Have you ever wondered why you have to take a test to obtain your driver’s license? It is to ensure you are aware of different road and traffic signs. Similarly, wouldn’t it be easy if there were some signs while investing, too? Well, the good news is – there are! The sign designed to warn you of the potential risks associated with a mutual fund scheme is the Riskometer.

Understanding Riskometer

The Securities and Exchange Board of India (SEBI) has incorporated a risk reference tool known as Riskometer. This tool offers a visual representation of the risk level associated with a specific mutual fund scheme. In turn, this helps you invest according to your risk appetite. SEBI has made it mandatory for asset management companies to display their Riskometers on their schemes.

Riskometer’s representation is divided into six different categories of risks:

- Low risk

- Low to moderate risk

- Moderate risk

- Moderately high risk

- High risk

- Very high risk

The Riskometer has become a vital tool to navigate the fixed-income investing segment, also known as debt mutual funds. Debt funds invest in fixed-income instruments such as government bonds, corporate debentures, commercial papers, and treasury bills. These investments can provide you with a steady income stream while managing risk effectively.

Debt instruments, often viewed as a safe bet, can come with a host of risks that you, as an investor, should be aware of. These include interest rate risk, credit risk, and liquidity risk, all of which can impact portfolio stability. With a growing preference for debt funds among conservative and semi-conservative investors, this Riskometer acts both as a caution board and a compass.

In this article, let’s see how the Riskometer guides investor decisions in debt funds.

What is the Riskometer and Why It Matters?

Understanding the Riskometer reading is quite simple. This visual tool simplifies investment decision-making based on risk tolerance, even if you are a beginner. It helps you become more mindful of the risk-return trade-off while investing. In turn, it makes you better equipped to make investment decisions based on your risk tolerance.

Here are some reasons why reading the Riskometer is important before you make investment decisions.

- The Riskometer is a simple tool for gauging the risk level of a specific mutual fund scheme before investing.

- All mutual funds are required to provide monthly updates about their Riskometer readings. This ensures transparency that helps build investor trust.

- Risk tolerance is one of the primary factors considered while investing. The Riskometer reading helps you decide based on your risk tolerance.

- Another benefit is it ensures you are aware of your risk exposure while investing in specific mutual funds. It ensures you don’t inadvertently invest beyond your level of risk tolerance.

- Apart from all this, since the Riskometer is regulated by SEBI, it ensures consistency across all fund houses. This goes a long way in building a transparent and clear investment environment that fosters investor trust.

Here’s how the total risk score of a fund is derived:

- Step 1: Identify the security’s category and determine the weight of each security within the scheme’s portfolio.

- Step 2: Assess the risks associated with each security based on the category to which they belong.

For example:

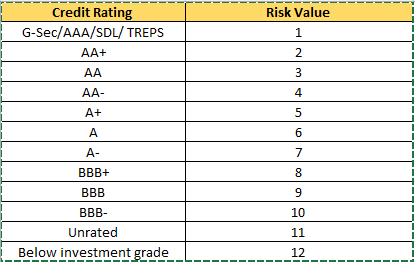

- Step 3: Assign a risk value to each risk parameter for every security based on the data published by SEBI.

For example:

- Using the data published by AMFI, the assessment for credit risk will be done using the following table

Click here to find the risk value of other factors like volatility, interest rate risk, and instruments such as equity derivatives, index futures, stock futures, and stock options.

- Step 4: Sum up the risk values according to the weight of each security.

- Step 5: Calculate the average risk score for the total portfolio.

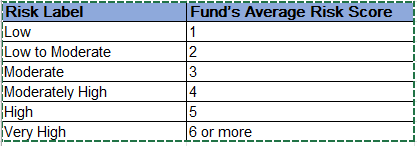

- Step 6: Use the calculated risk score to map the fund scheme to a specific risk category (e.g., Low, Moderately Low, Moderate, Moderately High, High and Very High) on the Riskometer.

The Riskometer of every mutual fund scheme will be assessed every month, and Mutual Funds/AMCs will reveal the Riskometer along with portfolio details on their website and the AMFI website within ten days after each month ends.

Impact on Portfolio

- Selection and allocation of instruments

Fund managers are required to select specific instruments to maintain a specific level of risk on the Riskometer. For instance, if a fund wants to remain at low risk, then its selection and allocation of instruments will be different from that of a fund that wants to maintain a moderate risk level. This helps establish and maintain a sense of self-imposed discipline on fund managers while selecting and allocating instruments within a debt fund’s portfolio.

- Risk assessment

As mentioned, a specific composition and allocation of instruments is needed to maintain a desired level of risk on the Riskometer. When the fund managers know this level, it becomes easier for them to nudge the investments within this range without crossing the desired risk category.

- Dynamic rebalancing

As the market conditions change, the Riskometer reading also changes. Whether it is a sudden increase in interest rates or downgrade in key holding, these factors change the Riskometer reading. In turn, fund managers rebalance the portfolio to maintain or reassess the fund’s risk level. It essentially promotes proactive risk and portfolio management.

- Clear and transparent communication

According to SEBI’s guidelines, it is mandatory for all asset management companies to disclose their Riskometer levels monthly. This gives you an easy-to-track metric to understand the overall risk profile of a debt fund. In turn, this ensures transparency and clear communication between the fund houses and investors.

- Investor Trust

The Riskometer plays a crucial role in promoting transparency by requiring ongoing and clear risk disclosures. This approach significantly minimises the likelihood of mis-selling, where you might be steered towards riskier funds while being misled about their safety.

The future of the industry is looking bright with lasting effects: enhanced investor confidence, better-informed choices, and a reduction in unexpected surprises.

The Riskometer is an incredibly helpful tool when it comes to selecting debt funds according to your risk tolerance. That said, there’s no such thing as a fool-proof investment. Remember, while investing, consider other factors such as the fund’s track record, credit quality, portfolio duration, volatility, asset allocation, your investment goals, etc and not just your risk tolerance.