Across the world, Equity and Debt have been the most debated and ubiquitous financial asset classes from an investor’s point of view. They are essential ingredients of any investment portfolio. There are a few interesting facts about the general characteristics of these two, which every investor/advisor should know.

Across the world, Equity and Debt have been the most debated and ubiquitous financial asset classes from an investor’s point of view. They are essential ingredients of any investment portfolio. There are a few interesting facts about the general characteristics of these two, which every investor/advisor should know.

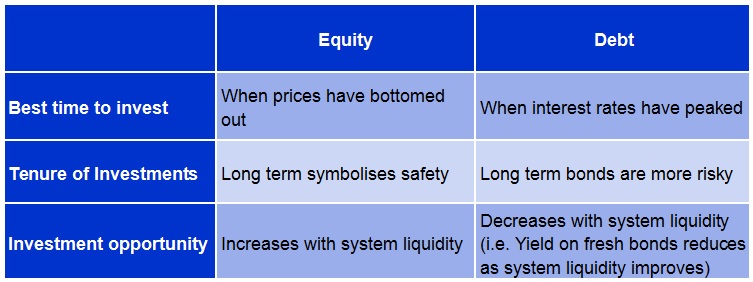

A few differences are shown in the table below:

Equity investors wait for markets to bottom out in terms of prices, to make an entry. But it is vice versa, for Investors in debt funds, who wait for market interest rates to peak so that they can enter at best possible rates. Once the interest rates tend to drop, those high interest papers into which one had invested, appreciates in value and the NAV of the debt fund or price of the bond increases. This happens when a new investor wishes to buy those high coupon paying bonds from you, you can demand a higher price from him.

For. E.g. If you invested Rs 1000 in a bond with coupon rate 10%, and suppose after six months of investment, the interest rate of fresh bonds in the market fall to 9.5%, you can demand higher price for your bond if you decide to sell it to another investor, say 1100.

In a debt mutual fund, this price appreciation is reflected in the NAV of that scheme holding this bond

In Equity, the terminology ‘Long term’ is related to safety. But when it comes to bonds, this works the other way round. Long bond funds are more riskier than short ones.

Short bond funds are less risky due to following reasons

- There is less probability of change in interest rates in short term.

- Most of the short term bonds are held till maturity and hence not marked to market aggressively. i.e. short term investors pick schemes or bonds with a desired YTM or interest rate and hence they do not compare these rates with changing interest rates in the market. They have specific requirements and hence they hold their investments till maturity and seldom trade on them.

- The sensitivity of bond price to change in interest rates is lower for short bond funds. The effect of change in interest rate on bond price is calculated using the below shown formula

% Change in Price = Modified Duration in years x Change in interest rate

Lets say the Modified Duration (means the change in maturity of a bond for every 1 % change in interest rate in the market) is 8 years and change in interest rate is 0.50 or 50 bps. Then the change in price is 8 x 0.50 = 4%. i.e. for a bond with MD 8 years, a 0.5% change in market interest rate (repo rate change) will affect the bond’s price by 4% on either side (When interest rate fall, prices increase and vice versa)

For a short term fund, with MD between 1 to 3 years, the percentage change in price will be smaller than that of a long bond fund. In the previous example, if the MD was 2 years, then the change in price of the bond would have been 2 x 0.5 = 1%

4. Most of the short term bonds would be non-coupon paying (i.e. zero coupon) and hence the Yield to Maturity is same as the yield promised by the bond. So there is no coupon reinvestment risk and yield swivels as in long bond funds. On the other hand, long term bonds (E.g. Govt Securities) are coupon paying bonds and are subject to interest rate risk and reinvestment risk. Interest rate risk is explained in the previous example. Reinvestment risk happens when half yearly or monthly coupons (interest payments) that one receives from a bond are reinvested in the market at lower interest rates and this results in lower realised yield at the end of the tenure. If the reinvestment of coupons happen at higher rates than the rate of the parent bond, the yield finally realised from the bond would be higher, and this means a higher YTM.

Now the third point. When system liquidity increases, it always favours the equity market. Higher surplus means more investments. But what happens to bond yields?

When system liquidity increases (i.e., when funds are easily available to all at low cost) interest rates would be at low levels . It’s true that existing investors will benefit from falling interest rates, but fresh investors would receive only the now reduced rates. Moreover, chances of bottoming up of rates may also happen at these levels which will affect the returns of new investors. The interest rate cycle follows a see-saw motion as in the case of any other economic indicator, and an upswing in rates adversely affect investors who entered at lower levels. Hence the system liquidity can affect equity and debt investments differently.

One has to learn the economic scenarios diligently before making investment choices. All the above discussed factors affect the returns of debt investments.

Posted: May 2018

Well articulated.

1. Modified Duration is always expressed in % and DURATION is expressed in years. Also, from MD, BPV (basis point value) is derived. % change in price = BPV x % change in interest rate.

2. As interest rate goes up, debt investor gets benefit of reinvestment risk. Agreed. Concomitantly, he suffers price risk, which appears to be conveniently unsaid.

3. Beta of stocks could also have found a mention.

Nevertheless, a sincere attempt to educate a naive investor.

Compliments.