The much-awaited Federal Reserve Open Market Committee (FOMC) took place on 16th and 17th March 2021. The announcements were important, as it could be a decisive factor in determining the movement of both the stock market and bond market. Everyone is still alarmed about the ‘taper tantrum’ of 2013. The concern was whether the second episode of it would happen under Jerome Powell, Chairman of Federal Reserve.

In 2013, stock markets found it difficult to digest the news on the hint of a rate hike. It created a series of turbulence in the emerging economies. India was also not immune from it. We were one among the ‘fragile five’ economies, apart from Brazil, South Africa, Indonesia and Turkey. The hint of a rate hike by the then Fed chief Bernanke led to a reverse flow of capital from emerging economies to the US. The result was a strong dollar and depreciating currencies of the emerging economies. Therefore, FOMC announcements for its March meeting were looked upon by investors across the globe.

What are the outcomes of the FOMC meeting?

In its March meeting, the FOMC also announced the projections on the US economy. The Fed upgraded the growth rate of the US economy significantly. The upgrade is supported by the additional fiscal support and the roll out of vaccination in the US. Biden administration had announced a USD 1.9 trillion stimulus package. As per the estimates of the Fed, real GDP growth rate for 2021 is projected at 6.5 percent. The projection for 2022 was revised slightly higher to 3.3 percent from 3.2 percent, and for 2023 it was revised down to 0.2 percent from 2.2 percent.

On the inflation front, the committee expects inflation rate as measured by core Personal Consumption Expenditure (PCE) to overshoot the target of 2 percent in 2021. The committee expects an inflation rate of 2.4 percent in 2021 and 2 percent and 2.1 percent in 2022 and 2023, respectively. The committee also projects the unemployment rate to fall to 4.5 percent from the previous estimate of 5 percent. The unemployment rate projections for 2022 and 2023 stands at 3.9 percent and 3.5 percent, respectively.

In this background, FOMC maintained to keep the rates at zero bound until the labour market has achieved full employment and inflation averages at 2 percent. Fed Chairman reiterated that the accommodative monetary policy stance would be maintained until these employment and inflation outcomes are achieved. Along side the zero bound interest rate, the balance sheet guidance will be also carried forward to support the economy.

On asset purchases, Fed committed to the current pace of purchase on Treasury and Mortgage Backed Securities (MBS) to ensure the smooth functioning of the financial market. The current pace of asset purchases by the Fed stands at USD 80 billion (gross) per month in treasuries, and USD 40 billion (net) per month in MBS. Fed Chairman also commented that it is too early to talk about tapering asset purchases as the US economy is still a long way from its employment and inflation goals.

Inflation concerns

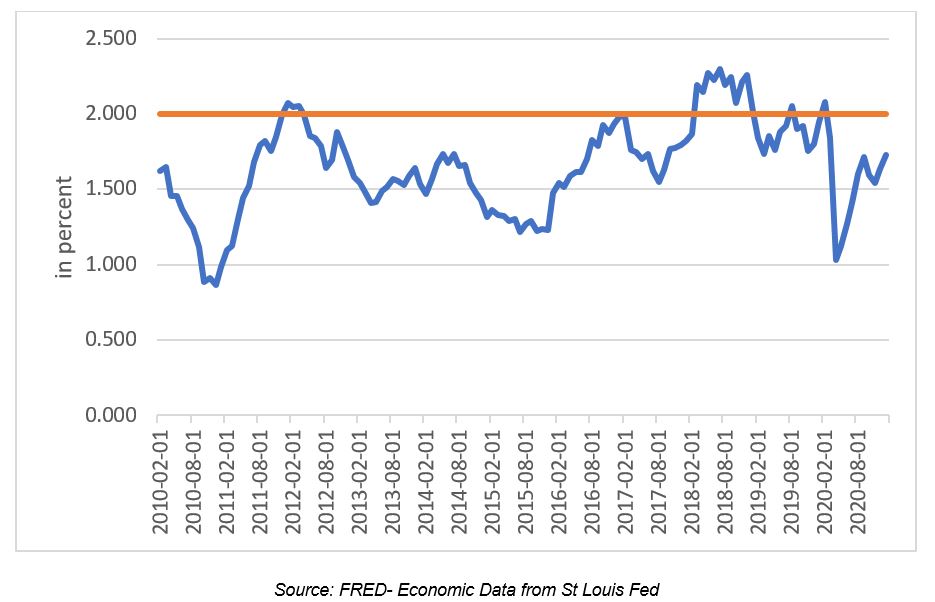

Though the FOMC announcements were comforting to the market, they failed in bringing enthusiasm among investors. Stock markets have fallen from their recent highs and bond yields are surging. The announcements failed in cooling the pressure on the bond yields. The relationship between bond prices and bond yields is inverse. A fall/rise in interest rate would push up/pull down the bond price. Thus, a fall/rise in interest rate would result in the bond yields to move down/up. In the present scenario, Fed Chairman’s assurance that the interest rate will be maintained at the zero-bound failed in bringing the yields down. One of the major reasons for this is the worry of inflation among investors. A strong rebound by the US economy would result in prices inching upwards. Inflation was more or less a dead phenomenon in the developed economies. The Unconventional Monetary Policy (UMP) measures that were unleashed post the Global Financial crisis of 2008 failed in achieving 2 percent target inflation rate. From the graph given below, it could be seen that PCE excluding food and energy has been more or less below the target rate of 2 percent for more than a decade.

Personal Consumption Expenditure Excluding Food and Energy (Chain-Type Price Index) (YoY)

Yet, now there are signals that inflation is making a comeback, which is worrying the investors. And, it looks like the Fed wants to see inflation rising, as it is considered to be a necessary evil in an economy. In such a scenario, Fed would let inflation rise moderately without raising the interest rate or cutting down its asset purchase program. If the inflation rate sharply increases in the coming months and crosses the projected level, Fed would be forced to act. However, this looks unlikely in the medium term.