As indicated in last month’s article, market volatility is rising. The equity market is undergoing a phase of consolidation, main indices like Nifty 50 and Sensex are unable to move to next levels. The momentum is settling down while broad indices are more robust. Rising uncertainty in global market from a possible fall in liquidity and economic growth is provoking dilemma and intermediary selloff. High inflation and the potential impact of the delta variant on economic recovery are serious concerns. FED is expected to discuss tapering, the possible reduction in amount of bond buying in future, which can marginally affect the rate of market inflows. A fall in inflows will influence the current premium-valued market. However, we presume that this consolidation will be short to medium-term as overall easy money policy, fiscal support and economic recovery are bound to stay in 2020-23. During the year ahead, we withhold our view of churching your portfolio into a balanced holding.

Equity could be in consolidation, going forward in 2021.

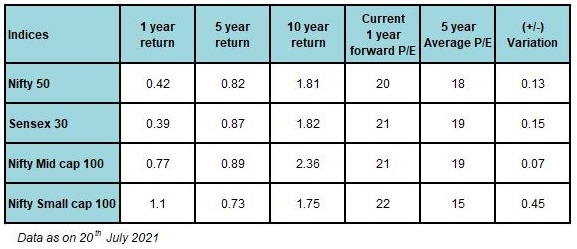

India’s robust absolute returns and current above average valuations:

The key question here is to know how the market will perform from the current all-time high and valuations levels. During 2020-21, global market was in a rally due to fiscal and monetary stimulus which kept the financial markets steady. Re-opening of economy, low interest rates and benefit to some stocks and sectors from pandemic added strength to the rally from the wretched low of April 2020. For Indian market, positive global market and rising domestic inflows from retail, either directly or through MFs helped a lot.

During the last few months, we have been citing cautiousness in equity market on the short to medium-term. It will be difficult to maintain the same exuberance. We expect the trend in equities to calm down. The future trend based on global factors will be the key for domestic market to sustain its success, which is getting vigilant.

The global concerns…

The spread of the delta variant is feared to impact the rate of global economic recovery. High inflation is expected to be transitory, but the consistent high consumer prices are adding concerns that the economy may have to suffer more than normal inflation in the short to medium-term. This is likely to affect the rate of GDP growth and change in monetary policy in 2022. The next Fed meeting is expected to discuss these points of contention and consider the time of tapering. Initially, Fed may reduce the rate of monthly bond-buying which will reduce the level of liquidity in equity market. This may happen only by early 2022 but market may start responding to this in H2CY21.

FIIs selling

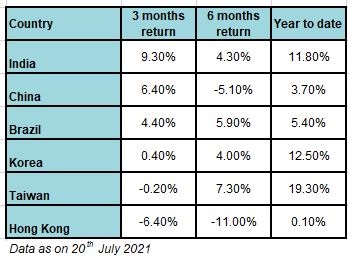

FIIs are in selling mode since April 2021. They have net sold Rs 30,000 crore of Indian equity during the last four months, as on 20th July. This is because of the overall policy of FIIs to cut exposure in emerging markets; in that India seems to be the least impacted due to low degree of selling and high domestic inflows.

Please note that the best Asian performers like Taiwan and Korea have started consolidating. While India has the benefit of high retail investor participation and IPOs inflows.

Retail inflows should sustain, else the Indian market may lose its strength

Today domestic retail and mutual funds inflows are so strong that it is absorbing the selling by FIIs. It has been limiting the level of price correction. Originally, retail investors were drawn to the markets in April 2020 by attractive low prices, global rally and rise in risk appetite, given the lack of change in their personal income, fall in cost of leverage and increase in free time. The benefit to the Indian market from increasing participation of retail investors will help in the long-term. But their liquidity is supported by the sustenance of generating profits, which ultimately depends on the ability of retail investors to maintain profits in trades. A slowdown in global easy money policy will be the key watch list for the broad market. Recently noticed high interest in IPO and HNI funding can impact the inflows into secondary market and level of leverage.

We suggest partial profit booking…

The broad market may maintain its lucrativeness due to low interest rate and progressive policies. Also, the pockets which are cheaper than the market and likely to benefit from unlocking will maintain its buoyancy. But it is sensible to take home some of the money, made from the strong one side rally during the pandemic. It may be a period of consolidation than in terms of percentages fall as the easy money policy may not vanish in all.

Book into these stocks and sectors…

Importantly, while doing that we should be taking partial profits on a stock-to-sector-specific basis as the possibility of a big correction is low. Stocks and sectors, especially domestic focused and defensives like technology, chemical, consumption, sugar, and pharma will do better than market and outperform. Book profits from sectors and stocks, which have benefited a lot during and from pandemic, FIIs inflows and high P/Es. Do not sell stocks and sectors which have a strong outlook either by change in business outlook, industry policy and restructuring in industry or balance sheet, add more of them during correction.

Develop a balanced portfolio…

We have been suggesting for a while to maintain a balanced portfolio, buy into value stocks, defensives, exports, and beneficiaries of unlocking. Volatility expected to be generated by global markets vary. Profit booking is advised based on stock to sector-specific as per their respective valuations and outlook. Overall, we have been advising you to reduce the level of equity in your portfolio and increase the portion of debt and gold by cutting mid and small caps. This is in anticipation of a short to medium-term correction.

Limited upside in the short-term…

We have a target of 16,165 for Nifty 50 in Dec 2021, showcasing an upside of ~3.5% from the current level of 15,632 dated 20th July, with a margin-of-error of +/- 5%. This target is based on premium valuation of 20x P/E, assuming superior valuation to stay as easy money policy will be maintained in 2021 & 2022.

Conclusion

That Indian market has gained well YTD, in the context of a friendly global market, domestic reforms and high domestic liquidity. Lately, the Indian market is caught in action of benefiting from unlocking and IPOs. Unlocking will add more traction in the coming quarters in real economy. During which it is possible that market may not follow a similar trend. This will be because of volatility in global market due to high inflation and change in easy money policy forecasted in early 2022. And secondly, some of the future gains are already factored in the pricing of premium valuations. Some pockets like IT, Tech-based, Pharma, Chemicals, Fertilizers and Consumer sectors are expected to maintain their buoyancy along with value buying and benefits from unlocking.