By Vijayananda Prabhu

Returns from both equity and debt are equally affected by changes in economic and geopolitical scenario across the globe. In equities we make losses while prices come down; in debt we incur losses when prices inch down (that is when yields go up). When there is higher demand for debt, the yields (the offered interest rate of papers) go up and hence the prices of existing bonds fall. This results in loss for existing bond holders. As in the case of equities, it’s a fine game of forecasting and actual results. Interest rates are really hard to predict. Events happening worldwide affect the interest rates of every open economy. But one could manage to generate decent returns out of this uncertainty if portfolio mix is kept at optimal levels. Lets learn how.

Basic theory

Longer the maturity of the scheme, higher the volatility or risk. Also, lower the credit rating of the papers invested into, higher is the risk. So conservative investors choose short duration schemes and aggressive investors choose long duration schemes. The NAV fluctuation will be higher for longer maturities than for shorter maturities since the chances of interest rate movements is less during the short term. The risk in a debt scheme could be read from modified duration (MD) which is the percentage change in NAV of a scheme for 1% change in interest rate. MD will be lower for short term schemes and higher for long term schemes.

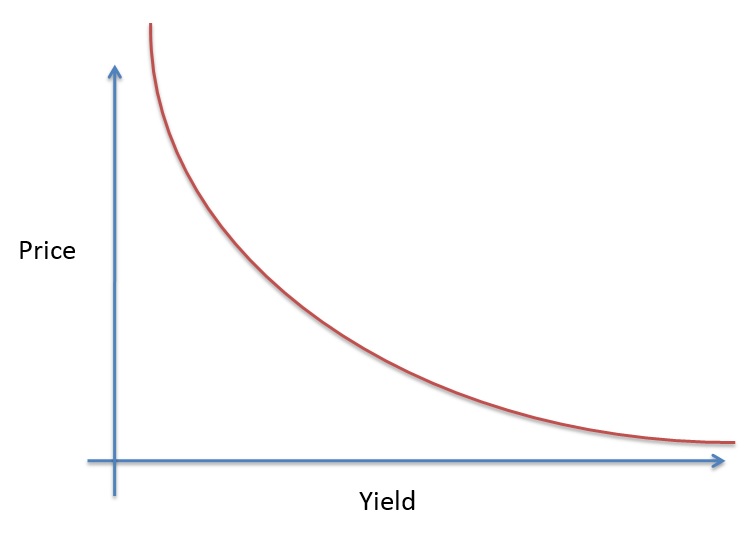

Interest rates and price of bonds are inversely correlated. When interest rate in the market rises, the price of bonds fall and when interest rates fall, the price of bonds rises.

Choice of maturity

Basic information one should keep in mind is that debt mutual fund schemes are classified mainly on the basis of maturity of debt papers they invest into. For e.g. a liquid fund invests in debt instruments with maturity less than 91 days; an ultra short duration fund invests in papers with maturity less than six months; and so on. Maturity is the most significant among all other parameters used to decide upon which scheme to invest. Various strategies come into play while selecting the maturity. These strategies depend upon the risk taking capacity of the investor. According to an unwritten thumb rule, one should match the investment horizon with scheme maturity. This means, if an investor intends to invest for three years, then he could invest in short duration schemes which has average maturity around three years and if the investor wishes to invest longer, then medium or long term fund is suitable. This is a conservative or passive strategy which does not yield the best returns always. One need to dynamically manage the investments, redemptions and reinvestments to make the best out of prevailing interest rate scenario.

There are two types of investors. One group wants to invest for long term and expect to receive cash flow out of their investment. The second group just wishes to capture capital appreciation opportunities over shorter periods of time, generally less than three years. Those looking for regular income and less volatility in capital choose short duration schemes and schemes with maturity less than three years. As we saw earlier, liquid or ultra short duration funds are ideal for short term investments. But aggressive investors, in spite of their investment horizon, choose long bond funds even for short duration investments. Suppose an aggressive investor wants to invest for 6months and the interest rate forecast for the near future is negative (i.e. rates will come down). Then, it will be a great opportunity to reap the price appreciation on long duration bonds. But this scenario might not last long. Interest rates come down, reach a trough, and then can move upwards. In such a scenario the earlier profits may get eroded. So a dynamic management of schemes is essential. If you are aggressive about returns and can tolerate risk then you have numerous strategies to adopt.

Choice of papers

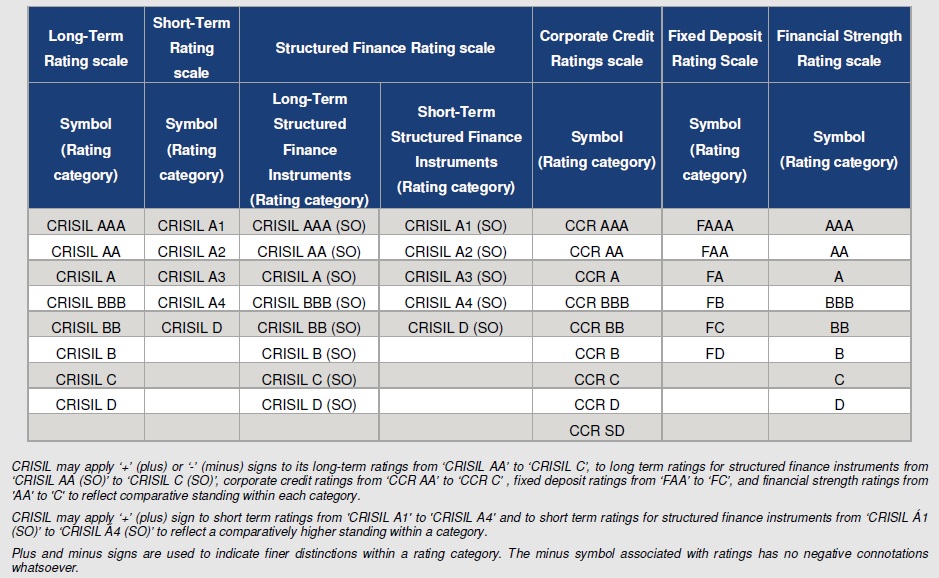

Here paper means bond instruments. When issued by the government it is called a bond and those issued by corporate entities are called debentures. Government bonds are sovereign in nature and therefore, there is no default risk. You will get the promised money back. But since they are long term in nature, price volatility will be high. Since corporate debt is not as safe as sovereign debt, credit rating agencies have classified issuers of debt instruments into various categories depending upon their capacity to pay the debt back on time. General nomenclature spans through AAA, AA, A, BBB, BB and downwards. As we move down, the credibility decreases and risk increases. Ratings from AAA to BBB is considered investment grade. Corporate bonds seldom carry maturities beyond 10 years. Most of them are short duration papers and interest paying ones and hence form part of short term schemes. The rating chart of CRISIL published in June 2017 is given below for general understanding.

The new SEBI categorization of schemes have named a few scheme categories like credit risk fund and corporate bond fund. Credit risk funds carry higher risk papers such as those rated AA and below, whereas corporate bond fund host papers with credit rating above and including AA+. Both these categories are short duration schemes with a maturity period of less than 4 years. Here, aggressive investors can choose credit risk schemes and moderate as well as conservative investors can choose corporate bond funds. When the interest rates rise a short term investor can benefit from increasing interest rates through reinvestment gains. A short term coupon paying bond will generate higher yield till maturity (YTM) since each coupon (interest payment) is reinvested at higher interest rate resulting in final redemption being higher amount than expected. This benefit is not available for T bill instruments since they are non coupon paying investments.

Current Scenario

We are witnessing an uptrend in interest rates since the last couple of quarters due to high inflation numbers, weakening rupee and FED rate interventions. So it is a tough time for duration investors who had invested in long duration schemes. Those who have the majority of their portfolio in short term funds, saw least volatility in prices. The current rate uptick could last for some time in future till the tight liquidity situation eases and inflation comes under control. One could ride this interest rate cycle in two different ways. One is to stagger purchase short term schemes over next few months. Second is to invest in low risk categories such as liquid and ultra short duration schemes. FMPs and NCDs are also decent options. The bull run in the bond market receded by late 2017 and since then there have been indications of rate reversal. Till the next rate easing cycle starts, it’s time to stay prepared and informed.