Preliminary results for the year ended March 2019 indicate a sharp improvement in the operational efficiency of the Indian corporate sector. We measure improvement in operational efficiency as a shrinking of the working capital cycle.

Preliminary results for the year ended March 2019 indicate a sharp improvement in the operational efficiency of the Indian corporate sector. We measure improvement in operational efficiency as a shrinking of the working capital cycle.

We include non-financial companies in our analysis. The sample size is 4,293 companies for 2018-19. These account for 65 percent of the sales of the full sample of about 20,000 companies per year in the preceding five years. The sample is therefore, small in count but significant in terms of coverage.

The working capital cycle is the length of time, usually measured in days, it takes to convert raw materials into finished goods and finished goods into cash. Evidently, the shorter the working capital cycle the better it is for the company. Companies yearn to convert raw materials into finished goods and finished goods into cash in the shortest possible time interval. Else, they have cash stuck in the business.

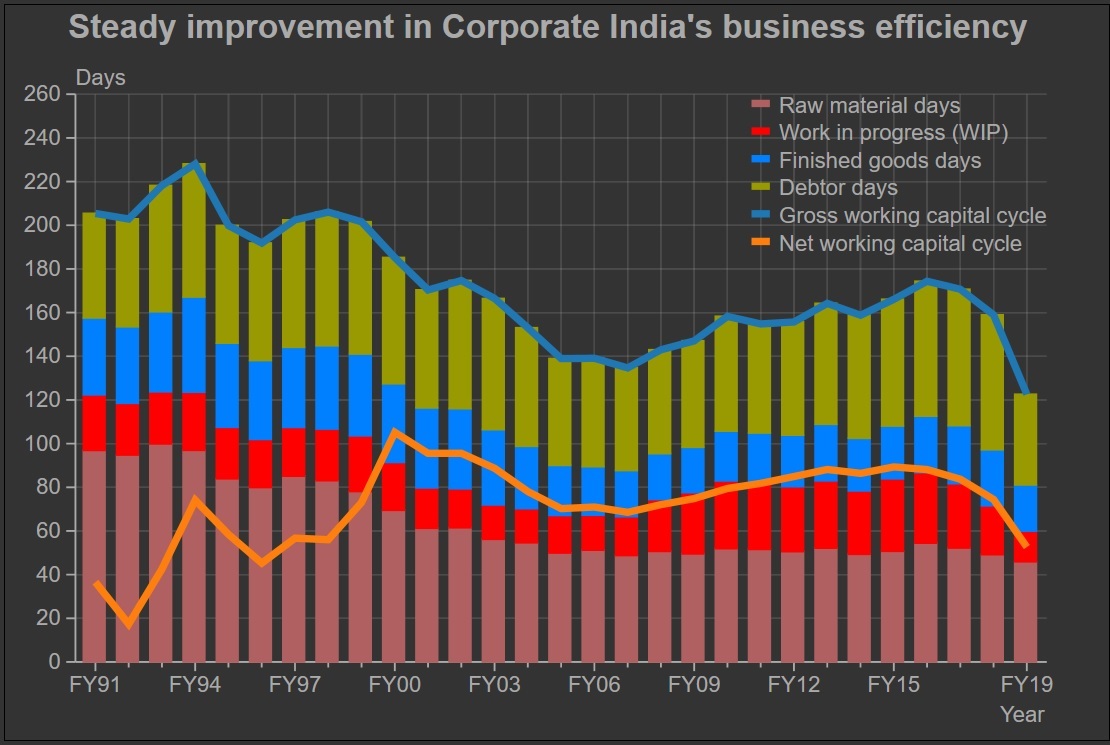

In the pre-liberalisation days, the average gross working capital cycle was over 200 days in India. After the initial euphoria of liberalisation that saw a huge increase in entrepreneurship and a corresponding increase in competition, which was also caused by increased imports, India Inc was forced to deal with its operational inefficiency for survival.

A sustained decline in the working capital cycle began only after 1998-99. The gross working capital cycle declined from over 200 days till 1998-99 to less than 135 days by 2006-07.

Much of this improvement came from a fall in the raw materials cycle. In the pre-liberalisation days when there were controls on supply of imported raw materials and even on domestic supplies of feedstock like coal and even other inputs like cement, companies were compelled to maintain huge stocks of raw materials to ensure that the production cycle was not disrupted. As liberalisation removed these controls and supplies became easier, companies reduced the amount of raw material they stocked and thereby reduced the raw material cycle.

This was a structural correction in the financial operations of companies engineered through economic liberalisation of the early 1990s. Befitting the nature of structural reforms, India Inc continues to benefit from this even today.

Between 2006-07 and 2015-16, the gross working capital cycle increased steadily to reach 174 days. But, the reason was not raw materials. It was in the work-in-progress cycle and the debtor days that deteriorated during this period.

These have since improved. And, the gross working capital cycle dropped sharply in 2017-18 to 159 days and then to just 123 days in 2018-19. This is the lowest working capital cycle recorded since 1990-91. It is likely that this, a preliminary estimate, will rise in the coming months. But, it is unlikely that it would change the basic finding that the working capital cycle has reduced substantially.

We derive the working capital cycle measures from the published audited financial statements of companies by computing four component ratios of the overall gross working capital cycle. In the paras below, we discuss the trends in each of these.

- Raw material cycle. This is the number of days it takes to move the raw materials available in stock into the production process. In the early 1990s, it took more than three months (97 days) to move them into the production process. Now, companies stock less than two months (50 days) worth of raw material stocks. This is the biggest source of improvement in the operational efficiency of companies.

In 2015-16, raw material stocks cycle rose to 54 days but has since declined to 49 days in 2017-18. Preliminary estimates for 2018-19 show a further decline to 46 days. It is possible that the estimate for 2018-19 may rise a bit as new information flows in but, it is unlikely to change the story that the raw material stocks are worth less than two months of raw material consumption of companies. This is a big gain compared to the pre-liberalisation days.

- Work-in-progress cycle. The time it takes for raw materials and other inputs to stay in the production process before they turn into finished goods has yo-yo’ed between 15 days and 30 days. Between 2001-02 and 2006-07, the work-in-progress cycle was less than 17 days. But, between 2008-09 and 2016-17 it was much higher at over 30 days.

In 2017-18, the work-in-progress cycle fell significantly to 22 days. And then in 2018-19 it fell sharply to just 14 days.

The fall in 2018-19 is however, largely because of an unusual fall in the work-in-progress cycle of construction companies.

- Finished goods cycle. The stock of finished goods sitting with companies at the end of the year is usually worth about 25 days of sales. In 2018-19, this ratio dropped to just 21 days of sales. The fall was across the board. The exceptions included the gems and jewellery industry that saw the finished good cycle rise from 65 days in 2017-18 to 111 days in 2018-19.

- Debtor days. A sharp reduction in debtor days is the single largest contributor to the decline in the overall gross working capital cycle in 2018-19. Companies recovered their dues from customers in just 41 days in 2018-19 compared to 62 days in each of the preceding three years.

The magnitude of the drop at 20 days in a single year is extraordinary. But, the fall is quite spread across all segments. The manufacturing sector saw a fall of 10 days in debtor days. Construction companies saw a similar fall. The fall in the non-financial services sector was a substantial 24 days. And, in electricity companies the fall was of a massive 54 days. Mining sector saw a modest fall of 8 days.

Each of the four components of the gross working capital cycle saw a decline in 2018-19. Therefore, each contributed to the decline. The reduction in debtor days contributed 56 percent of the decline in the working capital cycle in the year. Work-in-progress contributed another 23 percent; finished goods days contributed 12 percent and raw materials 9 percent.