By Antu Eapen Thomas

Bharatmala is a flagship program of the central government to boost infrastructure development and thereby improve the speed of traffic flow. The program is designed to bridge the gaps in the existing highway infrastructure so as to facilitate smooth freight transportation. Over the next five years, the Government has proposed to invest Rs6.92tn towards constructing 83,677kms of roads, i.e., more than 16,000km/year of tenders to be awarded and built every year. This is going to be a major push to the road project. Having said that, after this announcement NHAI has revised highway project award target from 6,500km to 10,000km for FY18 which signifies that more tenders can be expected before Q4FY18.The contractors having good execution capability, excellent pre-qualification and track record and with less leveraged balance sheet could benefit the most. We expect companies like KNR Construction, PNC Infratech, Dilip Buildcon and NCC to bag more orders.

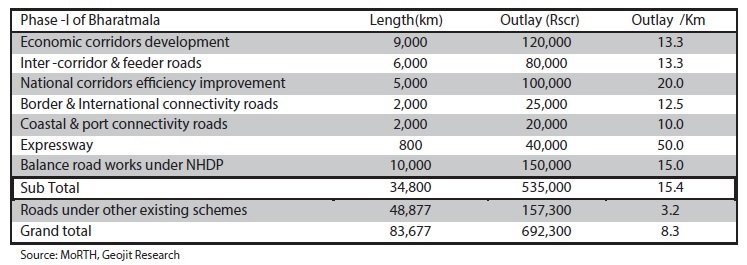

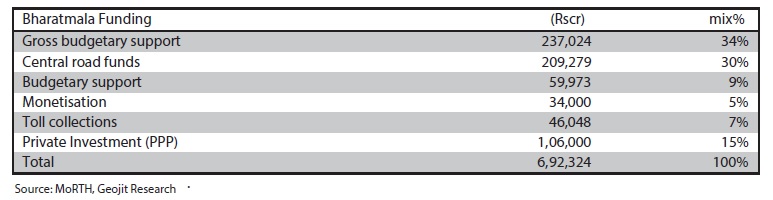

Fund mobilisation and implementation

Bharatmala project will be executed in a phased manner, in Phase 1 around 24,800km to be constructed excluding 10,000km of balance road works under the National Highways Development Program (NHDP) with a total outlay of Rs5,35,000cr. Additionally, Rs1,57,300cr will be spent to complete the other existing projects. A large chunk of funds will be mobilized through budgetary allocations (34%) and central road fund (30%) while rest will be through monetization of projects, toll collection and private investments. The program has identified around 26,200km highway corridor that have heavy freight traffic which is expected to carry 25% of freight in coming years, of which 9,000 kms are being taken up in Phase-I of Bharatmala with an estimated cost of Rs1,20,000cr.

In earlier years i.e, during FY10-13 BOT was the preferred way for the government to award road projects as entire capital will be raised by the developers for construction and developers will collect the toll revenue. While delay in land acquisition and implementation has increased the debt burden which eventually turned the sector into stagnation.

In FY15, the sector witnessed a revival through EPC (engineering, procurement and construction) model as government bears the entire financial burden, procuring clearances etc. which stimulates the pace of construction. In FY16, Hybrid Annuity Model was introduced where developer bears 60% of project cost

As far as Bharatmala project is concerned, the focus is to reduce the gap between project awarding and execution. Given government’s financial position and better budgetary support we expect most of the tender will be awarded through EPC mode. This would provide opportunities for EPC players and trigger huge traction in execution by FY18.

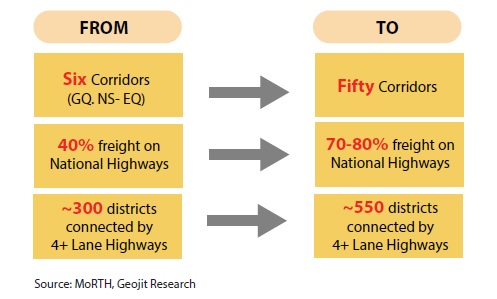

Massive transition in road network

Projects corridors are identified after a scientific study. The development of project include identification of the project stretches based on detailed O-D (Origin-Destination) study, freight flow projections, mapping of shortest route, technology-based automated traffic surveys and satellite mapping of corridors to identify upgradation requirements. Once the scheme is implemented, 70-80% freight would move along the National Highways as compared to current 40%. With all these technological support and enormous government funding, India’s road network is poised to witness a big leap in terms of accessibility.

Mammoth opportunity for road developers

The sector is going to witness a big traction in new order inflow which will be an opportunity for the established players in the segment. The 1st phase tender (34,800km) is planned to be completed by 2018, consequently about 3,000km of projects have to be awarded every month with an average cost 15.4cr/km. Land acquisition process and detailed project reports for the Bharatmala projects are underway. The tender will be announced only after acquiring 90% of the land and government will ensure project allocation under Phase-I is completed in next two years. Consequently, cost and time overrun can reduce significantly.

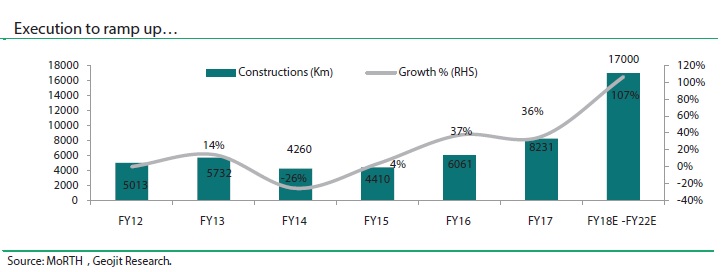

Enlarge in execution

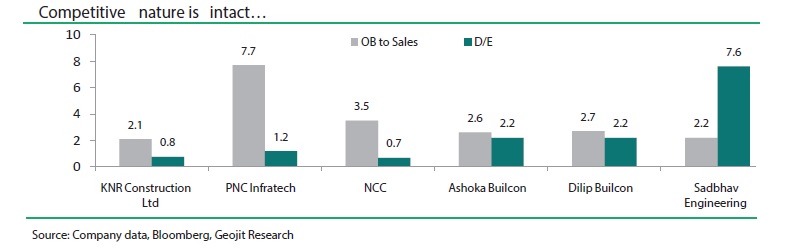

Companies like KNR Construction, PNC Infratech, NCC, Dilip Buildcon are sitting with an average order book to sales of 3.5x (Trailing 12M). In spite of good outlook, the industry was under constraint led by delays in land acquisition affecting the smooth execution of the projects. Given Government’s continued effort on land acquisition by increasing fair value of land and the upcoming project under Bharatmala Pariyojana the sector outlook is likely to significantly improve going forward. We expect the road map will improve in FY 18-22 as government is planning to construct 16,000km/year which equals the actual execution of MORTH for the entire last three years. If the projects are implemented as per the schedule the government will be successful in its ambitious target of building 46km/day against the current 23 km/day.

Execution to ramp up…

Better order book pipeline…

In FY17 the stock price of most good road developers rallied as the success of HAM (Hybrid Annuity Model) and massive order inflow helped companies to build their order book. NHAI had awarded a total of 8,000km but the actual execution was only 4,364km while land acquisition continues to cast cloud over the execution. In the new program the Government is planning to take up the project on a fast track basis and giving more emphasis on land acquisition with the support of respective State governments as per the norms of MoRTH. Additionally, NHAI has designed different solutions to tackle the issue of land acquisition. Parallel roads, ring roads/bypasses and other substitutes are being considered as well. Thus, with the implementation of Bharatmala we expect the order book of the leading road contractors will grow significantly.

We remain positive on KNR Construction with their execution capabilities and less leveraged balance sheet so that they can bid for more projects. PNC Infratech is sitting with an order book to sales of 7.7x TTM revenue which provide visibility. Recently the company has received appointed date for major projects which will energize execution going forward. NCC and Dilip Buildcon too have hand full of orders while NCCs advantage of low debt to equity (consolidated) of 0.7 times will help them in competitive bidding. On the other hand, asset monetization plan of Dilip Buildcon by selling their operational and under construction BOT projects will strengthen its balance sheet and bring them back to the competitive spree. Since most of the Bharatmala projects are lined up through EPC mode, the developers don’t need to raise long-term debt rather than working capital to grow their order book.

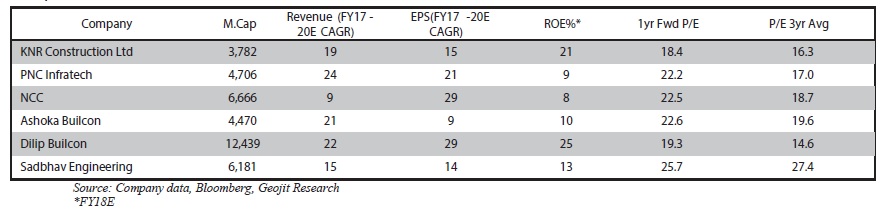

Competitors…