By Manu Jacob

For commodities, like other financial assets, there are several factors to look for in the year of 2021. For the past few years, commodities witnessed considerably large volatility. Most of the turbulence in the commodities is related to the health of industrial sector. The trade tension and pandemic crisis impacted the performance of industries in major economies in past few years. Worsening trade relation between United States and China have adversely affected the sentiments while the outbreak of the pandemic has impacted the markets hugely.

The optimism over the Covid-19 vaccination trials offered commodity market a big relief. Apart from that, the prospects of a new presidential term in US after confirmation of Joe Biden’s presidency, conveyed to investors a possibility for better trade relations with China. Although there is an element of uncertainty left, the markets’ reaction to these events shows that the investors are broadly optimistic.

Apparently, the economic numbers from key economies also affirm the recovery expectations of investors. Although certain indicators are yet to show a desirable result, including the employment data from US and inflation in US and China which are still below expectations. There are some economic numbers from both the top economies underscoring a recovery from recent dip. The US GDP in the third quarter has expanded at a pace of 33.1 percent according to the second estimate. The industrial production in China grew for the seventh consecutive month after its recovery from the pandemic-led crisis. However, there are still challenges as some economies are in partial lockdowns slowing the industrial activities. Some European economies are facing a second wave of the pandemic and the subsequent lockdowns have depressed the European industrial sector.

The stimulus from the world’s leading central banks have spurred the business activities during the worst period of pandemic. The US Fed maintained 0-0.25% interest rates for past eight months. The Fed also signaled a lower rate until 2023. However, it would require a series of financial aids through monetary and fiscal measures from top economies until the successful containment of the virus.

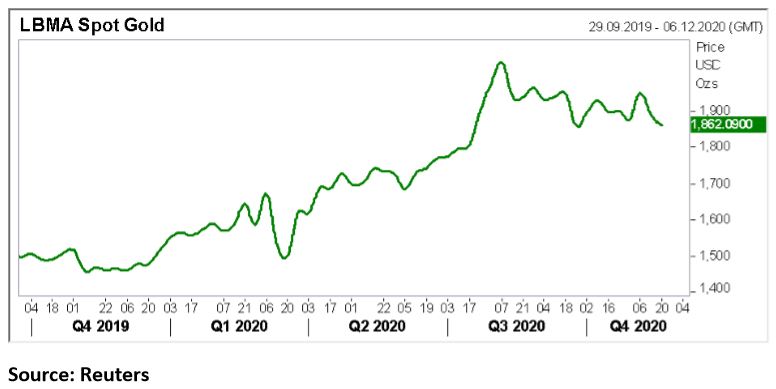

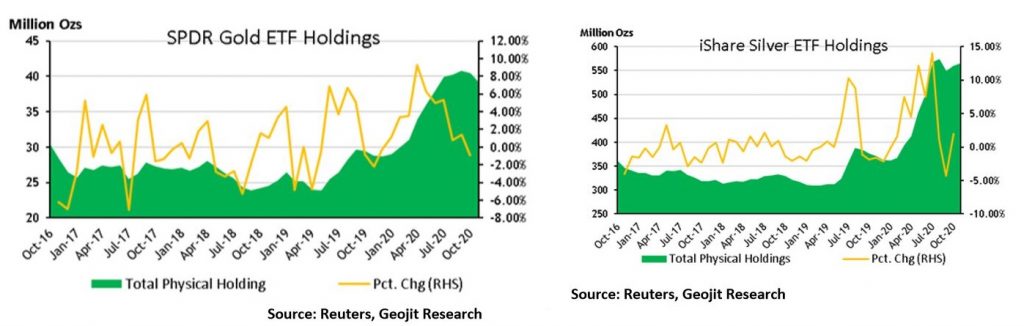

Gold was the top performing financial asset during the pandemic. Since the early stages of pandemic, investment in gold and various forms of gold derivatives have become attractive due to its safe haven status. Steady growth in ETF inflows helped precious metals during the second half of 2020. In the London Bullion Market Association (LBMA) spot platform, gold price hit an all-time high of USD2072 per troy ounce. Similar rally that was witnessed earlier in the year 2011, when gold spot hit USD1920 per troy ounce. On the other hand, silver caught the momentum only by the second half of the year. Unlike gold, silver prices are still far below its all-time high. Silver in LBMA spot platform hit a high of USD29.83 per troy ounce. Whereas in 2011, silver hit USD 49.51 per troy ounce.

Industrial metals managed to recover from the losses occurred during the pandemic. Stimulus packages from key economies helped to offset fears in industrial sector. China’s economy recovered in second and third quarter of 2020, after witnessing the worst quarterly decline in first quarter by 6.8 percent. The US economy also showed a strong recovery in the third quarter, as seen in the second estimate, after sharp decline in first and second quarter.

Along with the rebound in industrial activities, supply shortages helped the rally in copper prices. In London Metal Exchange, copper prices rallied to above two year highs. Robust growth in steel output helped the steel component and nickel and zinc prices also rose to yearly highs. Lead prices revisited the January levels. Diminishing aluminium output helped LME aluminium to two year high.

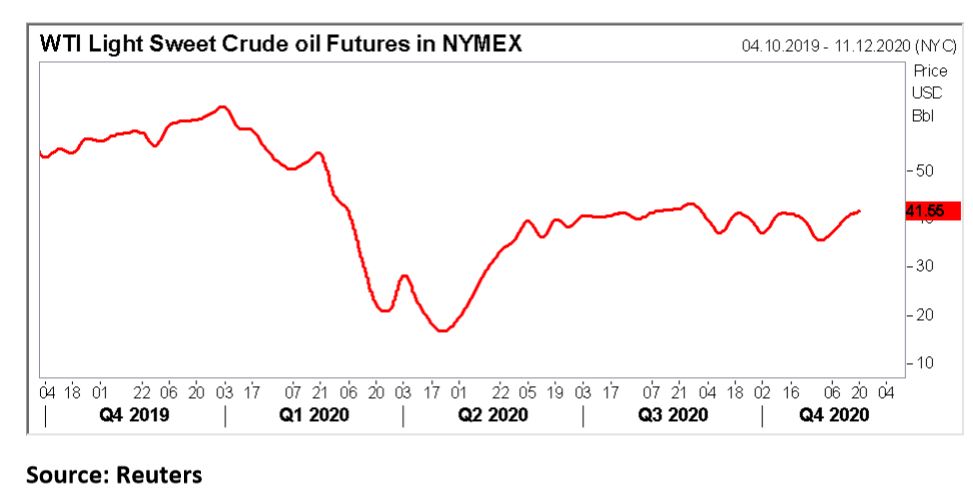

Crude oil prices returned to an ideal trading zone after recovering from historic fall. Restrictions to curb pandemic outspread have subdued the demand. The consolidated efforts of OPEC and their key allies including Russia have managed to keep the prices relatively high amid continuing impact of pandemic. Resumption of production in Libya amid lackluster demand outlook for 2021 is expected to pressure the cartel to adopt a higher compliance in crude oil output cuts and extension of the pact.

2021 is expected to offer some relief to global economy. The brewing optimism after Joe Biden’s victory is that the new presidential term in US may bring an end to more than two-year-old trade war between US and China. As far as industries are concerned, revitalizing trade relation between the top two economies would boost business activities in the long run. But, on the other hand, the inability to contain the pandemic would continue to keep labour market’s health fragile. The employment in top economies remains well below pre-pandemic levels. The rebound in private jobs in US is less compared to the drop in first quarter of this year. It will be essential that the nations and central banks continue to support the economy with fiscal and monetary policy aids.

Precious metals may find their trajectory rather steady through next year. Occasional downtrends in a rush for liquidation still remains as a possibility. Surge in ETF inflows may offer the safe haven assets a steady path. Prospects of industrial metals could be brighter with declining trade tensions between US and China, provided sufficient stimulus aids to offset the pandemic uncertainties are available. Lackluster demand for fuel is expected to weigh on the crude oil prices. Deepening of supply cut by OPEC+ alliance could offer some support to the prices. It would be challenging for oil producers to maintain prices at their desirable levels if the pandemic is not contained. This may have a prolonged impact through the upcoming year. Therefore, it can be presumed that the oil producing nations would consent to extending production cuts in the coming year.