The economic slowdown in India is worse than anticipated. The 5 percent GDP growth print for Q1 FY 20 has come sharply lower than most estimates. Going by the poor trends in manufacturing, particularly in automobiles, Q2 also is likely to be poor. But there will be clear pick up in growth in Q3 and Q4 and we are likely to end FY 20 with a growth rate of around 6 percent, which will be one of the best growth rates among large economies.

The economic slowdown in India is worse than anticipated. The 5 percent GDP growth print for Q1 FY 20 has come sharply lower than most estimates. Going by the poor trends in manufacturing, particularly in automobiles, Q2 also is likely to be poor. But there will be clear pick up in growth in Q3 and Q4 and we are likely to end FY 20 with a growth rate of around 6 percent, which will be one of the best growth rates among large economies.

Global economy is decelerating

Global economy, which accelerated in 2017 and 2018, has been decelerating this year and is likely to end the year with global output growing at around 3.2 percent. Even though US growth and employment data are impressive, the economy is decelerating after the longest expansion in history. US growth is likely to dip below 2 percent soon. Euro Zone is clearly weakening and is likely to slip into recession if the UK – EU talks end in a no-deal Brexit. Germany, the powerhouse of the EU, is on the verge of recession and the other large economies Italy and France are also not in good shape. China’s growth rate has almost halved from the peak of 12 percent and is likely to weaken further. Japan is struggling. The US-China trade war has impacted global trade. Consequently, poor exports have impacted economic growth in most countries. In brief, the global economic scenario is far from favorable; a global recession in 2020 cannot be ruled out.

Synchronized global monetary stimulus

The Fed again cut interest rates on 18th September without signaling an accommodative policy. Earlier the ECB had announced QE 2.0. For the first time in 10 years, 20 central banks have cut rates this year, which is indicative of the serious slowdown in the global economy. This monetary accommodation can succeed in pre-empting a global recession in 2020, but a lot depends on how the US-China trade skirmishes evolve. According to the Fed, trade policy uncertainty accounted for 0.8 percent dip in global GDP in the first half of this year. Therefore, trade policy and global trade are crucial in determining how the global economy responds.

India will rebound in the second half

The government has responded to the challenging environment with appropriate stimulus. The big bang cut in corporate tax rates has come as the icing on the cake of several stimulus packages announced earlier. The monetary stimulus provided by the RBI through four rate cuts will start yielding results soon. Since inflation is very low, there is room for further rate cuts by the RBI. Another 25 bp rate cut is likely in the October policy. Monetary policy acts with a lag of two to three quarters in India and therefore, the beneficial impact of the monetary easing can be felt in Q3 and Q4. Further more, the bountiful monsoon this year will raise agriculture growth rate, mitigate the rural distress and stimulate the aggregate demand in the economy. Also the positive impact of the various stimulus measures announced by the government will be visible by the last two quarters of the financial year. The favorable base effect alone will raise growth rates in Q3 and Q4.

History will repeat

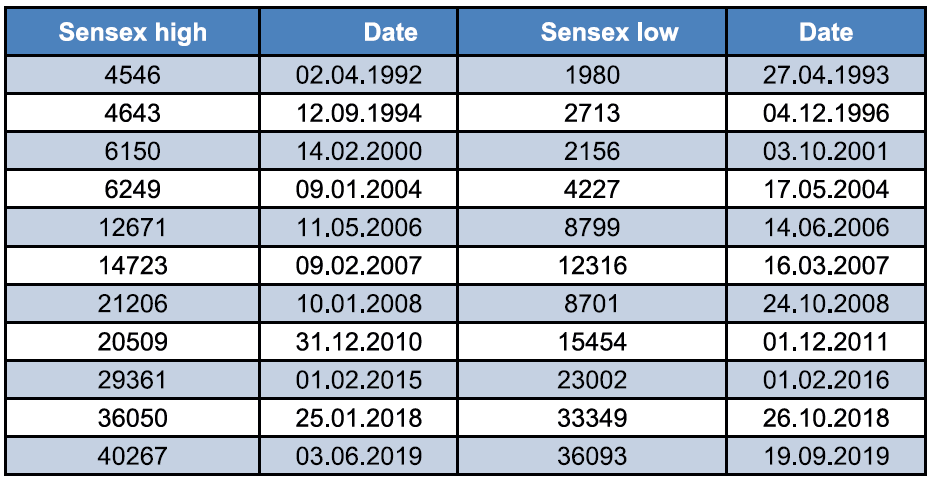

Stock market presents the classic example of history repeating itself. History of stock markets tells us that booms are followed by crashes, and crashes lead to smart rebounds, taking the markets to levels higher than the previous highs. Let’s take a look at the booms, crashes and recoveries in the Indian stock market since the early nineties.

It is evident from the table that booms have been followed by crashes and crashes have led to sharp recoveries, which took the markets to higher and higher levels. The present downtrend will be no different. But it is important to appreciate the fact that the peaks and troughs of the market will be known only in retrospect. Therefore, the only strategy, and the best one too, for the investor is to invest systematically unmindful of the short-term ups and downs in the market. Investors should remember that stocks are available cheap during periods of pessimism. Since we are in a pessimistic environment, there are very good shopping opportunities for the discerning investor. Fortune favors the brave!