By Krishnaprasad N.B.

By Krishnaprasad N.B.

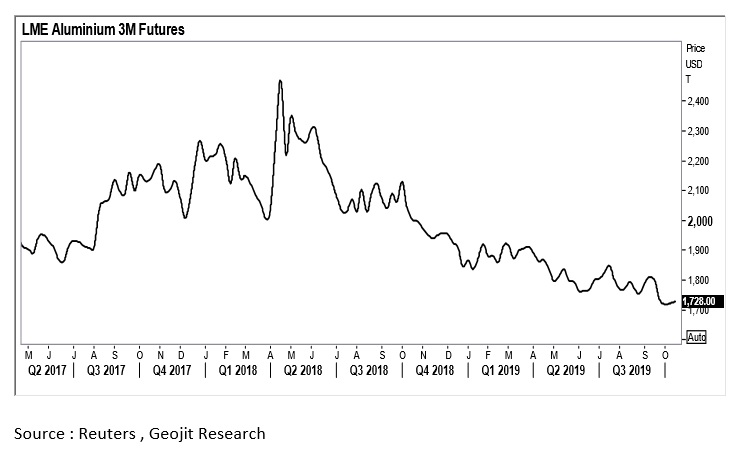

The aluminum market has been traversing in a drab demand scenario for more than a year. The light metal’s price in the London Metal Exchange, the key benchmark platform for base metals, shed 25 percent since the start of 2018. Similar trend was witnessed in domestic prices as well but the liquidation pressure was limited due to a weak domestic currency. The lackluster physical demand amid downbeat manufacturing activities from major consuming countries drove prices through a sloppy path.

Since mid-2018, Aluminum prices started losing grip on escalating trade friction and fears of slowdown in industrial sectors. Prices hardly marked any gains since then, except the first quarter of 2019 when U.S. and China agreed on a partial trade truce.

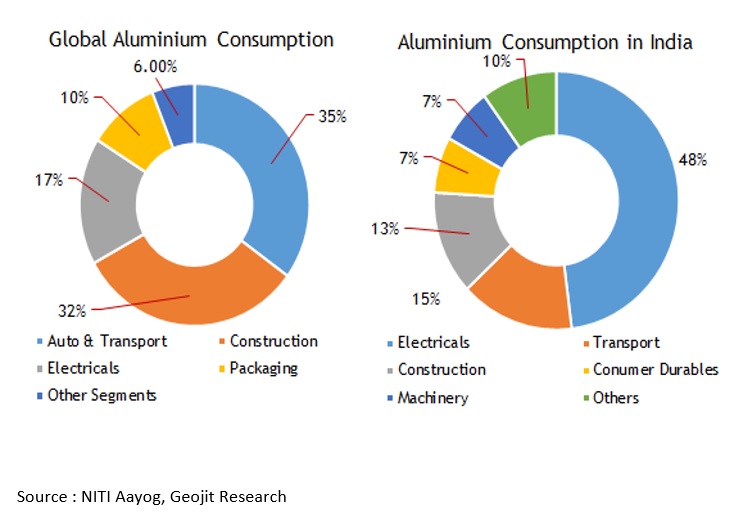

Aluminum is widely used in industries like automobile, transportation and packaging. Feeble global economic momentum hit the automobile sector, one of the metal’s biggest consumer, influencing prices. The global automobile sector accounts for around 30-40 percent demand for the light metal. Reports say, global automobile production tumbled by more than 7 percent since the start of the year against a 1.7 percent growth in the previous year. Weak economic sentiments hurt the global business confidence prompting cutback in business spending and weakness in manufacturing.

US-China trade tensions and weak global demand

US started imposing tariffs on Aluminium imports since March 2018 as a protectionist measure to safeguard domestic producers. However, prices soared in the subsequent month on supply worries as US imposed sanctions on Russian aluminum giant, UC Rusal, that has 7 percent of market share in global Aluminium production, accusing ‘malign activities’ by its key stake holder. The LME unlisted the Rusal’s stocks from its registered warehouses fueling supply worries in the market.

However, the short-lived spike in prices lost its steam as the U.S – China trade tensions overshadowed supply worries. China’s downbeat auto sector along with property market weakness have adversely influenced global aluminum prices.

The trade war tensions between the world’s top two economies triggered fears of recession which lead to feeble industrial activity across the world particularly in China. However, unfortunately, the stimulus measures taken by China’s government to prop up the economy was not as effective as expected.

Role of China in global aluminum market

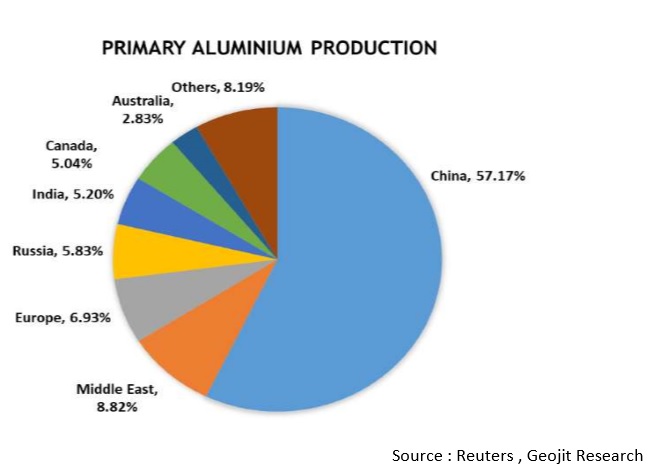

China is a dominant player in global aluminum market as it accounts for half of global production and consumption. The country is the major producer contributing almost 57 percent of world’s production followed by Middle East and Europe. India is the 3rd largest producing country and occupied the 5th place. China, Russia, Canada, India, UAE, Australia and Norway together contribute 80 percent of the global primary aluminum production.

Data indicates that the 15-month old trade dispute with U.S has hit the Chinese economy adversely. Recent sluggish economic indicators from the region underscored fears of a recession. The Chinese economy grew at the slowest pace in almost three decades in the third quarter of 2019. China’s producer’s inflation fell sharply by 1.2 percent YoY in September 2019 and the growth of industrial production fell to 17-year low.

Meanwhile, defying the bearish trend witnessed in London markets, Aluminum prices in China revived in the last three quarters. It was mainly due to the closures of about 3 million tonnes of production in the second half of last year that led to deficit in China’s aluminum. This situation has further inflated in 2019 lending support for aluminum prices in Shanghai market.

Indian Scenario

Indian consumption story of aluminum is slightly different from the rest of the world. In India, the top consuming area for the commodity is “electricals”, mainly from the boost for rural electrification program and second place is occupied by transport. These two sectors together consume more than 60 percent of total aluminum usage in the country. The electrical industry segment itself shared a major chunk of 43% of aluminum consumption followed by transportation and consumer goods.

According to NITI Aayog, aluminum sector contributes around 2 percent of our manufacturing GDP. Increasing government spending to develop smart cities, rural electrification and consumer goods have amplified the consumption of aluminum to certain extend.

Tariffs hike over Chinese products gave advantage to Indian exports in global markets, exports of aluminum to U.S showed a remarkable increase by 58 percent to $221 Million in 2018 according to an independent Congressional Research Service (CRS).

Challenges

One of the issues that the Indian aluminum industry is facing now is high production cost, which challenges the competitive advantage in global market. According to global aluminum cost reports, the average production cost of Indian aluminum producers is one of the highest among other producing countries. Meanwhile, other lead producing countries enjoy subsidies on raw materials such as coal and Natural gas for power generation and through other supporting policy measures. The production cost of the metal in India has continued to increase during the last few years due to rising cost of raw materials, increase in energy price, and surge in various duties, cess and logistical charges.

Trade conflicts with U.S. led China to divert its surplus aluminum to other countries and this makes India more exposed to dumping. The NITI Aayog, in a report titled Need for an Aluminum Policy in India, pointed out that aluminum imports from China into India are almost 30 times India’s aluminum exports to China.

Supply, Demand & Price outlook

It is expected that aluminum market will be oversupplied in the coming years. Ongoing weak global demand and hopes of increased supply from China may swing to a supply glut. Easing industrial controls and leveraged economic policies in China are likely to brace industries to add more capacity that may lead to an oversupplied market later. Hopes of further aggressive stimulus measures may also assist the sentiments.

China will remain the driving force of global aluminum prices. If the trade tensions and global macroeconomic headwinds continue, prices would remain under pressure. Increased availability and low prices of alumina, the key raw material for the industry may also affect the trend. However, any breakthrough in trade talks and policy measures by China may lead to spurt in demand from the automobile and packaging industries later.