By Manu Jacob

Financial markets were unusually turbulent so far in 2020, and commodity markets are no exception. Business confidence has been adversely hit by COVID-19 pandemic and the collateral damage caused by the worldwide lockdown of economic and business activities. Most commodities tested multi-year low levels on worries over economic contraction during this period.

Resuming business activities after a period of lockdown offered some relief to the commodity segment. Stimulus measures from central banks of key economies also boosted sentiments. The key indices pared nearly half of the losses that occurred during the initial COVID-19 period.

The International Monetary Fund (IMF) has downwardly revised the global growth projection for the year 2020 to -4.9%, that is, 1.9 % below the previous estimate given in April 2020. The IMF growth projection for the United States in 2020 is -8.0%. Among the emerging economies, China’s growth is expected to be 1.0% in 2020.

The US Federal Reserve gave its projection for the second quarter of the year 2020, expecting a deterioration in the US real Gross Domestic Product (GDP). Although the US labor market conditions improved in May, these improvements were modest when compared to the substantial deterioration seen during March and April.

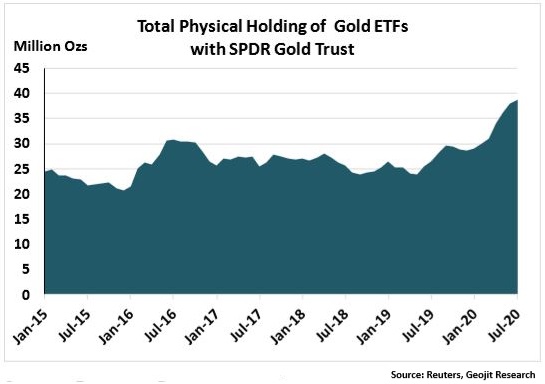

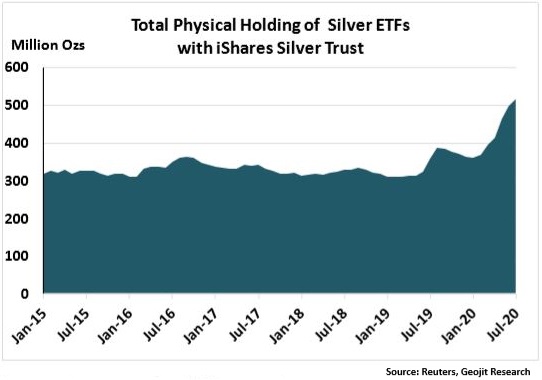

Increased ETF inflows on safe haven appeal boost Gold and Silver

The demand for safe-haven assets took precious metals to new heights. Lingering uncertainties on economic growth and rising coronavirus infection rates fueled the appetite for safe-haven assets. Global rally for gold-backed Exchange Traded Funds (ETF) in the first five months of 2020 outpaced records for any calendar year. According to the World Gold Council, Gold ETF inflow in the first five months was $33.7 billion, which exceeded the highest level of annual inflow of $24 billion seen in 2016. However, the central bank purchases of gold were relatively moderate during the past two quarters, considering the multi-decade record levels seen in 2018 and 2019.

Gold prices moved to an all-time high near $1943 per ounce London spot platform, gaining around 28 percent so far in 2020. In India, domestic gold prices were breaching its records owing to weak Indian rupee.

Silver prices were not as aggressive as gold in the safe haven segment during the initial period of the pandemic. The prices dipped to more than 10-year lows on diminishing industrial demand for silver in the first quarter. Strong ETF inflows and bargain buying at lower prices lifted the London Spot silver to a near 7-year high in July 2020 gaining around 35.0% year to date.

For the rest of the year, sentiments in gold and silver are expected to be brighter considering the rise in Covid-19 infection rates. Besides, the global growth projections for rest of 2020 and deterioration of economic growth in major economies continue to attract safe haven investments in precious metals.

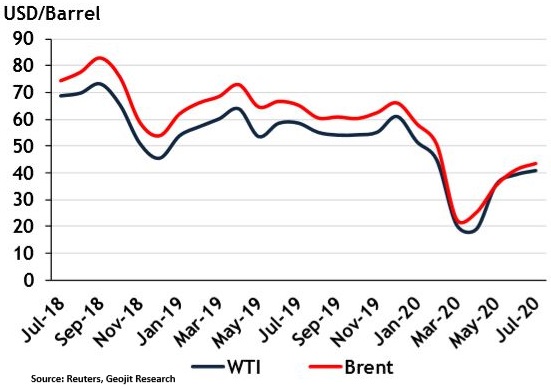

Crude revived on OPEC+ efforts, but decision to ease production cuts acts as dampener

Crude oil was the worst casualty among commodities after the Covid-19 crisis hit the markets. Lower fuel demand in the wake of worldwide lockdowns and subdued refining activities had an effect on the prices, while excess production from crude oil producers following the discord in OPEC+ alliance led to the prices nosediving to historic lows. On 15thApril 2020, Chicago Mercantile Exchange (CME) issued permission that certain contracts in NYMEX can trade or be settled below zero considering the crude oil market environment. The WTI crude oil futures in NYMEX slipped below zero hitting as low as $-37.63 per barrel as sellers were paying buyers to avoid incurring storage cost.

The OPEC+ alliance once again entered into a supply cut agreement and implemented it from 1st May. Subsequently, the prices recovered, trimming nearly half the loss incurred due to the Covid-19 effect by the end of the second quarter. But the looming concern is the decision by the OPEC and key allies including Russia to ease record output cuts from August 2020. In the first half of the year, the WTI light sweet crude oil in NYMEX was down by around 35.69%, whereas North Sea Brent crude traded in ICE was down by 37.65%. In the domestic MCX platform crude oil shed 31.26% in the first half of 2020.

The OPEC estimates the demand for its crude oil to be 23.8 barrels per day (bpd) in 2020. Meanwhile, the Paris-based International Energy Agency (IEA) said the global crude oil demand would be 92.1 million bpd for 2020. Looking forward, the spread of COVID-19 may slow the recovery in crude oil prices. On the other hand, OPEC+ alliance’s commitment to supply cuts would prevent major downside risks.

The NYMEX natural gas witnessed dips to lowest levels in more than two decades. Relatively warmer winter in US and sufficient storage during the withdrawal season dragged the prices lower. Meanwhile, the decline in industrial demand owing to lockdown also added to downward pressure. Natural gas prices declined 16.40 % in the first half of 2020 in NYMEX, while Natural gas futures in MCX fell 11.67%.

The Energy Information Administration (EIA) expects the US demand for natural gas from electric power sector, the largest consuming sector, to rise by 2.9% in 2020 in comparison with 2019 due to new natural gas-fired electric generation capacity and competitive natural gas prices. The return of industrial demand on easing lockdown measures also is expected to support prices for the rest of the year.

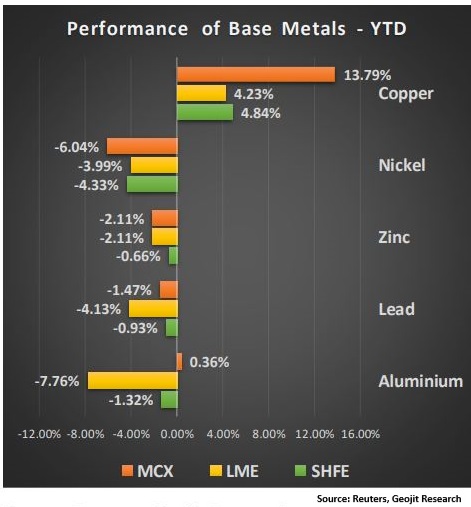

Base Metals still in clouds of pandemic and US-China trade relation

The industrial metals have faced numerous crosswinds during the first half of 2020. Although China’s demand recovered to a certain extent after resuming industrial operations, most metals are still languishing in their recovery path. Renewed tension between US and China, and the prospects of slower economic recovery in major industrial economies continue to keep a lid over the base metals.

Copper was the sole gainer to trade above the pre-COVID-19 levels among the base metals. The supply disruption in Chile due to rising coronavirus cases in the country lifted copper prices to yearly highs in key global platforms. So far in 2020, London Copper hit two year high at $6633 per metric tonne by mid-July gaining around 7.4%. Shanghai copper rose to CNY53470 per metric tonne gaining around 8.7% while COMEX copper tested one year high at $2.98 per lbs gaining around 6.7%. In the same period, MCX copper prices surged 15.92% to a seven year high of Rs.509 per kilogram.

Nickel prices are still more than 3.0% below the 2019 closing rate in both London and Shanghai markets and 4.5% lower in MCX. Although the recovery seems moderate, critical fall in prices may get support from the supply shortage that had cushioned the nickel prices during pandemic led fall in the first quarter.

In LME, lead, zinc and aluminium are yet to pare the losses from the first quarter. But same commodities revived in Shanghai market on hopes of faster recovery and more stimulus measures in China. Zinc and lead were down 3.0% in London market by mid-July, while in Shanghai market prices of both commodities revisited the December 2019 levels. Similarly, London aluminium is 7.0% below the 2019 closing rate, while Shanghai aluminium prices tested two year highs.

For the rest of 2020, base metals may find support from fiscal stimulus package from top economies and lower interest rates. However, clouds of a second wave of pandemic pose a risk to the outlook.