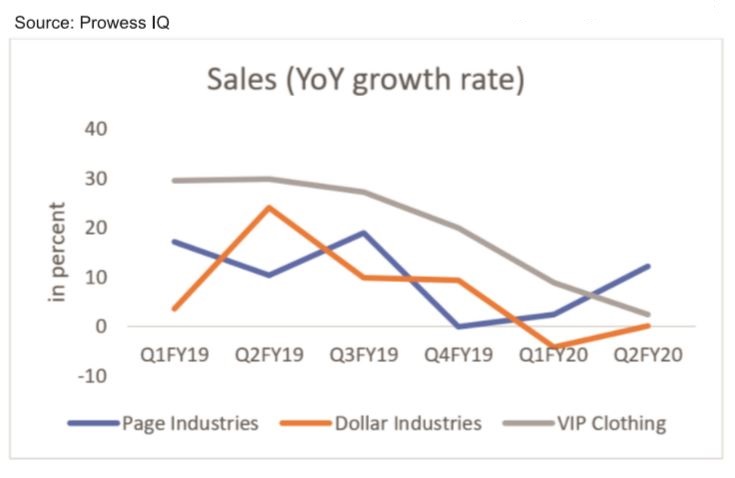

Another major indicator that tracks the consumption slowdown in the economy is Men’s Underwear Index (MUI). The index followed by Alan Greenspan, former Fed Chairman, indicates that declining sales of men’s underwear can indicate that the economy is struggling. The sales of underwear are typically considered to be stable as it is considered to be necessity. The below graph shows the sales growth rate of the three major companies in India:

Here, it could be seen that the sales growth of VIP clothing is showing a declining trend in the last 6 quarters. The other two companies are exhibiting a fluctuating trend. Page industries has also shown some recovery in Q2FY20 at a growth rate of 12 percent from 10 percent in Q2FY19. On the other hand, Dollar industries are struggling with their low sales growth rate at -4 percent and 0.19 percent in the first two quarters of FY20.

Cause or Effect

Now, the question is whether the consumption slowdown is the cause or whether it is the effect. Consumption is positively related to the disposable income. Higher wage would lead to higher income, and thus higher consumer spending. However, a declining trend is visible in the case of wage growth in both the rural and urban sector. Rural wage growth declined from 27.7 percent in FY14 to less than 5 percent in FY19. Corporate wages have also exhibited a single digit growth in FY19. The RBI Annual report also points that the wage growth for agricultural and non-agricultural labourers remained subdued in FY19 at around 4 percent.

The performance of the agricultural sector – major employment provider – determines the health of the rural economy. The growth of the value-added in agriculture and allied activities started decelerating from Q3FY19 onwards. The low food inflation at 0.70 percent in FY19, negatively affected the income growth in rural sector. Similarly, the deceleration in industrial output to below 4 percent during 2014-19 also had its impact on the income and employment generation both in the rural and urban areas. Adding to this, the liquidity crisis further dampened the consumption demand in the economy.

These developments lead to a ‘domino effect’ in the economy, and is acting like a vicious cycle. A vicious cycle of low income, low consumption, low production, and low employment generation. Now, the focus should be on how to break this vicious cycle, and lift the economy out of it.