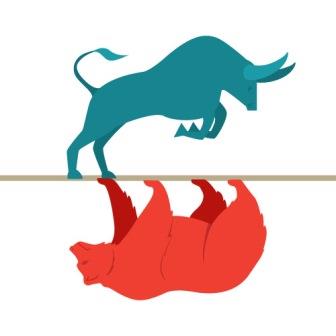

“The global economy is in a synchronised slowdown”, said IMF Chief Economist Gita Gopinath. IMF slashed the growth rate to 3 percent for 2019, one of the lowest since the global financial crisis.

“The global economy is in a synchronised slowdown”, said IMF Chief Economist Gita Gopinath. IMF slashed the growth rate to 3 percent for 2019, one of the lowest since the global financial crisis.

There could be various factors that paved the way to the current slowdown. But, what is the major contributing factor? All fingers would point to the trade war between the two large economies, US and China. As per the IMF estimates, the trade tensions between the US and China will shave away 0.8 percent from the global GDP by 2020. Another disturbing figure is that global trade growth has reached only 1 percent in the first half of 2019, the weakest level since 2012.

Cost on the US economy

The trade tensions have caused significant damage to both the countries. For instance, the manufacturing industry in the US is facing a major contraction. The Institute for Supply Management’s manufacturing index for September stood at 47.8, one of the lowest since June 2009. The index registered 46.3 percent in June 2009, the last month of the Great Recession. The service sector in the US is growing, but at a weaker pace. The Non-Manufacturing index by the Institute of Supply Management slipped to 52.6 in September from 56.4 in August. Though, the service sector is growing, there are concerns on whether the contraction in the manufacturing industry is spilling over to other sectors. Adding fuel to the fire, retail sales fell by 0.3 percent in September, the first time in the last seven months.

Concerns are also going around on the inverted US Treasury yield curve. A yield curve usually reflects the market sense of the economy. It shows the yield of the bonds against different maturity dates. Usually, the long-term bonds provide higher yields when compared to the short-term bonds, and the yield curve slope upwards. The curve becomes flat if the yield of long term-bonds is no different from the short-term bonds. And, if the yield curve is inverted, it means the short-term bonds offer more yield than the long-term ones. An inverted yield curve shows that the investors are expecting a slower growth and lower inflation in the future, and thus lower yields. It is considered to be a reliable indicator in predicting economic slump. Though the US yield curve is no longer inverted, experts are of the view that signals from the yield curve should not be neglected.

Growth slowdown in China

China’s economy is also not immune from the negative impact of the trade war. The economy grew at a slower pace in the third quarter at 6 percent. Produce Price Index (PPI) is following a deflationary trend, due to the slowing output and falling raw materials prices. PPI dropped to 1.2 percent in September, one of the steepest declines since July 2016. On the other hand, Consumer Price Index (CPI) rose by 3 percent in the same month. The rise in CPI is mainly due to the rising food prices. African swine fever has pushed up the pork prices by around 69 percent in September, which is reflected in the rising food inflation.

Relief from BREXIT Deal

BREXIT without a deal was another area of concern for the global economy. It would have been a big blow to the global trade, already suffering from the US-China trade war. BREXIT without deal would have led to more tariffs and border checks, disrupting the movement of goods and services. To a great relief, Britain and European Union have agreed to a new divorce deal. Now, all the eyes are on the British parliament, whether Prime Minister Boris Johnson would get the necessary backing for the agreement.

Rising Geopolitical Tensions

The rising geopolitical tensions are also posing a threat to the global economy. The drone attack on the oil facilities of Saudi Arabia’s Aramco shook the world markets. Iran was blamed for the attack by Saudi Arabia. Though the crude oil prices have returned to the normal path, the tensions in the Middle East is an area of concern. On the other hand, the list of the countries with US sanctions are also increasing. US has placed sanctions on Iran, Russia, Venezuela, and now Turkey is also in the radar.

The global economy is facing issues ranging from trade tensions to geopolitical tensions, disrupting economic activity. The emerging economies are also not immune from this slowdown. The emerging economies like India, Brazil and South Africa are also facing an economic slowdown due to global and domestic factors.

Now, the focus should be on how the global economy can climb back to the growth trajectory? Can a monetary stimulus by the Central Banks help in reviving the global economy? However, even now the global economy is in the phase of a loose monetary policy that were unleashed during the Global Financial crisis. In such a scenario, the Central Banks will have limited room, and the impact of such a stimulus would be also less. The need of the hour is to put an end to the trade barriers and rein in the geopolitical tensions.

US and China, have reached a partial trade deal; however, uncertainty is still hovering with the imposition of tariffs in place. With the Presidential elections coming close, it is expected that Trump will take measures to retain his chair. Urgently, he needs to initiate steps to reduce the pain from the trade war. Let’s hope for the best!