By Manu Jacob, Commodity Research Analyst

By Manu Jacob, Commodity Research Analyst

Whenever there is tension in the Middle East, crude oil comes in crosshair. The recent attack in Saudi Arabia, the world’s biggest crude oil exporter, has disrupted more than half of its daily output. Consequently, the crude oil prices spiked in major global platforms, rallying to monthly highs. But the question is: how long such mishaps could influence the market? For obvious reasons, its impact is for the short term. But in the long run, prices would follow the factors that exist for a prolonged period.

In November of 2016, Organization of Petroleum Exporting Countries (OPEC), a group consisting of the major crude oil producing nations, decided to limit their production in an effort to lift the prices from multi-year lows. The oil cartel OPEC and their major allies including Russia entered into strategic supply cut since January 2017 to support the oil prices. Crude oil prices have been rising since then. Interestingly, some external factors contributed to price surge including outages in Libya and Nigeria, political crisis and US sanctions in Venezuela, geopolitical tensions surrounding Middle East and US sanctions over Iran’s crude oil exports. However, over the past two and a half years, supply glut still remained a key issue that restricted the prices from settling on a higher trajectory. Whereas during the later period, cooling demand took toll and added downward pressure on prices.

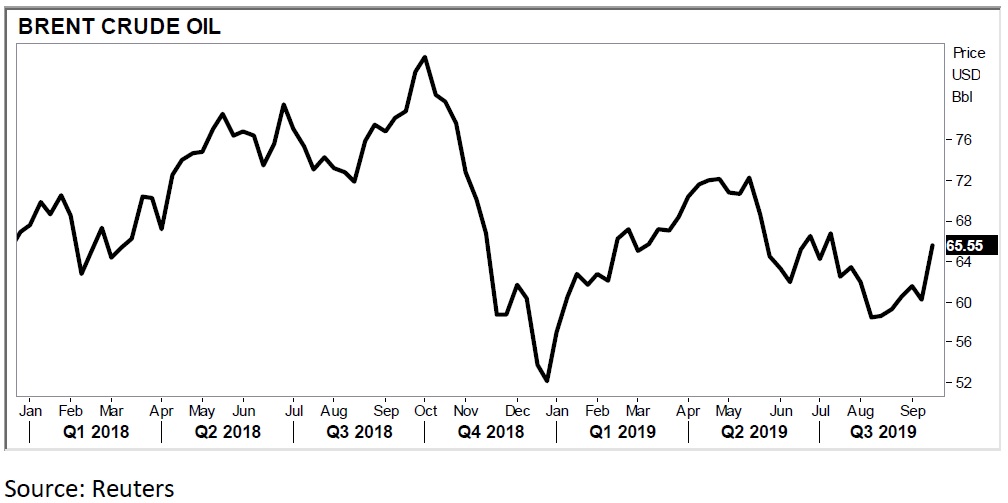

Brent crude oil, a blend that is extracted from North Sea and traded in Inter Continental Exchange (ICE) platform, was trading at a near four year high of $86.63 per barrel, it then dived to $50.26 per barrel in the third quarter of 2018. The prices were knocked down by surging supplies and slowing demand to witness the worst monthly fall in two years in October of 2018. Similarly, in the first half of 2019, crude oil prices witnessed an upswing initially and the Brent crude reached as high as $75.60 per barrel and soon slipped to the vicinity of $60 per barrel.

Factors hindering the prices

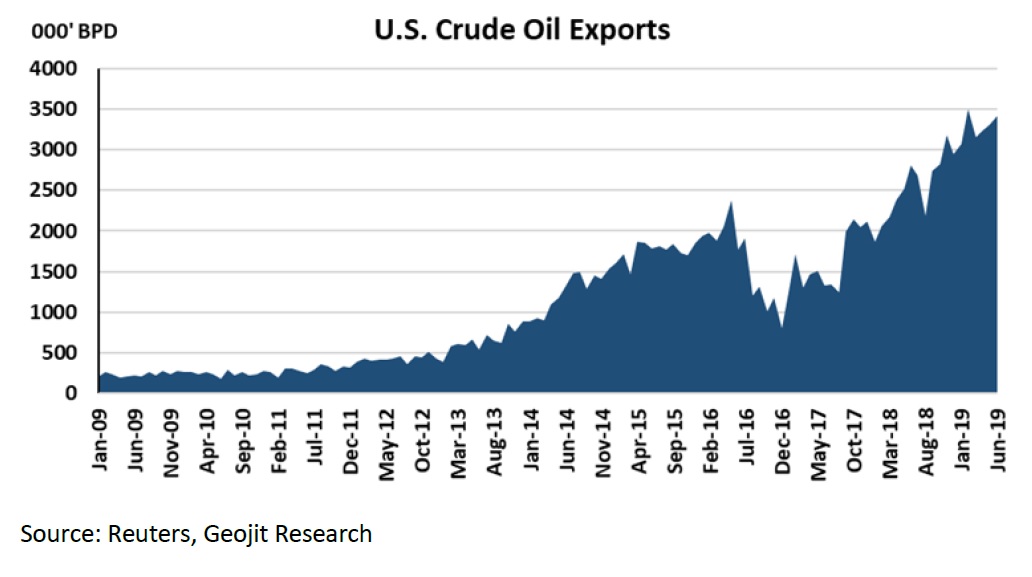

Increase in US production has been counterweighing the efforts of OPEC-led supply cuts from its very beginning. As per Energy Information Administration (EIA), the US crude oil production increased by 17% in 2018, producing 10.96 million barrels per day. In 2018, the US became the world’s largest crude oil producer surpassing Saudi Arabia. Being the major crude oil consumer US consumes more than three fourth of its production and its exports are equivalent to only half of Saudi’s oil exports.

As new rounds of tariffs have been imposed since September, the trade relation between US and China have been worsening as days pass. Regardless of the fact that both countries relaxed some of their protracted tariff rows there is a growing speculation among the market watchers that President Donald Trump would let the trade dispute linger until the next election. Even after keeping aside all these speculations, the statistics would not let the market remain so calm. In the second quarter of 2019, the Chinese economy posted 6.2% growth year on year, lowest in more than two and a half decades, after marking a 6.4% growth in the first quarter.

The International Monetary Fund has downgraded the global growth forecast for 2019 to 3.2% in July from a forecast of 3.3 % given in April. For 2020, the global growth forecast was downgraded by 0.1% points to 3.5%.

OPEC-led supply cuts

Since March 2019, the OPEC and non-OPEC complied more than 100% in the agreed supply cuts, whereas the compliance was below 100% in January and February of 2019. Saudi Arabia and Russia, the two oil giants who are involved in the pact, had to give up some of their market share against US during this period. Besides, Russia had repeatedly raised their concern over slowdown in its economic growth from cutting down crude oil production. Despite all these concerns, the OPEC nations and their allies agreed to extend the supply cuts until March 2020.

Several times during this period, certain OPEC members were granted exemption from supply cuts. OPEC’s ministerial panel decided to give exemptions to Iran, Venezuela and Libya in December 2018 for the remaining period to alleviate their burden from external factors. Iran was under the shadow of US sanctions over the nuclear deal and Venezuela was under US sanction over democratic issues. Libyan oil production was repeatedly confronting chronic production outages due to political divisions and civil war and the oil exports were often suspended.

Supply and Demand

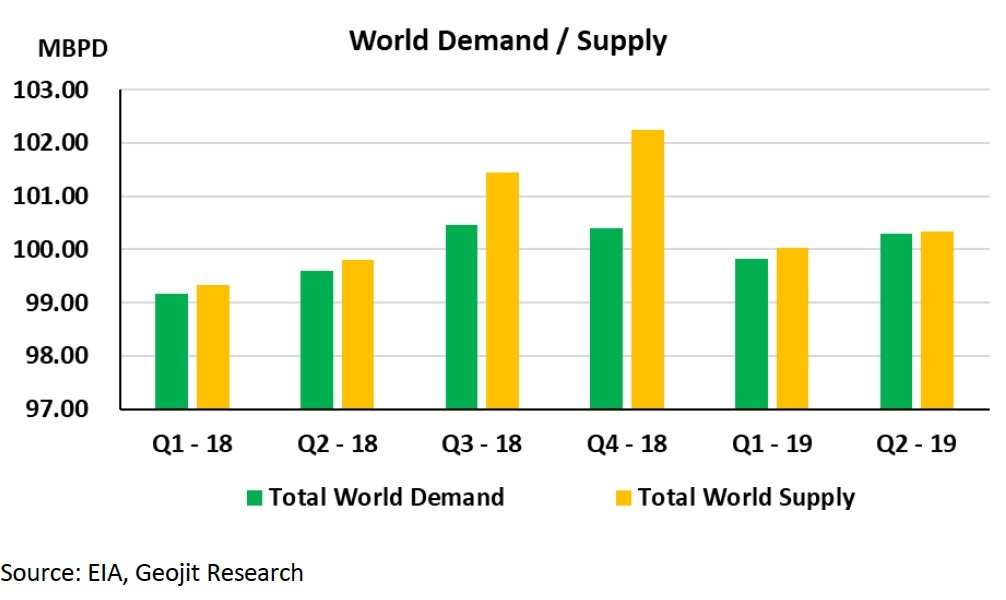

The global crude oil production in 2018 averaged 100.71 barrels per day while the total global demand averaged 99.91 barrels per day in the same period. In the first half of 2019, total crude oil production averaged 100.17 barrels per day while the demand was 100.06 barrels per day. Although the joint efforts by oil cartels to restrict production have manged to shrink the volume of crude oil available in the market, the market remained sufficiently supplied in the recent period.

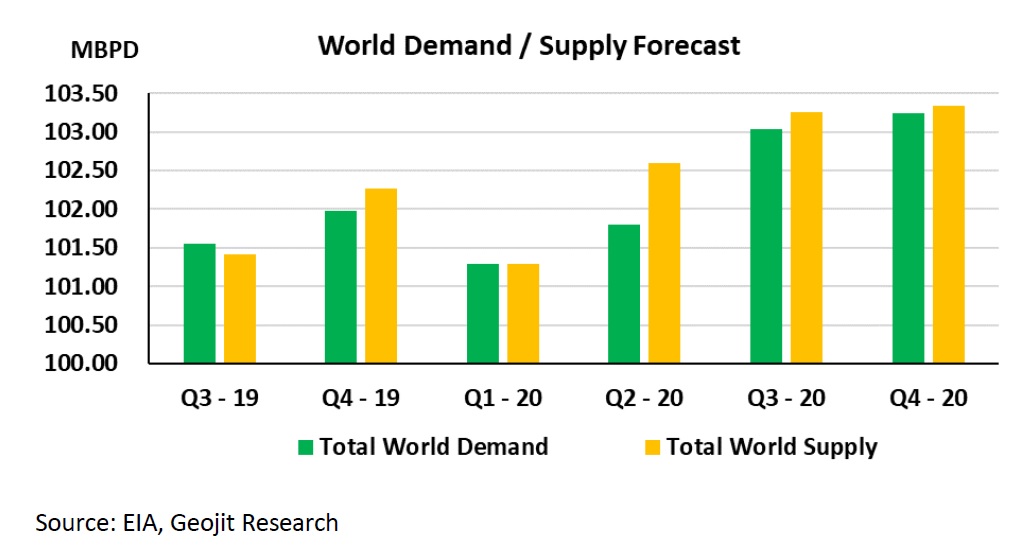

OPEC and the key market watcher International Energy Agency (IEA) have lowered the crude oil demand outlook for 2020. The crude oil market witnessed a sluggish growth in demand during the first half of 2019. For the rest of the year and in 2020, crude oil production is expected to be mostly in surplus. Overlooking this scenario, the leaders have urged the members for a deeper cut from their already agreed production levels.

Despite all the efforts from crude oil producers, the prices of crude oil remained highly unstable in the long run. Apart from OPEC-led strategic supply cuts, unplanned supply disruptions and outages have confused the producers and uncertainty of restoring the output has a substantial influence on crude oil prices. Not to mention most of the crude oil producers who subdued production abiding the supply cut agreement are capable of pumping more oil in the market. The economically stable nation like Russia could increase supplies once the country is relieved from the pact. Increasing supplies from United Sates is expected to offset the supply shortages arising from OPEC-led supply cuts. On the demand side, the slowing growth in major crude oil consumers including China and India may subdue the demand in the upcoming year. However, the present volatility from unprecedented attack on the oil facilities in Saudi will have impact on the prices for a short period. Once the issues settle down, attention will focus on the factors that influence prices in the long run. Even if Brent prices settle above $80 per barrel, gravitation from the prevailing supply demand factors may not let prices hover higher for a long period.