The broad indices have been positive in the last three to four months given the pre-election rally in expectation of a strong government which is in-line with market expectation and is likely to define the direction of the market in the long-term. We hold a positive view in the medium to long-term with mid and small caps likely to do better in H2FY20. But now we are identifying few of the factors which could have an impact in the short-term like lack of earnings growth, oil prices and near-term hiccups.

The broad indices have been positive in the last three to four months given the pre-election rally in expectation of a strong government which is in-line with market expectation and is likely to define the direction of the market in the long-term. We hold a positive view in the medium to long-term with mid and small caps likely to do better in H2FY20. But now we are identifying few of the factors which could have an impact in the short-term like lack of earnings growth, oil prices and near-term hiccups.

A weaker than anticipated Q4 results…

Market was expecting a bounce in earnings growth starting from Q4FY19. Though low base of Q4FY18 was a factor, market was hoping for revamp in earnings growth led by financial sector, due to reduction in NPA rate, start of credit growth and residing interest rate. But based on Yes Bank result, it seems that the NPA issues are persisting, putting a question in the mind of the investors. Yes Bank reported a big loss of Rs1,507cr for Q4 on account of 9times spike in provisioning and contingencies of Rs3,662cr, which includes a contingent provision of Rs2,100cr provided against potential stressed assets in real estate, media, entertainment and infrastructure sectors of a total tune of Rs10,000cr. Besides the GNPA/NN the gross non-performing assets (GNPA) / net gross non-performing assets (NNPA) have increased to 3.22%/1.86% in Q4FY19 on account of slippages from an airline company and stressed infrastructure conglomerate. It’s pretty concerning that the bank’s exposure to BB and below rated corporate portfolio has increased to 8.3% compared to 2.2% in March 2018. Bankex is underperforming on concerns that it may replicate to other stocks.

But we understand that this is a stock specific issue, in the industry each bank has its own problems of which many have been identified and corrected while some are under progress, a good portion of which is factored in the market. In the past 2 years, growth of loans & advances by Yes Bank was one of the highest in the banking space, with 34.7% and 53.9% growth in FY17 and FY18 respectively. If we look at other banks, the financial performance is satisfactory for Private Banks and high-end NBFCs but overall marginally lower while performance of PSUBs is weak except SBI. We are very positive on financial sector and expect to outperformer strongly in the coming year.

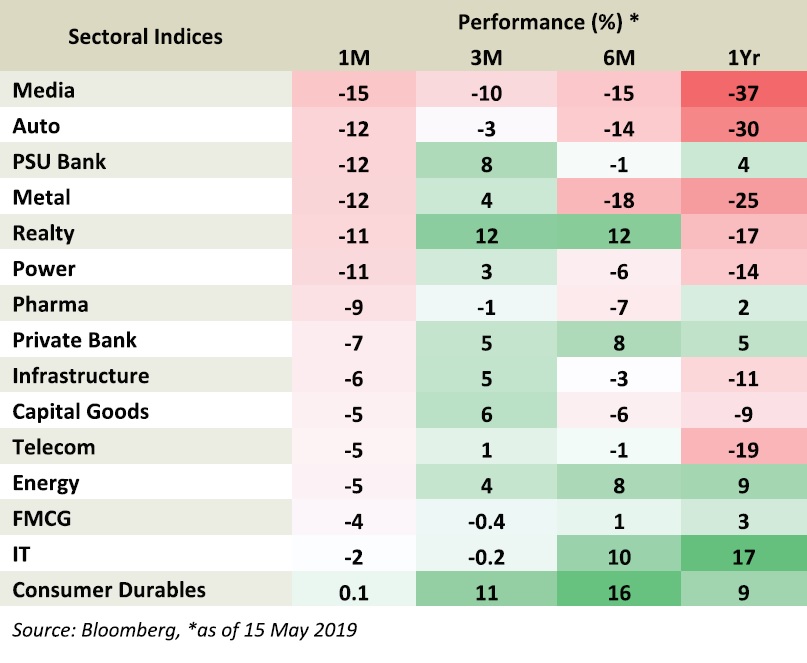

Overall the market was hoping for 20% growth in earnings and till date 15th May it is marginally below expectation. The weakest performers are Auto, Metals and Energy. Financial and FMCG are mixed while best performers are cement and IT sector.

Global worries…

Oil prices have been upwards since the year from $50 to $72. The end of US waivers on oil imports from Iran has led to rise in oil prices, a key issue for the domestic market in the last two months. Market is expecting rise in OPEC output but with prospective risk due to rise in tensions between US and Iran, and other geo-political issues in Iraq, Libya and Venezuela.

While consolidation in the global market impacted the trend of domestic market, global economic data had turned poor. As a result FOMC, had turned more dovish in recent policy meetings, hinting no change in interest rates during 2019 due to economic concerns. However, a better than expected US 1st quarter GDP growth of 3.2% kept the investors to check on the upcoming policy, whether FED could re-think its projection with risk of increase or change in quantitative measures. But positively, FED has maintained its stance and consensus view is status quo in CY2019. Weak US inflation and US-China trade concerns is giving a mixed bias to investor’s sentiment.

US market is down by 5% during the month of May due to US-China trade clash. Markets had hoped that there will be a deal by the end of April. But talks failed in the end of last week, with US imposing a hike in tariff from 10% to 25% on $200 billion worth of Chinese products applicable from 1st May onwards. China retaliated with 25% tariff on $60bn US product imports.

There are speculations regarding this issue and whether this punitive action can expand further. The U.S. Trade Representative is taking steps to prepare and slap tariffs on the remaining Chinese goods coming into the U.S. We also have allegations from US stating that Chinese are moving away from the concessions, leading to fear whether China is fine with this trade war. Well, based on official statements we can expect a better clarity on this issue in the coming three to four weeks. There are views that trade war will become worse before getting a deal, which we are seeing today. The consensus is that a deal will be achieved given the larger interest of respective nations and world.

A strong election rally while the economy is weak

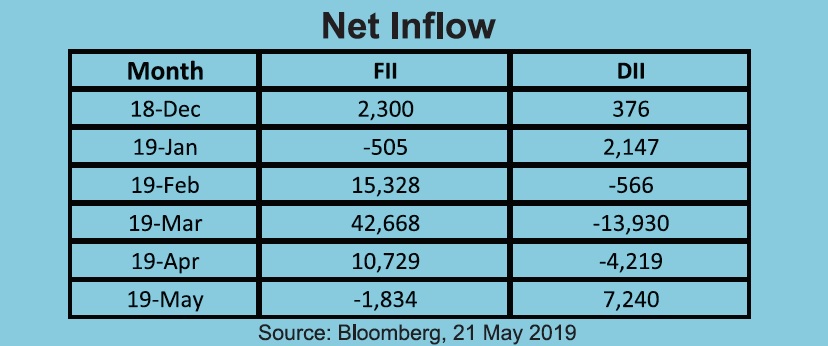

In the last two to three months, Indian equity market has been in exuberance due to higher liquidity from FIIs while inflows from domestic institutions and retail have been subdued. Though FII inflows have been positive, all the investor classes are waiting for the final electoral decision. FIIs had turned negative in the month of May ahead of the final result.

The domestic market went into a profit booking mode, post a good pre-election rally and nearing the event risk. It was believed that a good portion of the outcome was factored in the market assuming a clear mandate. Nifty50 had made a new high of 11,850 dated 18th April, which is 12% up from the low of 10,597 dated 19th February. A deeper consolidation started from 3rd of May as pre-election rally faded by the last phase of the election. Continuous political dramas, different views in many types of poll surveys and notably what will be the end result and its implication to the market alerted the investors to turn cautious in the short-term, till the event risk is digested. At the same time performance of India was also impacted due to dearer valuations led by lack of earnings and economic growth.

FIIs have been very positive on emerging market YTD, but India was underperforming with a dollar-based return of 5% while MSCI-EM index is up by 10% led by China and Russia with 20% return. FIIs too are waiting for the final decision to invest in India post the event with a certainty. We had a view that, if we have a clear mandate to form a stable government, it will have a positive reaction extending the pre-election rally due to higher inflows from FIIs and domestic institutions. Accordingly, the market went to a new high of 40,000 on Sensex given the larger than expected mandate in history.

This positive trend is likely to continue in the long-term while in the short-term we can expect some consolidation given overboard valuation and economy yet to pick up. Also, the recent economic data has been weak and it may take another two to four months more for the economy to stabilize. This mandate is not going to change the economy immediately and start to control the market’s momentum. Being stock specific with a bottom-up-approach and choosing quality names and brands will be a safe investment strategy in such times. The sustainability of the ongoing election rally will depend on the measures given in the full budget and global factors. In the long-term we continue to be positive in which mid and small caps are likely to do better in H2FY20.