By Sreenish S R

By Sreenish S R

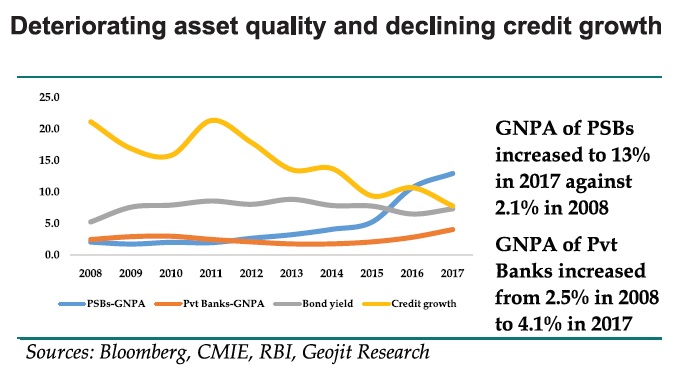

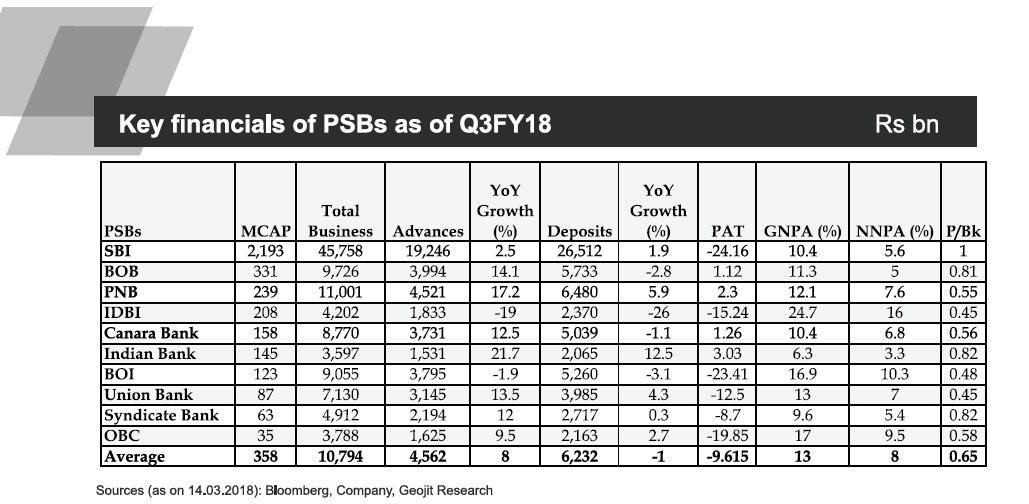

Indian banking sector withstood very strongly when the world economy faced the financial crisis of 2008. But now the non-performing loans have increased to 9.73% in 2017 against 2.21% in 2009, which indicates the deteriorating nature of asset quality in India. The story of Indian banking industry today is different from those days. The escalating load of NPAs, rising bond yields and decline in credit growth rate are the major issues faced by Public Sector Banks (PSBs). 21 PSBs continued to recorded net losses of Rs18,097 crore whereas 17 Private sector banks reported a net profit of Rs.11195 crore with a growth rate of 12% in Q3FY18. At this juncture, recently reported Punjab National Bank and Rotomac Global frauds led incidents magnified the impact on Indian PSBs.

Unfolding NPAs

According to RBI the percentage of stressed advances (NPAs + Restructured loans + Written off assets) of Indian banks on total advances for Public sector banks is at 15.6, Private sector banks at 4.6, foreign banks at 4.5 and all banks together at 12.1 as on 31st March 2017. Bad loans of PSBs stood at Rs 7.34 lakh crore by the end of second quarter this fiscal, bulk of which came from corporate defaulters. On the other hand, private sector banks’ NPAs were considerably low at Rs 1.03 lakh crore by September 30, 2017. Leading corporate houses and companies accounted for approximately 77 per cent of the total gross NPAs from domestic operations for the banks. The inefficiencies of PSBs in managing risks are visible and which has been reflecting in their results and NPA numbers.

Recapitalization may not fetch benefit

Before the budget presentation, the Government announced a recapitalization plan of Rs.88,139 crore in 20 Public sector banks (PSBs) by 31st March 2018. This is a part of the mega Rs2.11lakh crore bank recapitalization plan announced by the government in October last year. It is spread over two financial years 2017-18 and 2018-19. The recapitalization of PSBs was expected to improve their capital ratios, but huge losses during the third quarter of FY18 and rising bond yields are likely to partially negate the recapitalization program of the government. The PSBs are typically the largest investors in sovereign securities and they are expected to lose more than Rs20,000 crore in the January-March quarter, due to a continued spike in bond yields and as they held more bonds than are required by the regulator.Source(http://www.livemint.com/Industry/Uqw5ubTVqJhVMQaJq4DkXI/PSU-banks-facing-over-Rs20000-crore-of-losses-on-bonds-in-J.html)

Recent fraud cases

The fraud reported in the Mumbai branch of Punjab National Bank is valued around a massive Rs.12,700 corers. The estimated value of this fraud is equivalent to ~30% of its net worth as on FY17. PNB’s officials issued a series of fraudulent Letter of Undertaking (LoUs) to overseas branches of Indian banks in favour of three companies run by Nirav Modi namely Solar Exports, Steller Diamonds and Diamond R Us for availing buyers’ credit.

The CBI has initiated enquiry against Kanpur-based businessman Vikram Kothari, his wife and son in connection with the suspected fraud of Rs 3,695 crore of loan funds advanced by a consortium of seven banks to his company Rotomac Global Pvt Ltd. Kothari, his wife Sadhana, and son Rahul, all directors in Rotomac Global Pvt. Ltd, have allegedly diverted the bank loans towards purposes other than they were meant for.

The Enforcement Directorate on 9th March 2018 filed a charge sheet against former Andhra Bank director Anup Prakash Garg in connection with Rs 5,000 crore bank fraud involving the Vadodara-based Sterling Biotech Ltd of the Sandesara group of companies. The ED claimed that the Sandesaras had paid over Rs.1.52 crore to Garg as quid pro quo for facilitating bank credit and other transactions.

Declining credit growth

The credit growth was at 21% in 2008 and it has been declining continuously till 2017 to the level of 7.8% except an uptrend showed in 2011 at 21.4%.The year-on-year growth in total credit improved to 10.7 per cent till the middle of February 2018 from 4.4 per cent a year ago (February 2017), according to Reserve Bank of India data. After the reported fraud cases, the loan disbursals to corporates fell, especially from public sector lenders because they became defensive in loan disbursement. The management of public sector banks, which account for 70 per cent of banking in India, is shifting their focus to retail from big-ticket business. Thus, the business loan disbursals has been pushed down the priority order. The third quarter of FY18 began with hope of better industry credit growth in line with recovery in economic activity. But, the fraud at PNB spoiled the pace, which may reduce credit disbursals for next few quarters.

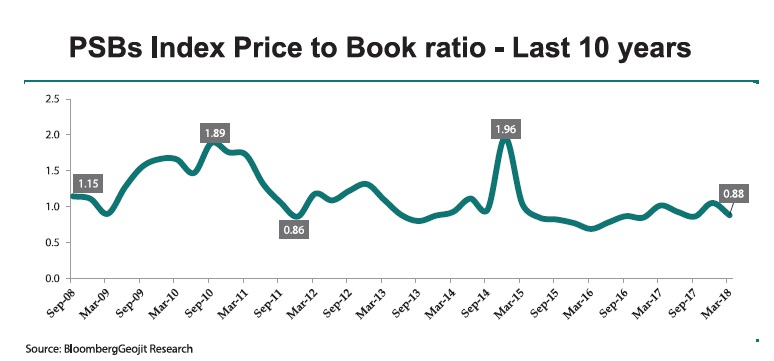

The fraudulent activities in the banking sector may be a reason for the regulator to come with strict NPA and recovery norms. We expect the PSBs to shift their focus from corporate lending to retail to reduce the risk. The shift in concentration of loan disbursement from corporate lending to retail lending will affect the credit growth and the revenue of the banks. Rising cost of deposits, and declining margins are the other headwinds in the banking sector. Most of the public sector banks namely BOB, Union bank, SBI, PNB, BOI, Canara Bankand IDBI are trading below their 10 year average Price to Book ratio. Despite the fact that bank shares are available at lower valuations, the outlook remains negative for the PSBs on account of these events.