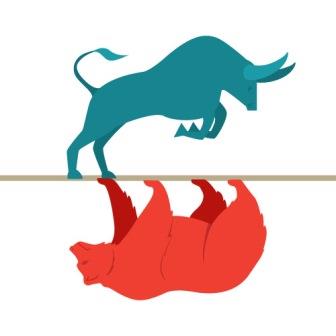

The rally in the broader market is here to stay as mid- and small-caps are on revival path, according to VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services. Vijayakumar, however, believes in large caps, only private sector banking has room to go up further.

Vijayakumar added that the auto sector that has been struggling due to falling sales caused by demand slowdown for a while now is likely to turn around soon while the cement, capital goods, private banks and aviation can be the high-earning sectors for the next four to five years.

In an interview with CNBCTV18.com, Vijayakumar spoke at length about foreign institutional investments declining post Budget, the impact of coronavirus on the Indian market, trend reversal in broader markets, and the December-quarter earnings. He also shared his preferred stocks and spaces and an advice on how a new investor should enter the market now.

Edited Excerpts:

How do you think FIIs are taking the Budget? There haven’t been any big inflows since.

The abolition of DDT is positive for FIIs. The subdued inflows may be due to the lack of signs of economic recovery and concerns regarding the coronavirus.

Broader markets have seen a trend reversal in 2020, do you think this will continue? Why are investors moving towards midcaps, small caps now?

It is possible that the rally in the broader market might continue. The large-caps, particularly those with earnings visibility, are priced to perfection. There is no room for them to go up further, except in private sector banking, where market share gains will give room for further appreciation. Mid-and small-caps, after negative returns for two years, certainly look poised for a revival.

Post Budget announcements like the abolishment of DDT or changes in tax slabs… how do you think this will impact the insurance stocks? Which ones do you prefer in the space?

Insurance stocks will continue to do reasonably well even though the new IT regime without exemptions is a dampener. Also, the insurance segment doesn’t gain from the abolition of DDT and shifting of the tax burden to dividend receivers since they do not enjoy the pass-through status enjoyed by mutual funds.

December-quarter earnings have recovered a bit compared to the last few quarters. Which could be the high growth-earning sectors in the next four to five years?

We expect autos to turn around soon. Cement, capital goods, private sector banking, and aviation can be the high-earning sectors for the next 4 to 5 years.

With the government giving a boost to EVs, what do you think will be its short-term impact in the auto space. Would you suggest any auto stocks to buy at current levels?

Even though the government is giving a boost to EVs, it will take quite some time for EVs to grow in India since creating the charging ecosystem is going to be a time-consuming affair.

Do you think the markets are fairly valued? Is it a good time for a new investor to jump in or should they wait for some consolidation?

The markets are fully valued and quality large-caps are richly valued…Investors should invest systematically without waiting for the opportune time.

Post-December-quarter earnings, what is your view of the financial sectors? Public banks, private banks or NBFCs – which do you prefer and why?

We prefer the leading private sector banks since they are gaining market share. In PSU banks the only option is the leader in the space. In NBFCs the gold loan companies look good.

Indian retail stocks are currently the most expensive retail stocks in the world. What justifies this underlying excitement or even euphoria?

It is hard to justify valuations. There is absolutely no margin of safety in this space.

Have you seen any major impact of the coronavirus in the domestic indices? How long do you think the threat may continue?

The corona concern has not yet impacted the markets. Perhaps the markets are discounting that the spread of the virus would be contained. Don’t know how long the threat would continue.

First Appeared in CNBCTV18.

yes can see the market slashing due to corona virus especially china and middle east and south Asian countries , investors can buy shares as considering this as an golden opportunity for investments only , the market will come back in a strong manner once the corona stops spreading into more countries , as an investor I advice to buy shares and hold on .