It is that time of the year when most people start planning on how to save tax. Both Equity Linked Savings Scheme (ELSS) and Public Provident Fund (PPF) offer Tax Exemption under Section 80C of Income Tax Act, 1961. Here are the benefits and features of both ELSS and PPF.

Key features of ELSS:

• Investments into ELSS are eligible for Tax Exemption under Section 80C of Income Tax Act, 1961

• ELSS are diversified Mutual Funds, that invests majority of the corpus into Equities Market / stocks

• Investments into ELSS funds are subject to market and other risks associated with Equity Investments

• Investment can be made through Systematic Investment Plans, by investing every month or as a Lump sum / Bulk, depending on the investor’s choice

• Investments have a 3 Year Lock-in period (in the case of SIPs, 3 year lock-in period is applicable to each installment) This is the lowest among other 80C options

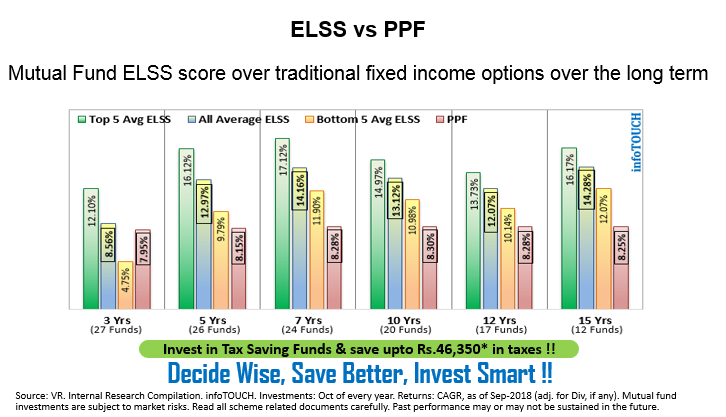

• Track record shows that ELSS funds have delivered higher returns compared to other 80C qualifying instruments in medium to longer term (as of Sep-2018)

To view the latest ELSS schemes recommended by Geojit please refer Geojit Insights

Key Features of PPF

- Public Provident Fund (PPF) scheme is a popular long term investment option backed by Government of India which offers safety with attractive interest rate and returns that are fully exempted from Tax.

- Attractive interest rate of 8.0% that is fully exempted from Income Tax under section 80 C

Individuals in their own name as well as on behalf of a minor can open the account. As per extant instructions, opening of PPF accounts in the name of Hindu Undivided Family is not permitted. - Good long term investments of 15 years Thereafter, on application by the subscriber, it can be extended for 1 or more blocks of 5 years each.

- Deposit Amount as low as Rs.500 and maximum Rs.1,50,000 in one financial year

- Deposits can be done maximum in 12 transactions

- Loan can be availed between 3rd to 6th financial year

- Partial withdrawal facility can be availed from 7th financial year onward

- Account can be extended in a block period of 5 years after maturity

- In case of monthly contributions, it is advisable to make it before 5th of a month, in order to avail the full interest benefit and in the case of Lumpsum, before 5th April of a Financial Year. PF interest is calculated on the Minimum balance between 5th till end of the month. Though interest is credited on 31st March of a year, it is calculated on a monthly basis.

- PPF Interest rates are linked to the Government bonds Yield of similar maturities, with a mark-up (certain additional %) to the average government bond yields in the previous quarter. PPF Interest rate remained 7.6% between Jan-2018 till Sep-2018. Prevailing Interest rate is 8% (1st October onward till further notice).

Pl mention some ELSS Scheme with SIP wherein for investing .

To view the latest ELSS schemes recommended by Geojit please refer Geojit Insights

Vital information to the investors, especially youngsters.

Good information.