By Hareesh V

Gold took another hit in August, its fifth consecutive month of decline, with spot gold prices crashing to near a-one-and-half year low of $1160 a troy ounce. Gold had showcased an exceptional run-up from 2004 to 2011, when price of the yellow metal went up from $400 to $1,900 an ounce. Since peaking in 2011-12, gold is now trading down by more than 35 percent. Since the start of April this year, prices lost more than 12 percent in the international market. Strengthening dollar and firm global equities drew investor confidence, pushing gold down.

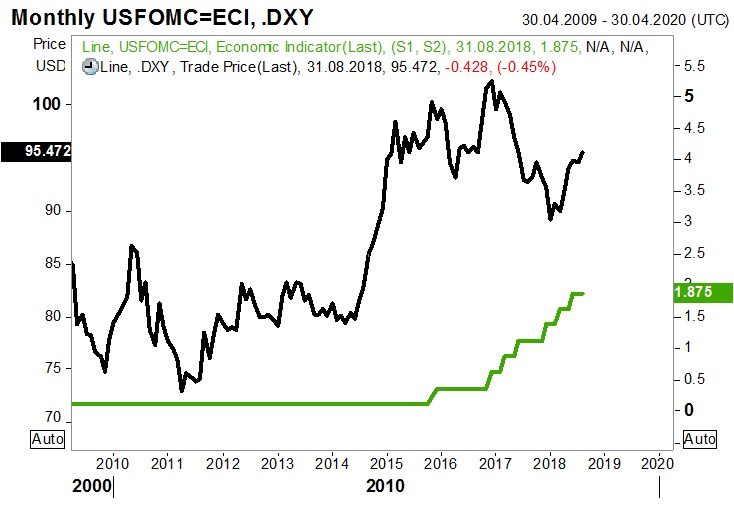

Gold’s appeal has dulled due to a combination of factors like money flowing into equities at the expense of gold, robust dollar and monetary tightening by the U.S. Federal Reserve. As per recent data, in the second quarter, the U.S. economy grew at its fastest pace in nearly four years, boosting investor confidence in dollar. U.S. economic growth has been buoyed by Trump administration’s package of tax cuts and government spending. Also, dollar is attracting more haven flows as investors are now paying attention to the U.S Federal Reserve’s monetary policy moves. The U.S Federal Reserve raised rates twice this year and is on course to hike it further, backed by strong labour market and rising inflation.

Rising U.S. interest rates are alarming non-interest yielding assets like gold. Higher interest rates lift dollar and boost yield in assets like bonds, which could dent investor appeal on interest-free assets like bullion. The U.S dollar gained more than seven percent during this year, supported by U.S. administration’s move on imposing tariffs on imports. A strong dollar is prompting traders to stay away from taking big bets on gold. A firm dollar makes gold expensive for holders of other currencies as gold is priced in dollar.

Simmering geopolitical issues, concerns over ongoing U.S. – China trade spat, U.S sanctions on Iran, increasing oil prices, growing anxiety over Brexit and Turkish financial crisis had little impact on the precious metal. Gold usually gains when global geopolitical conditions worsen. However, it is not reflecting in gold now, challenging its safe haven appeal.

The yellow metal stayed weak despite U.S. imposing sanctions on Iran, which is expected to hit oil supply and raise inflation. Inflation could bring down the value of one’s portfolio and investors usually invest in gold to beat inflation risks. However, the inflation hedge demand for gold was also not activated.

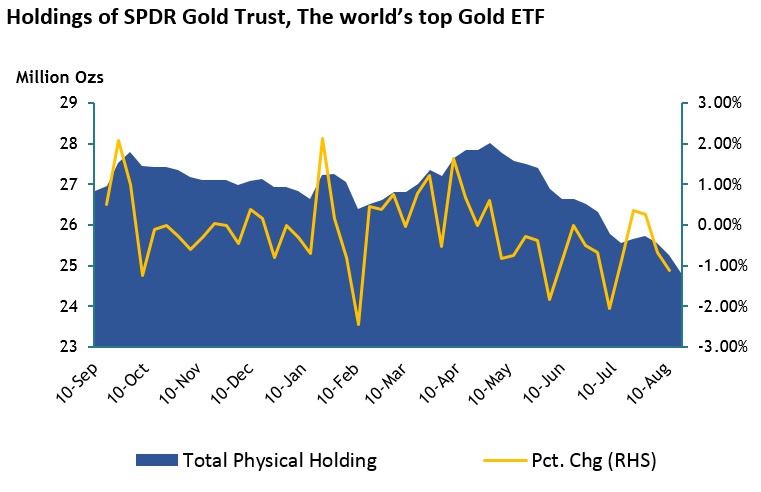

The bearish stance in gold was accentuated by demand concerns from consumers like China and India, which form a huge market for the commodity. Investment interest in gold remains under pressure as the holdings of SPDR Gold Trust, the world’s largest gold ETF has fallen to one year low levels. The net short bets on gold by hedge funds and large speculators are also at its multi-year low levels.

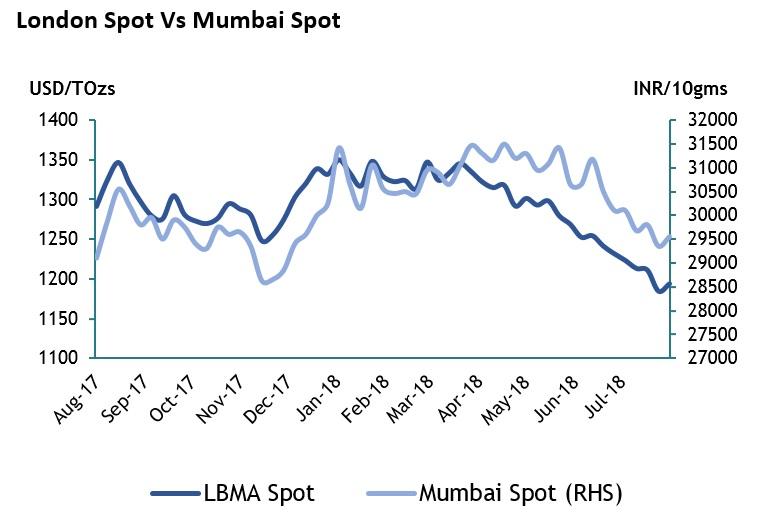

In the meantime, though weakness sustained in the overseas market, the Indian prices corrected moderately due to weak local currency and premium charged by domestic traders. Indian prices have been on an upside trajectory since the start of the year, but the trend slightly reversed since mid June. In the domestic market, prices held well above Rs 29,000 per 10 grams. It recovered from a low of Rs 28,055 to Rs 31,650 per ten gram during the initial six months of the year.

Reversing its previous trend, Indian gold imports are now significantly higher. In July, imports to the country jumped more than 40 percent against the same period in the previous year. This is due to stock building by jewelers amid low prices and expectations of higher rural demand owing to strong monsoon. Usually Indian demand for gold perks up in the last quarter of the calendar year as Diwali and Dussehra fall during this period, when purchasing gold is treated as auspicious.

A record weak INR too supported the sentiments for Indian gold. Indian currency has fallen about 10 percent since January to its all-time low of Rs 70.41 versus dollar. Weak INR would raise the landed cost of the commodity.

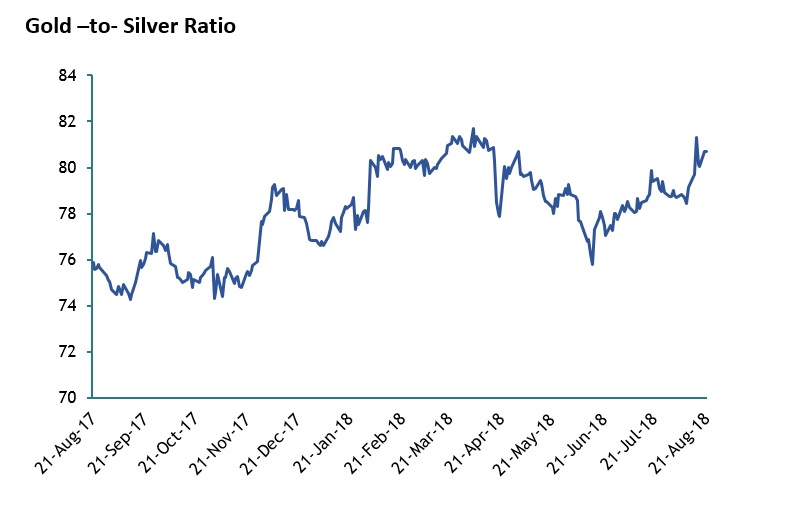

The gold to silver ratio- the amount of silver required to buy one ounce of gold is now at its highest levels. This ratio tends to move higher either when gold prices suddenly move up or silver moves down. Anyhow, many traders take this ratio as an indicator to determine whether it is the right time to buy or sell precious metals.

Looking ahead, the trade worries will continue to dominate the market. Gold is presently losing lustre as a safe haven and store of value. Policies taken by the U.S. Federal Reserve and its repercussion on U.S. currency, geopolitical factors like U.S – China trade spat, global oil prices, performances of the stock market and physical demand from China and India may sway the trend.

On the domestic front, prospects of a good monsoon, upcoming festive season and chances for higher rural income due to increased MSP are likely to trigger firm rural demand. With the current market fundamentals being unfavorable for gold, a wait and watch approach may make sense for larger investments. Still, buying small quantities at periodic intervals with a view to hold for a longer period, would be a better strategy.