An important lesson of the last 100 years of financial history is that stocks outperform all other asset classes by a wide margin, in the long run. However, in the short run, returns can be very volatile. Very few people have the time and expertise to invest in the stock market directly. Therefore, a very good option for investors is to invest in stocks through the mutual fund route.

An important lesson of the last 100 years of financial history is that stocks outperform all other asset classes by a wide margin, in the long run. However, in the short run, returns can be very volatile. Very few people have the time and expertise to invest in the stock market directly. Therefore, a very good option for investors is to invest in stocks through the mutual fund route.

SIP (Systematic Investment Plan) is an ideal form of investment where the investors invest at regular intervals, say, weekly, monthly or quarterly. Monthly SIP is an ideal strategy. Since the investment is done systematically the investor gets the benefit of Rupee Cost Averaging. This means that since investment is done regularly, the investor gets more units when the prices are down, thereby reducing the average cost. Therefore, market corrections are good and desirable from long-term investors’ perspective.

As consumers we are happy when prices of goods decline and unhappy when prices rise. Going by this principle of consumer rationality, investors should be happy when stock prices decline and concerned when stock prices rise too much too fast. But this is not often the case. When market corrections are sharp and swift, many investors panic and try to sell and get out of the market. Conversely, when prices rise sharply, moving even into bubble territory, they continue to buy, hoping irrationally that prices will continue to move up. The‘manic-depressive’ nature of the market causes irrational investor behaviour.

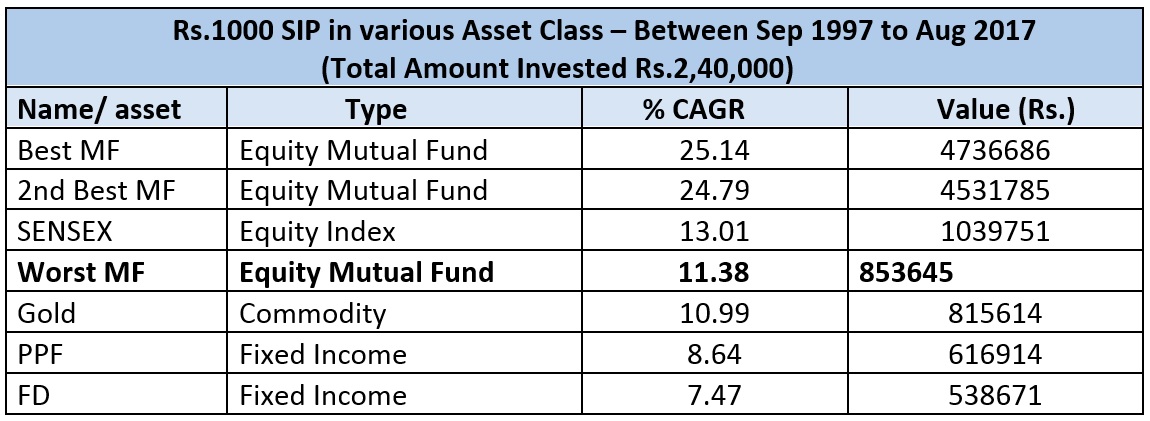

History tells us that big money is made when investors stay invested for a sufficiently long period of time. Particularly, it is important to stay the course during a bear phase. This results in sharp upturn in the value of investment when the cycle inevitably turns. Take a look at the returns from systematic investment in various asset classes during the last 20 years.

The difference in returns from traditional asset classes like bank FDs, gold and PPF on the one side and the best performing mutual fund on the other side, are huge. Even the worst performing mutual fund has performed much better than traditional asset classes.

To reap the benefits of this superior returns, it is important to remain invested. The sharp correction that we are witnessing presently in mid and small-caps is a long overdue correction. Investors should not negatively react to the correction and exit. They should keep their cool and stay the course. Patient investors will reap the benefits of lower current prices. Remember the saying: “To be a successful investor one needs only a average person’s intelligence, but ten person’s patience.”

To start investing download Geojit’s Mutual Fund App Funds Genie. The desktop version can be accessed from www.fundsgenie.in

Posted: July 2018

GOOD SUGGEST

Good suggisition

i am investing monthly 5000 five thousand sip please advice

SIP is always good. Continue with SIP. Don’t panic and stop SIPs when market falls.

Wonderful article. Strengthens my faith in SIP. I am doing 2000 rs monthly SIP in Geojit.

i had retired from service on 31/05/2018.I had arranged to stop the SIPs in July or August SINCE MY REGULAR INCOME OF SALARY STOPPED.A LUMPSUM AMOUNT RECEIVED DUE TO RETIREMENT HAS TO BE DEPOSITED IN bank to fetch monthly income.IS MY DECISION RIGHT

If you can’t continue your SIP since your monthly income has stopped, it is ok. But if you are a tax payer you can think of an SIP in tax savings scheme (ELSS). Bank deposits are safe for fixed income after retirement. If you are a senior citizen you can invest in Senior Citizens Savings Scheme (SCSS) which gives 8.4 % return now (available in Post Offices & select banks). It is also eligible for exemption U/S 80C.